Samsung Enters the Tri-Fold Arena to Challenge Huawei's Early Lead

The foldable smartphone market has entered an exciting new chapter as Samsung officially launches the Galaxy Z TriFold, marking the tech giant's ambitious entry into the tri-fold segment previously dominated by Huawei. After watching from the sidelines for over a year, Samsung is now ready to challenge Huawei's Mate XT with a device that promises to reshape the premium foldable landscape.

Breaking News: Samsung's Game-Changing Move

Samsung's announcement of the Galaxy Z TriFold represents a pivotal moment in mobile technology. Set to launch in South Korea on December 12, 2025, at 3.59 million won (approximately $2,450), this device marks Samsung's most ambitious foldable project to date. The strategic pricing positions it as a direct competitor to Huawei's offerings while undercutting the Mate XT's premium price tag.

The Galaxy Z TriFold features an impressive 10-inch display when fully unfolded—the largest screen Samsung has ever integrated into a smartphone. When folded, it transforms into a standard 6.5-inch device that fits comfortably in your pocket. This dual functionality addresses one of mobile technology's most persistent challenges: balancing portability with productivity.

Technical Innovation: Samsung's Engineering Marvel

Samsung has equipped the Galaxy Z TriFold with cutting-edge specifications that demonstrate serious engineering prowess:

Display and Design:

- 10-inch unfolded display (largest ever in a Samsung phone)

- 6.5-inch cover screen for everyday use

- Ultra-thin 3.9mm profile when unfolded

- Armor FlexHinge system with dual hinges for optimal weight distribution

Performance Specifications:

- Customized Snapdragon 8 Elite processor

- 200-megapixel main camera system

- 5,600mAh battery (largest in any Samsung foldable)

- Titanium frame with Advanced Armor Aluminum

- Ceramic-glass fiber-reinforced polymer back panel

The device's hinge system, dubbed the “Armor FlexHinge,” represents a significant engineering achievement. These dual hinges work together to manage the complex weight distribution inherent in tri-fold designs, addressing durability concerns that have historically plagued foldable devices.

Market Dynamics: Huawei's Head Start and Proven Success

While Samsung brings formidable resources and brand recognition to the tri-fold market, Huawei has already established a significant foothold. The Chinese tech giant launched the world's first tri-fold smartphone, the Mate XT, in September 2024, giving it a crucial 15-month head start.

Huawei's Market Performance:

Huawei's Mate XT has achieved remarkable commercial success despite its premium pricing. The device sold approximately 470,000 units through the second quarter of 2025, generating over $1.3 billion in revenue. This performance is particularly impressive for a first-generation product with limited international availability due to the absence of Google services.

The company has already released its second-generation model, the Mate XTs, which launched in September 2025 with enhanced features including stylus support on its 10.2-inch display. This rapid iteration demonstrates Huawei's commitment to maintaining its technological edge in the tri-fold segment.

Comprehensive Comparison: Samsung vs Huawei Tri-Fold Specifications

| Feature | Samsung Galaxy Z TriFold | Huawei Mate XT | Huawei Mate XTs |

|---|---|---|---|

| Launch Date | December 2025 | September 2024 | September 2025 |

| Display Size | 10 inches | 10.2 inches | 10.2 inches |

| Cover Screen | 6.5 inches | 6.4 inches | 6.4 inches |

| Thickness (Unfolded) | 3.9mm | 3.6mm | 3.6mm |

| Processor | Snapdragon 8 Elite | Kirin 9000 series | Enhanced Kirin |

| Main Camera | 200MP | 50MP (5.5x telephoto) | Upgraded system |

| Battery | 5,600mAh | 5,600mAh | 5,600mAh |

| Operating System | Android | HarmonyOS 4.2 | HarmonyOS 5.1 |

| Stylus Support | Not announced | No | Yes |

| Price (USD) | $2,450 | $2,800-$3,364 | $2,520-$3,077 |

| Market Availability | Global (phased) | China + Limited international | China + Limited international |

| Google Services | Yes | No | No |

Sales Performance Analysis: Huawei's Strong Track Record

Huawei's Mate XT series has demonstrated that there is substantial demand for tri-fold devices despite premium pricing:

Huawei Mate XT Sales Milestones:

- 400,000 units sold by April 2025

- 470,000 units shipped by Q2 2025

- 488,000 units cumulative sales before Mate XTs launch

- $1.3 billion in revenue generated

- 6.5 million pre-orders for the original Mate XT

These figures are exceptional for a first-generation product in a nascent category, especially considering the device's high price point and limited international distribution. The success validates consumer appetite for innovative form factors and establishes a benchmark for Samsung to measure against.

Market Position and Competitive Landscape

Current Foldable Market Share (2024):

- Samsung: 32.9% global foldable market share

- Huawei: 23.1% global share, 49% in China, 75% in Chinese foldable segment

- Motorola: 17%

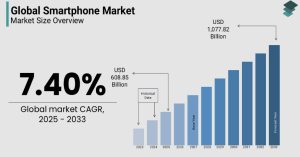

Market Growth Projections:

The global foldable smartphone market shipped 19.3 million units in 2024, representing just 1.6% of total smartphone sales. However, industry analysts project significant growth, with shipments expected to reach 45.7 million units by 2028. The tri-fold segment represents the premium tier of this growing market.

Samsung Galaxy Z TriFold Sales Predictions

Based on market analysis and historical data, we can project Samsung's potential performance:

Conservative Estimate: 150,000-200,000 units in first year

- Factors supporting: Brand recognition, global distribution, Google services integration

- Limiting factors: Late market entry, high price point, limited manufacturing capacity initially

Moderate Estimate: 300,000-400,000 units in first year

- Samsung's established foldable customer base

- Superior marketing and distribution channels

- Competitive pricing versus Huawei Mate XT

- Technical advantages in camera and processor

Optimistic Estimate: 500,000-600,000 units in first year

- Strong brand loyalty in Western markets

- Early adopter enthusiasm

- Potential price reductions through promotions

- Six-month Google AI Pro trial and screen repair discounts as incentives

Projected Sales Comparison Table:

| Period | Huawei Mate XT (Actual) | Samsung Z TriFold (Projected) |

|---|---|---|

| First Quarter | 200,000+ units | 100,000-150,000 units |

| First Six Months | 400,000+ units | 200,000-350,000 units |

| First Year | 470,000-500,000 units | 300,000-500,000 units |

| Revenue (First Year) | $1.3+ billion | $735M-$1.2 billion |

Regional Market Dynamics

China Market: Huawei maintains a commanding position with 75% market share in the Chinese foldable segment. Samsung faces significant challenges penetrating this market where local brand loyalty is strong and Huawei's ecosystem is deeply entrenched.

Western Markets: Samsung holds a decisive advantage in North America, Europe, and other Western markets where Google services are essential and brand recognition is strong. The Galaxy Z TriFold's 2026 US launch will target this lucrative segment where Huawei faces regulatory and ecosystem barriers.

Emerging Markets: Both brands are targeting markets like Southeast Asia, the Middle East, and Latin America, where premium smartphone adoption is growing. Samsung's established distribution networks provide a competitive edge.

Strategic Advantages and Challenges

Samsung's Strengths:

- Proven track record with Galaxy Z Fold series

- Global distribution infrastructure

- Google services integration

- Superior camera technology (200MP main sensor)

- Competitive pricing strategy ($2,450 vs Huawei's higher prices)

- Strong after-sales support (50% screen repair discount, home service)

Samsung's Challenges:

- Late market entry (15 months behind Huawei)

- Manufacturing complexity of tri-fold design

- Limited initial production capacity

- Higher average foldable price ($1,218 vs $421 for standard smartphones)

Huawei's Advantages:

- First-mover advantage with proven product

- Strong position in Chinese market (75% share)

- Already on second generation (Mate XTs)

- Established tri-fold manufacturing expertise

- Successful premium positioning

Huawei's Limitations:

- Absence of Google services limits international appeal

- US sanctions affecting component supply

- Limited presence in Western markets

- Higher pricing for international models

Industry Expert Perspectives

Industry analysts view Samsung's entry as a validation of the tri-fold concept rather than a threat to Huawei's dominance. Bryan Ma, vice president of device research at IDC, noted Huawei's remarkable achievement in developing the tri-fold design despite being cut off from advanced chips and Google services due to US sanctions.

Francisco Jeronimo, IDC's vice president covering devices, commented on Huawei's Mate XT performance: “The performance is quite strong considering it's one of the most expensive smartphones available and this shows there is a demand for something innovative.”

The Future of Tri-Fold Competition

The tri-fold smartphone segment is poised for significant expansion as additional manufacturers enter the market:

Confirmed and Rumored Entrants:

- TCL: Has demonstrated tri-fold technology at trade shows but awaits consumer demand signals

- Tecno: Showcased Phantom Ultimate 2 tri-fold concept at Mobile World Congress 2025

- Apple: Industry wildcard—no confirmed plans but expected to eventually enter foldables

Market Evolution Timeline:

- 2025-2026: Samsung and Huawei establish duopoly

- 2027-2028: Additional manufacturers enter, prices begin to decrease

- 2029+: Tri-fold becomes mainstream premium category

Consumer Considerations and Market Outlook

The tri-fold segment targets early adopters and technology enthusiasts willing to pay premium prices for cutting-edge innovation. Key consumer concerns include:

Durability and Longevity: Multiple fold points create potential failure points. Samsung's 50% screen repair discount acknowledges these concerns while providing peace of mind for buyers.

Practical Utility: The transition between phone, mid-sized display, and tablet mode must offer genuine productivity benefits to justify the price premium.

Software Optimization: Applications must be optimized for multiple screen configurations to deliver seamless user experiences.

Conclusion: A New Era of Mobile Innovation

Samsung's Galaxy Z TriFold launch transforms the tri-fold smartphone segment from a niche curiosity into a legitimate competitive category. While Huawei has demonstrated strong sales performance with approximately 470,000 units sold and $1.3 billion in revenue, Samsung's entry brings global distribution, Google services integration, and proven foldable expertise to the market.

Sales Outlook Summary:

- Huawei Mate XT series: Projected to reach 1 million cumulative sales by Q1 2026

- Samsung Galaxy Z TriFold: Estimated 300,000-500,000 units in first year

- Combined tri-fold market: Expected to exceed 1.5 million units by end of 2026

The competition between these tech giants will ultimately benefit consumers through accelerated innovation, improved reliability, and gradually declining prices. As TM Roh, Samsung's Head of Device eXperience Division, stated: “Galaxy Z TriFold solves one of the mobile industry's longest-standing challenges—delivering the perfect balance between portability, premium performance, and productivity all in one device.”

The tri-fold revolution has begun, and with Samsung now in the arena, the battle for foldable supremacy promises to drive the next generation of mobile innovation. Whether Samsung can match or exceed Huawei's impressive sales performance remains to be seen, but one thing is certain: the foldable future is unfolding before our eyes.