This month, the world's two major beauty giants Estee Lauder Group and L'Oreal Group have released financial reports, both pointing out that the high-end beauty market in mainland China continues to be weak, further revealing the complexity of doing business in the Chinese market in 2024. Among them, high inventory levels, slow recovery of Chinese outbound travel and changes in consumer behavior continue to put growth pressure on international beauty groups.

Allie Rooke, founder of Clean Beauty Asia, an organization focused on helping brands enter the Asian market, said: “Chinese consumers are still buying less frequently for certain products and are turning to local Chinese beauty brands in certain product categories.”

However, China remains one of the key markets for global beauty brands. Fabrizio Freda, President and CEO of Estee Lauder Group, said on the earnings call: “We have a strong business in China and a strong market share. We will definitely continue to make long-term investments in China.”

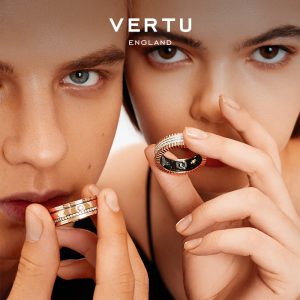

Photo by Estée Lauder

Despite the resistance, there are many positive signs in the market that brands still have a chance to succeed. For example, Estee Lauder Group's Sea Blue Mystery (La Mer) has achieved double-digit retail sales growth in China thanks to strict cross-channel strategy control, and has achieved strong market share growth in the field of high-end skin care products. The group said that overall, despite the challenges, its brands still have strong appeal among Chinese consumers. On the other hand, thanks to the promotion of offline distribution investment, L'Oréal Paris's sales in China increased by 5.4 in fiscal year 2023.

Based on our analysis of the market and interviews with several industry experts, we have summarized the challenges and opportunities facing the global beauty industry in China in 2024:

# **Challenges and Opportunities 1:* *

# **Increasingly picky Chinese consumers * *

At present, Chinese beauty consumers are focusing on products related to maintaining skin health and streamlining daily care. “As beauty products continue to innovate, people expect immediate results, whether through more efficient ingredients or innovative technologies, including smart devices or artificial intelligence diagnostics,” said Kuzak Park, group research director for market research firm Kantar Greater China.”

Consumers are becoming more knowledgeable about product ingredients and formulations, preferring scientifically validated results. Yang Hu, Euromonitor International Health and Beauty Insights Manager, said: “Chinese beauty consumers are more eager to understand knowledge (such as ingredient mechanisms, formulations and laboratory results) in order to compare and find the most cost-effective products.”

Photo by T Japan

Advanced technology means that personalized and customized beauty products will become more common. This may include products that are customized for different skin types, issues, and/or preferences. “More and more young consumers are checking ingredient levels before buying a product to make sure the product is truly appropriate for their skin type and specific problem,” adds Kantar's Park.

As we all know, the Chinese market has a special liking for explosive products. Rooke of Clean Beauty Asia pointed out that the success of professional dermatology brand Murad depends on explosive products. It is reported that the brand officially entered the Chinese market in July 2019, and focused on promoting its Resurgence retinol youth glow essence, which focuses on retinol. “It has a comprehensive, scientific skin care orientation that is led by professional dermatologists,” Rooke said. Following the success of the retinol ingredient among consumers, Murad recently launched products containing vitamin C.

Photo by Murad

Chinese beauty consumers are also increasingly aware of the environmental impact of the production process. Analysts expect this to spur demand for environmentally friendly options. “This trend may benefit the further popularity of natural ingredients that do not contain synthetic chemicals and harmful additives,” Park said.

Moreover, the rise of individualism is reshaping the younger generation's definition of beauty. Yang Hu of Euromonitor International said that young people's consumption of health and wellness is “returning to the basics” and “Generation Z is seeing the consumption of beauty products as a manifestation of this.”

Social value is also an important buying factor. In 2023, Euromonitor International found that 33% of Gen Z made a purchase decision based on the social and political beliefs of a brand or company. “Integrating social values into communication strategies has helped many brands achieve image transformation,” Hu continued. She cited Perlea, a local beauty giant brand founded in 2006 and headquartered in Hangzhou, as a powerful example of the correct practice of social values. For three years since 2020, the company has been promoting gender equality by producing branded films about “female power,” which has allowed it to “successfully deliver its brand image among young consumers”.

Image source: Pereya

# **Challenges and Opportunities 2:* *

# **Continued rise of domestic brands * *

There are many shopping festivals in China today-from Double Eleven, Tanabata to 618. Executives said on the earnings call that Estee Lauder Group believes that sales in China during various holidays are highly concentrated. The company said that the Estée Lauder brand tends to be at the top of the rankings for live streaming in stores during such shopping festivals.

But there are growing signs that these shopping festivals can no longer be seen as an effective sales window. The market share of Chinese beauty brands increased, consumers bought less, and the unit price of customers decreased. Estee Lauder Group said: “Although our performance in Douyin has more than doubled, our total online sales have declined due to the lower-than-expected performance of Tmall during the Double Eleven event.” Rooke said that the overall situation is indeed the case: “In the past year, the traffic on the Tmall platform has dropped significantly. Although the jitter has increased, it is not enough to make up for the loss caused by the Tmall.”

Estee Lauder Studio Photo Source: Shake Voice

In China, global brands are leading the skincare category in terms of consumer perception, but “last year, their market share was carved up by local brands such as Nature Hall, Paperbird and Winona, which are gaining traction on social platforms such as TikTok,” said Ellie Thorpe, director of brand equity platform Kantar BrandZ.

Photo source: tremolo

Price inconsistencies between different platforms can also damage brand image and cause consumers to doubt the authenticity of products. “In China, the compliance requirements for operating beauty brands are stricter and the cost is rising,” said Bai Lulu of Wei UK Consulting, which works with multiple beauty brands. These have slowed the pace of new product imports and made it more difficult for overseas entities to operate.

Bai Lulu believes that overseas brands have missed some growth opportunities due to various factors. Many companies that rely on cross-border e-commerce face issues such as policy regulation, higher operating costs, complex platform rules and irregular delivery times, which severely limit their cross-channel expansion. “International brands tend to have a stronger presence on platforms such as Taobao and Tmall, while local brands are good at using new platforms such as Tiktok for marketing. [Although] it is worth pointing out that the Estee Lauder Group has shown a significant improvement on the [Tiktok] platform,” Bai Lulu said.

# **Challenges and Opportunities 3:* *

# **Hard-to-shake fragrance opportunities * *

As early as the beginning of 2023, the VOGUE Business has clearly pointed out the major opportunities of the Chinese fragrance track, and this trend is still established in 2024. All eyes are now on China's booming fragrance market, which is expected to more than double from 2021 to 2025, according to a report by consulting firm BCG.

Interparfums chief executive Philippe Bénacin said in the report: “China should eventually become the world's second largest fragrance market.” Mintel expects the market to grow at a CAGR of 13.4 from 2023 to 2027, with total sales reaching Rmb22 billion.

Estee Lauder Group said the drop in skincare sales in the second quarter of last year was partially offset by strong growth in perfume sales, while the track's strong growth was driven by the launch of Le Labo and double-digit growth in Jo Malone London and Tom Ford. Freda said on the earnings call that effective commercial activities and high-profile holiday product marketing are driving this trend. Jo Malone London, a subsidiary of the group, has been winning over consumers through social media campaigns, new perfume products and numerous home perfume products. It topped the Tmall perfume list during last year's Double Eleven.

Photo by Jo Malone London

Le Labo also benefited from a late entry into the market compared to its competitors. “There was a lot of pent-up demand before they came in,” Rooke observed. “Le Labo is well-known, the category is growing, and the brand's aesthetic and philosophy are popular-just like Aesop.”

Photo by Le Labo

Bai Lulu said that as Chinese consumers pay more attention to brand narrative and product quality, transparent brand values and high-quality products can help Western brands win fans. “I suggest using personalization, which is very popular, or using some metaphysical ideas as an aid to marketing, such as, what scent can enhance luck? International brands like Argentum are a good example.”

Image source: Argentum

Mintel points out that perfume purchases in China's first-tier cities are the highest, reflecting the reality that many brands prefer to open their first stores or launch marketing campaigns in these areas. Now Shanghai has become the holy land of fine perfume, especially Xintiandi. Previously, China's local fragrance brand Guanxia opened an impressive independent flagship store in a spacious Spanish-style villa on Hunan Road in Shanghai's former French Concession, demonstrating the level of detail that local brands are pursuing when competing for market share. The domestic brand is embedding cultural products into its DNA and products-whether it's visual merchandising, design or storytelling.

Photo Source: Summer View

As the rise of local fragrance brands continues to pose challenges for established overseas leaders, giant companies are finding that acquiring and investing in these Chinese brands is a new way to connect with younger consumers.

Late last year, Estee Lauder Group, through its investment arm, acquired a minority stake in Melt Season, a relatively new Chinese fragrance brand. At the beginning of 2024, L ‘Oré al Group announced its investment in Xia, while Shanghai-based beauty retail and brand management group Ushopal to take a stake in another Chinese fragrance brand, Wen Xian. Ushopal founder and CEO Guo Lu expects niche perfumes to dominate in 2024. “As the market continues to fragment, brands that focus on traditional channels will find lower conversion rates and return on investment,” Guo Lu said.

Photo Source: Wen Xian

So will international groups be concerned about the rise of local Chinese brands? Estee Lauder Group's Freda said on the earnings call: “We fully believe that local Chinese brands will continue to grow, but our innovative strengths and brand differentiation will be key. Therefore, we will continue to invest in maintaining this differentiation advantage.”

# **Challenges and Opportunities 4:* *

# **The Importance of Physical Retail * *

Rooke expects outbound tourism, which has been recovering slowly since China's reopening, to rebound in the second half of 2024. “We can already see the impact of tourism growth in the last quarter of 2023 on Hong Kong's retail sector.” Estee Lauder Group also confirmed this: Hong Kong's net sales increased by double digits due to the reopening of the border and increased store traffic.

A strong physical retail business remains crucial. On the Estee Lauder Group earnings call, Freda said that physical stores in mainland China entered the third quarter with strong momentum, driven by strong double-digit retail sales growth in department stores, multi-brand specialty stores and independent stores.

However, new retail formats and visual displays are raising the standard of physical retail. In December last year, the much-anticipated CDF Sanya International Duty Free Shopping Center Block C opened in Hainan. By 2025, Hainan will become a completely duty-free island and is expected to develop into a luxury center. In the field of high-end make-up products, including La Prairie's largest travel retail store in the world, Cartier's first perfume boutique in the Asia-Pacific region, Dior and Pat McGrath Labs, etc. have all entered Sanya.

CDF Sanya International Duty Free Shopping Center Block C Source: Sanya News Network

So far, overseas brands have been operating in China with their international high-end positioning. But Rooke said they risk being left out if they haven't now “reshaped themselves to accommodate the growing sophistication and needs of Chinese consumers.

One of the reasons Benefit closed Tmall stores was their inability to adapt to changing consumers and markets. On the other hand, Helena Rubinstein, part of L'Oréal Group, has succeeded in completely reinventing itself in China. “As a premium anti-aging brand backed by scientific results, it is now a highly sought after brand,” says Rooke.

The Chinese market is in a state of rapid change, especially after the epidemic, the popularity of domestic brands has soared and they are more easily accepted by local consumers. A report by Bain & Company, “China Luxury Market 2023: A Year of Recovery and Transformation,” found that the beauty category achieved solid growth of about 8%, driven by strong momentum in cosmetics and perfumes. The men's beauty market is expected to continue to grow, with more and more men showing interest in skin care, hair care and cosmetics. The rise of e-commerce through enhanced video channels is likely to drive further growth in the online beauty market.

Photo by Helena Rubinstein

Estee Lauder Group's Freda remains optimistic: “Recently, we have seen some weakness in consumer sentiment, reducing the frequency of purchases of high-end beauty products. However, we remain very optimistic about the long-term opportunities in China and will continue to invest.”

Overall, global beauty groups remain bullish on China's future in the medium to long term, despite recent headwinds from soaring local brand popularity and setbacks in travel retail. Driving this optimism are a number of emerging market opportunities, including the rapid growth of fragrance sales in China, the rise of the men's beauty market and signs of a rebound in travel retail. With the intensification of competition from China's local beauty brands, international brands must continue to invest to enhance their competitiveness and innovation capabilities in order to maintain their leading position in the eyes of Chinese consumers.

(Source: VOGUE)