The Mysterious Call of Tibet: VERTU IRONFLIP Takes You to the Big Picture of Your Heart

In the ancient and mysterious land of Tibet, where the sacredness and serenity of nature can be felt with every

If the proliferation and development of the internet have given rise to mobile payment, then the advent of Web3 has written a new chapter in cryptographic payment and has propelled the development of cryptographic wallets to new heights.

Traditional electronic wallets serve the purpose of storing assets and facilitating mobile payments. On the other hand, cryptographic wallets, in addition to storing assets and enabling mobile payments, have also added the function of identity identification. This is also the entry point and authentication for users to navigate through various DApps in Web3.

In the traditional internet, a person’s identity is often symbolized by their reputation and behavior in the real world. However, in Web3, the symbol of identity is demonstrated through assets in the cryptographic wallet, transaction behavior, and collected NFTs.

(1) The Development Cycle of Crypto Wallets

Bitcoin has been in existence for 13 years, and the blockchain has gone through four iterations from version 1.0 to 4.0. Similarly, wallets have also evolved through four stages. They have developed from single-asset wallets and single-chain wallets to multi-chain, multi-asset wallets, evolving from a simple transfer and receipt function to a blockchain ecosystem aggregation service platform.

From 2009 to 2012, wallets began their initial development phase with the birth of Bitcoin and blockchain.

From 2012 to 2020, the era of hackers and the rise of Ethereum led to a surge in smart contract wallets, a significant increase in transaction activities, the popularity of DeFi liquidity mining, and the number of cryptocurrency wallet users exceeded 50 million, entering a rapid expansion phase.

Since 2021, with the explosion of NFTs, DAOs, public chains, and Web3.0 applications, cryptocurrency wallets have become a popular choice for people to store and trade assets. Supporting cross-chain assets has also become one of the key considerations for users when choosing a wallet. At this time, cryptocurrency wallets focus more on interactive functions and user experience.

(II) Classification of Cryptocurrency Wallets

Cryptocurrency wallets can be divided into decentralized wallets and centralized wallets according to whether the user controls their private key. Decentralized wallets can be further divided into cold wallets and hot wallets based on whether they are connected to the internet. Cold wallets can be further classified into hardware wallets, paper wallets, etc., depending on the storage medium. Hot wallets can also be divided into mobile wallets, web wallets, etc., based on the tool used for internet connection. In addition, cryptocurrency wallets can also be categorized based on public chain ecosystems, whether they are custodial, and other types.

(1) User Scale

The user base is growing, with the market share rising in tandem.

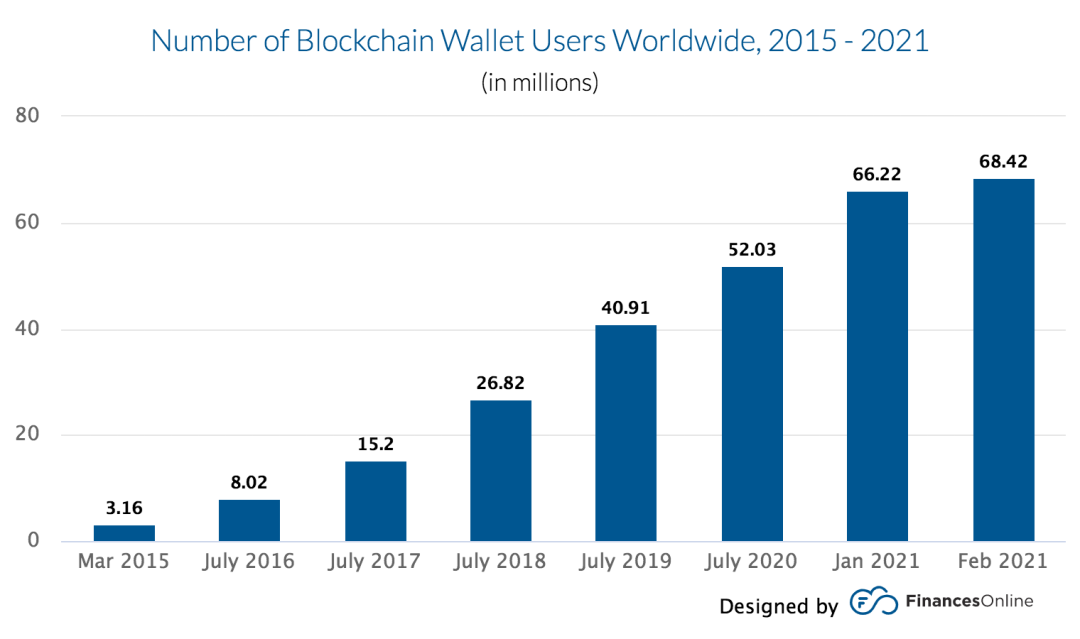

The significant rise of digital assets has driven the market demand for secure storage and on-chain activities of digital assets, presenting an opportunity for the development of the digital wallet industry. A large number of developers and funds have poured into this sector. According to statistics from Blockchain.com, the average ownership rate of encrypted tokens in 2022 was 3.9%, with over 300 million people worldwide using encrypted assets. Among them, the number of users with encrypted wallets reached 68.42 million in 2021, and by July 2022, the number of encrypted wallet users had already reached 81 million, showing exponential growth. Looking at future development, wallets will not only serve as the gateway to the encrypted world but also take on extended functions such as digital asset management and social interaction, highlighting their undeniable importance.

(II) Business Model

The business model is gradually shifting from a B2B (Business-to-Business) model to a B2B+B2C (Business-to-Business and Business-to-Consumer) model.

As the development of encrypted wallets continues to evolve, their business model is also changing. When encrypted wallets are used as tools for storing users’ private keys, they focus on accumulating users and developing their fund deposit functions. However, their profitability is limited and they are unable to generate substantial revenue.

To generate revenue and profits, cryptocurrency wallets have broken away from traditional business models and introduced value-added services (such as financial products, PoS mining, trading, asset aggregation, market information, etc.) as well as advertising and other traffic monetization methods to increase income.

Currently, there are mainly two types of cryptocurrency wallets in the market: To B (business-to-business) and To C (business-to-consumer). Compared to the To B field, the To C field is the main source of profit for most cryptocurrency wallets.

(III) Primary Market

Crypto wallets, as part of the Web3 infrastructure, are highly favored by investment institutions.

Crypto wallets are one of the main tracks for institutions to invest in the cryptocurrency field. In the first half of 2022 alone, the total financing amount in the wallet sector reached $400 million, far exceeding other fields. Data shows that the amount of investment received by wallets has continued to grow in recent years, with global cryptocurrency wallet financing increasing from $200 million in 2018 to $900 million in 2021.

The market is teeming with a variety of wallet products, with over 200 crypto wallet products currently available in the Google store. The competitiveness between different wallets mainly depends on their user base in the crypto market.

Therefore, some mainstream wallets usually cooperate with major public chains to expand their trading shares. Users’ needs for wallets are generally considered from three aspects: convenience, ease of use, and security, and the development direction of crypto wallets is also based on these factors. 7 O’Clock Capital will analyze representative wallets in the current market mainstream mobile wallets, public chain ecosystem wallets, trading platform wallets, asset custody wallets, hardware wallets, identity wallets, and other market segments.

(I) Mobile Wallets

BitKeep

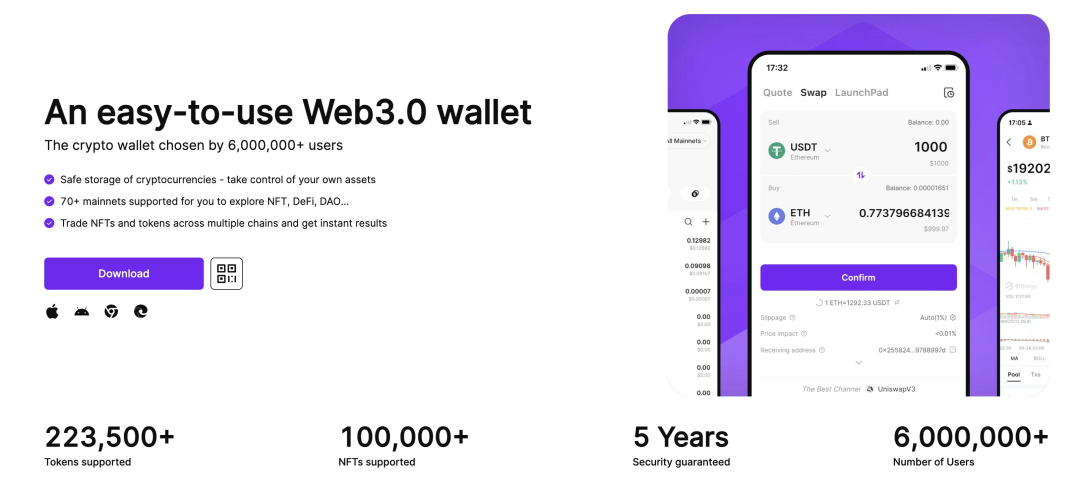

BitKeep Wallet is the largest Web3 multi-chain wallet in the Asian market and an important strategic partner of 7 O’Clock Capital. It was established in Singapore in 2018. In May of this year, BitKeep completed a $15 million Series A financing round, with a valuation of $100 million, led by Dragonfly Capital. Currently, it has more than 6 million users.

Product Features:

Provides accurate DEX market K-line functionality; supports cross-chain transactions across 18 public chains; offers a “borrow GAS fee transaction” feature, allowing easy trading without the need for mainnet coins as GAS; integrates an NFT trading market, supporting NFT project INO and NFT minting; supports over 70 mainnets, tens of thousands of DAPPs, and hundreds of thousands of cryptocurrencies; supports OTC trading; and has launched BitKeep Business, an open Web3 ecosystem platform aimed at the B-end market.

BitKeep Wallet is one of the well-known digital asset wallets in the industry, integrating brand, technology, functional experience, user reputation, education, and services. It employs various security mechanisms such as cold and hot separation and offline signing to ensure the safety of funds. BitKeep continuously refines its product in every aspect to become the safest and most powerful gateway to Web3.

II) Public Chain Ecosystem Wallet

EVM Ecosystem: Metamask

Metamask is one of the six major products under the Ethereum technology development company ConsenSys, and it has also received support from the Ethereum Foundation. On March 15th, ConsenSys announced the completion of a $450 million D round of financing with a valuation of $7 billion, led by ParaFi Capital, with other investors including Temasek and SoftBank Vision Fund 2.

Features:

MetaMask has over 30 million monthly active users, with a global user base, including high engagement from the United States, the Philippines, and Brazil. It is a lightweight Ethereum open-source wallet and also an app wallet. It has the function of testing Ethereum smart contracts and supports the most comprehensive Dapps. It is compatible with hardware wallets Ledger and Trezor. The operation interface is simple and very suitable for beginners to experience. Users can customize their wallet experience, such as adding new application interfaces to MetaMask. The high Gas fee rate is the only criticism, which is the overly simple UI design and page.

(3) Trading platform wallets

Trading platforms are also launching their own encrypted wallets, represented by Coinbase Wallet, OKX Wallet, and 1inch Wallet.

Coinbase Wallet, also known as the most suitable wallet for cryptocurrency beginners, currently has web plugins and mobile terminals. By scanning the QR code on the plugin wallet with the mobile application, you can connect and access DApps and DeFi applications on the desktop with one click. However, the Coinbase plugin wallet page is too simple, and related transaction records can only be viewed on the App side. In addition, users must confirm all transactions in the plugin in the mobile application, and it also supports the storage of NFTs. So far, Coinbase Wallet supports Ethereum, Polygon, and Optimism.

OKX Wallet is the official wallet of the OKX exchange, developed and used to meet users’ Web3 needs. It has the backing of one of the world’s largest digital asset trading platforms, OKX, which currently has more than 20 million users worldwide. As a secure and fully functional Web3 wallet, OKX Wallet will allow exchange users to quickly enter the Web3 world.

OKX Wallet features include:

Multi-chain and multi-asset support for over 25 public chains and 1000+ DeFi protocols; NFT purchase, trading, and creation functions

Web3 user entry point, integrating various types of DApps (DeFi, GameFi, and selected DAOs); open-source and developer-friendly, allowing Web3 developers to easily connect their dApps with the OKX Wallet.

It provides a good user experience, integrating the needs of beginners and professional users, and offers a complete process guide for newcomers.

1inch Wallet is an integrated DEX aggregator that supports transactions and transfers of hundreds of tokens on Ethereum, BNB, Polygon, Optimistic Ethereum, Arbitrum, Gnosis, Avalanche, and Fantom public chains. 1inch provides users with deep liquidity and better flash exchange rates. Not long ago, it announced the distribution of 300,000 OP airdrops to 1inch Wallet users on the Optimism network to reward users who interact with Optimism through the 1inch Wallet.

(IV) Asset Custody Wallet

Safeheron is a preferred asset custody wallet, characterized by high asset security. It has completed a Pre-A round of financing of 7 million US dollars, led by Yunqi Partners and Web3Vision, with PrimeBlock Ventures, Cobo Ventures, M77 Ventures, 7 O’CLOCK CAPITAL, and former Sequoia Capital China co-founder Zhang Fan participating.

Safeheron is the only self-custody service provider in Asia that has mastered MPC (Secure Multi-Party Computation) and TEE (Trusted Execution Environment) technologies. Since the launch of the product, it has served more than 20 customers, who have collectively managed more than 1.5 billion US dollars in encrypted assets and facilitated transactions worth more than 4 billion US dollars using Safeheron’s wallet services.

The main features of the wallet include:

Digital asset custody has undergone many evolutions, from only hot wallets to a mix of hot wallets, cold wallets, multi-signature, etc. MPC technology + TEE technology makes Safeheron stand out in the asset security custody market. Currently, Safeheron has officially reached a strategic cooperation with MetaMask to enter the enterprise-level MPC multi-signature security field and firmly occupy the high ground in the market.

(5) Hardware Wallets

Cold storage is the preferred storage method for everyone. It is not only the preferred choice for long-term token holders and Bitcoin supporters, but also suitable for institutional custody services. By disconnecting the encrypted USB device from the Internet, it provides physical security protection for users, eliminating the situation where a third party controls the funds.

The following are comparisons of three mainstream hardware wallets in the market:

In addition to the three hardware wallets mentioned above, it is necessary to specifically mention the OneKey wallet, which is the only hardware wallet invested by Coinbase. It has also developed a mobile APP wallet with distinct features and smooth usage. OneKey wallet recently announced a $20 million Series A round of financing, led by Dragonfly and Ribbit Capital, with participation from Framework Ventures, Sky9 Capital, Folius Ventures, Ethereal Ventures, Coinbase, Santiagoroel, and Fishkiller.

The OneKey hardware wallet has the highest growth rate in sales in Asia, with a rich product line, including OneKey Swap, OneKey Desktop for PC, OneKey plugin, and OneKey app. The hardware wallet supports all EVM chains, including ETH, Polygon, BSC, and OKT, as well as networks such as BTC, Solana, Near, and Trx. It is currently adding multi-chain support and function optimization at a weekly update rate. It is compatible with the OneKey plugin and MetaMask to connect the hardware wallet for participating in DeFi, making it an essential hardware wallet for users to participate in DeFi.

Features:

Full platform support including desktop, browser plugin, and mobile app; supports multi-chain, multiple mnemonic phrases, and multiple software and hardware wallets; supports passphrase. Built-in multiple nodes and free switching between default chains; weekly iterations, new feature additions and chain support, as well as feature optimization.

Summary: On the one hand, the wallet is an essential tool for users to interact with the blockchain, and can be seen as an important gateway from the real world to the encrypted world; on the other hand, the essence of the wallet is a private key management tool with strong asset attributes. The future development of encrypted wallets will also continue to enrich and expand around these two characteristics, towards a comprehensive and integrated direction for business optimization and resource aggregation.

(Six) Multi-chain Wallet

Coinhub is a multi-chain decentralized wallet product serving the DeFi ecosystem, which has now launched browser plugin and mobile versions, supporting more than 40 public chains including Bitcoin, ETH, BSC, Solana, Polygon, Avalanche, Tron, Arbitrum, and Optimism, and has cooperated with more than 2000 DApps. Users are distributed in more than 50 countries and regions worldwide, with a global self-media traffic coverage of more than 1.5 million, and a global ecological community coverage of more than 2 million users.

Coinhub fully displays users’ assets through contract analysis, intelligently recommends high-quality applications through data analysis, and realizes convenient financial management, one-click mining, and optimal transactions through the aggregation of DeFi tools. It allows users to fully understand current data and conveniently operate and manage assets in the new DeFi ecosystem, reducing user risk and realizing asset appreciation.

(7) Identity Wallet

The emergence of Web3 and the concept of the metaverse has given a deeper positioning to the attributes of encrypted wallets. Wallets will serve as users’ identity identifiers, representing not only digital assets but also digital identities, and endowing wallets with social attributes.

Formatic Wallet (now renamed Magic)

It has completed a financing of 27 million US dollars, led by Northzone, with participating investors including Tiger Global, Volt Capital, Digital Currency Group, CoinFund, and Alexis Ohanian, the co-founder of Reddit.

Features: Users can register a wallet by simply entering their email address, with no mnemonic phrase generation. User identities are protected by a delegated key management system that complies with SOC 2 standards and is based on a hardware security module (HSM). From a developer’s perspective, integrating Fortmatic wallets is extremely simple, making it a developer-friendly wallet. For any existing web3 application, it can be integrated by copying just a few lines of code. However, it is currently mainly compatible with EVM networks.

(8) Web3 Wallet

The Web3 wallet Steakwallet, now renamed to Omni, raised $11 million in seed funding in September at a valuation of $50 million. Investors include Spartan Group, GSR Ventures, and Eden Block, among others.

Omni has stated that it has built its own custom smart contract middleware, allowing users to stake on over 20 protocols and has built-in liquidity staking options. Users can also move assets to different blockchains through cross-chain bridges and display NFTs from different chains on mobile applications. It is currently available on all major Ethereum Virtual Machine (EVM) and Layer 2 scaling solutions, such as Arbitrum, Optimism, and Polygon. The company is currently preparing to integrate with zkSync and Starknet.

Wallets, as one of the essential tools for participants in the cryptocurrency market, hold a very important position in the infrastructure field. Currently, there are many entrepreneurs entering the wallet track, and we believe that in Web3, the importance of the wallet portal will surpass the trading platform and become one of the traffic aggregation places and infrastructures of the metaverse in Web3. Its value will be reflected in the following aspects:

(I) DID Identity Proof

Vitalik Buterin pointed out in his long article “Centralized Society: Seeking the Soul of Web3” that Web3 currently has considerable limitations at the application level, and this limitation stems from the current lack of native components in Web3 that represent “human identity and social relationships.” Wallets are the perfect Web3 components, where all information such as identity, driver’s license, medical records, and address is displayed through smart contracts to generate a unique DID system. In the end, wallets will achieve functions such as offline identity authentication, on-chain identity aggregation, on-chain credit scoring, and on-chain behavior authentication.

(II) Web3 Gateway

Currently, the four levels of the Web3 stack are protocols, infrastructure, use case layer, and access layer. Due to the complexity and structural issues at each level, they cannot be well integrated. Wallets are at the top of the stack, serving as the entry point for various Web3 activities, which will fully realize the Web3 stack. For example, wallets will replace existing login or registration systems, no longer using Facebook or Google credentials to create new accounts on all websites. Instead, all logins will be approved using wallets, becoming the main entry point for most Web3 applications.

(III) Public Chain Connector

The development of Web3 applications is based on smart contract platforms such as Ethereum, Solana, Avalanche, Cosmos, and other public chains. Regardless of whether it is layer 0, layer 1, or layer 2, a wallet will be developed to adapt to the development of its own chain ecosystem. This is done for two reasons: to prosper the ecosystem and to compete for traffic. However, the multi-chain competitive landscape has fragmented the liquidity and composability of DeFi products, and digital assets cannot circulate freely among all public chains. As a connector, the wallet will build bridges between all public chains.

(IV) Becoming the “Alipay” of Web3

While supporting payments and transfers, all Dapps are integrated into the wallet, allowing project developers and users to gather in large numbers to form a new generation of internet ecosystem based on blockchain technology. In this ecosystem, all online operations of users can be carried out through the wallet, including social interaction, short video browsing, shopping, ordering meals, hailing rides, and traveling.

(V) Metaverse Hardware Devices

The wallet will evolve into a small chip, allowing for a perfect integration of the virtual and real worlds through the chip. A device similar to contact lenses, once implanted, can achieve the effect of naked-eye AR, with daily use complemented by a control terminal similar to a mobile phone. Each person’s information is directly displayed on their face through AR, including age, occupation, emotional status, social relationships, digital assets, etc. In the metaverse, everyone’s information is transparent and interactive. You can log in to obtain any metaverse experience and purchase any items sold in the metaverse, making full use of the wallet’s interoperability to provide a better experience for users.

The future development of wallets also faces challenges:

Regulatory compliance issues, the service providers of Web3 applications will be digital people projected from real people offline, but from the perspective of global regulatory compliance and popularization of Web3, the verification of real people may be inevitable. It is possible that both may coexist in the future, with accounts that have been authenticated by real people enjoying more rights in the Web3 world, but purely digital people will also be accepted.

Another derivative issue is the protection of privacy. How to protect the identity information of users when using wallets for various authentications and binding offline information is a problem that needs to be faced in the technical implementation.

The narrative of Web3 is constantly being deconstructed and reshaped, attracting more new developers and users to enter. However, compared to the global population of 4 billion Internet users, the current user base of Web3 is still far from being comparable. Data shows that as of the first quarter of 2022, Facebook had 2.936 billion monthly active users, while the monthly active user count of the wallet Metamask was only 30 million. This means that the proportion of digital asset wallet users is still very small, and the potential for future market development is huge.

We assess that in the Web3 digital world, there are at least several billion users yet to be discovered, which also means that there are still infinite possibilities in the field of wallets. This will also be a stage for adventurers to show their talents. In the future, whoever can capture the majority of users in the Web3 world will be able to win this war.