In the context of high inflation and interest rate hikes, bonds hold significant importance for institutional investors and family offices. Some investors who pursue stability may even allocate about 80% of their funds to bonds.

However, relevant reports have shown that in recent years, global family offices, in pursuit of higher returns, are reducing their allocation to fixed income (including bonds) and increasing their investments in private equity, real estate, and private debt.

Despite this, bonds, which are seen as the “bedrock” of asset allocation in the market, remain an important part of the balance between risk and return that family offices pursue.

So, how should family offices allocate bonds, and what potential risks will family offices face when investing in bonds?

The 2008 financial crisis led to a significant adjustment in the stock market. Some wealthy Dutch families were disappointed that banks and wealth management institutions failed to protect their assets during the crisis, so they jointly established Andreas Capital in 2009 to help them manage their assets independently with people they are close to.

After research, Andreas Capital decided to focus on stock and bond investments. To this day, the founding families remain the owners and clients of Andreas Capital.

In terms of investment categories, bond portfolios are generally less popular than stocks. Traditionally, the asset allocation ratio for family offices is 60/40, which means 60% stocks and 40% bonds.

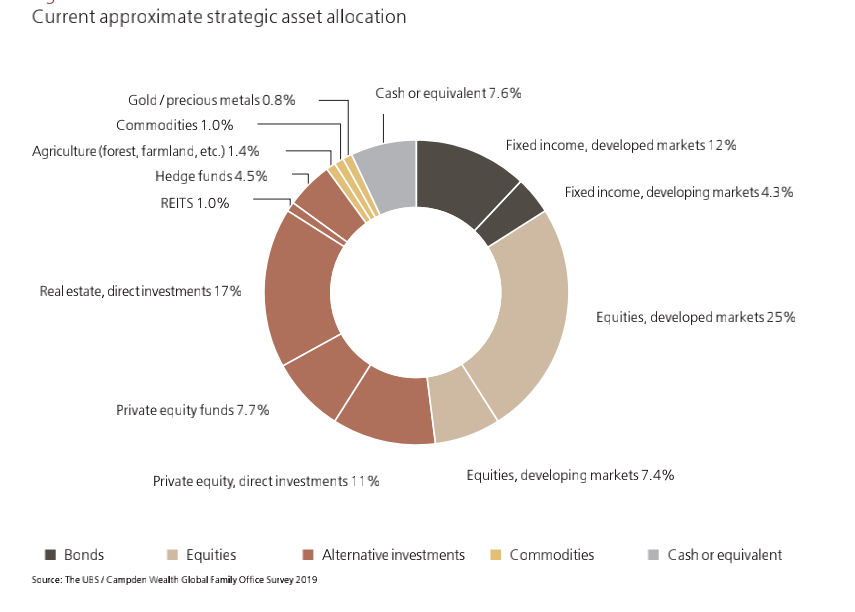

In the 2019 Campden Wealth Global Family Office Report, equities accounted for 32.4%, and fixed income (bonds) accounted for 16.3%.

01 The “ballast stone” of the family office

Bonds are often one of the most trusted components of a family office's investment portfolio. “Apart from bonds and the businesses controlled by the family, we don't have much trust in other things,” said the founder of a single-family office in North America.

This is because, over time, bonds help to balance risks. In the event of a stock market crash or potential economic downturn, bonds can help cushion the impact.

For example, in the 2019 Campden Wealth Global Family Office Report, nearly half of the family offices adjusted their investment strategies to guard against an economic downturn. “We have been reducing our stock investments and putting more money into bonds and real estate,” said a member of a single-family office in North America.

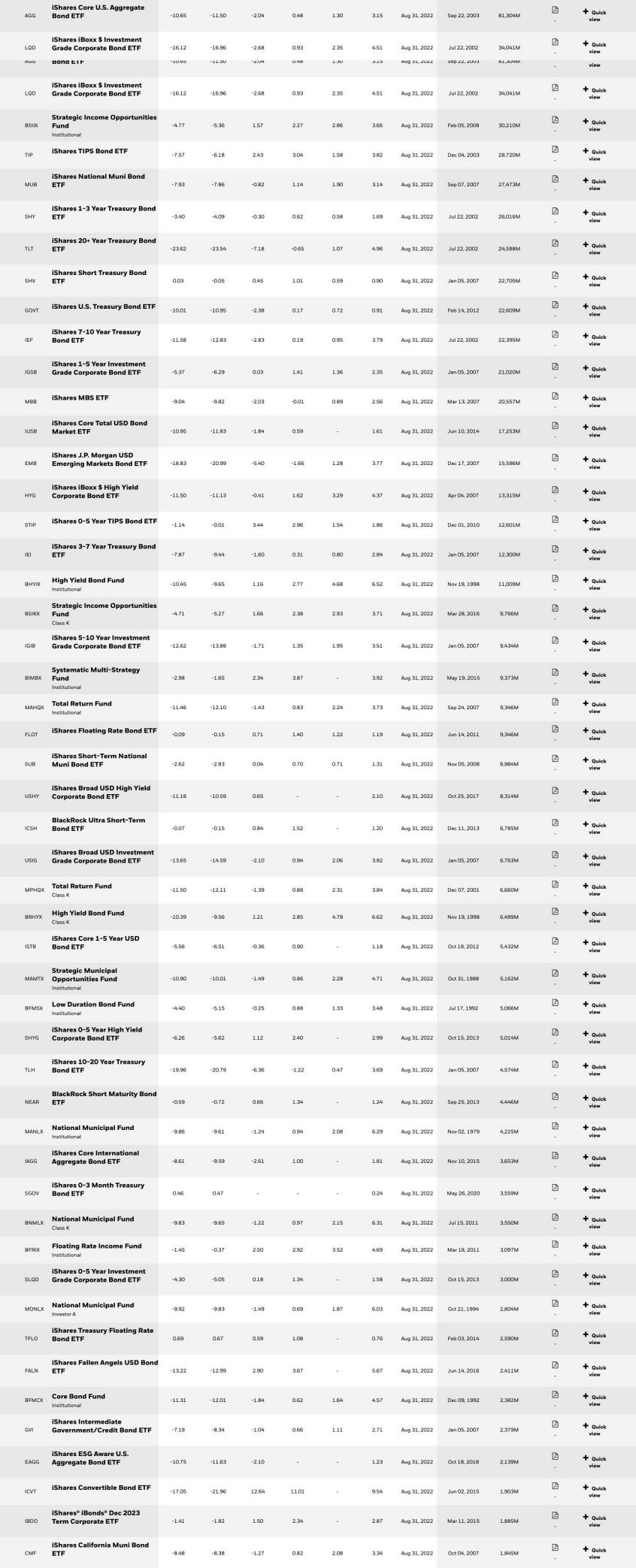

In addition, asset management companies such as BlackRock also allocate bonds and other fixed-income assets. Here is their fixed-income investment portfolio.

What exactly is a bond?

In simple terms, a bond is similar to an IOU, representing a loan from investors to borrowers such as companies or governments (companies or governments are also known as bond issuers). The borrower uses this money to fund its operations, and investors earn interest from their investment.

In return, the borrower promises to pay the investor a specified interest rate during the bond's term and to repay the principal, also known as the bond's face value or par value, upon the bond's maturity.

In the early 20th century, the bonds held by bondholders were coupon bonds, also known as fixed-interest bonds, which had coupons attached to the bond certificates. Bondholders could go to the bank with payment vouchers or deposit vouchers for handling.

Nowadays, buying and selling bonds has become easier than before, and it is also easier to obtain “coupons” (originally referring to a part of the bond certificate in the old days, which bondholders could cut off and take to the bond issuer on the interest payment date to request payment of the current interest).

There are various ways to classify bonds:

By issuing entity, they can be divided into government bonds, local government bonds, financial bonds, and corporate bonds.

By interest payment method, they can be divided into discount bonds (zero-coupon bonds) and coupon bonds.

By whether the interest rate is variable, they can be divided into fixed-rate bonds and floating-rate bonds.

By maturity period, they can be divided into long-term bonds, medium-term bonds, and short-term bonds.

By fundraising method: Public bonds, private bonds.

By the nature of the guarantee: Unsecured bonds, secured bonds.

Special types of bonds: Convertible corporate bonds.

The Stern family is a century-old Jewish French banking family from Frankfurt. The earliest head of the family was Samuel Hayum Stern, a wine merchant.

His son, Jacob Samuel Heyum Stern, founded a banking business called Jacob SH Stern in 1805. Subsequently, his descendants expanded the family business to Berlin, London, and Paris, which included the famous Bank Stern (a financial consulting firm) and J. Stern & Co (J. Stern Company). In addition, the family is also a shareholder of some of the world's important banks.

For generations, the family has been active investors in emerging markets, and their major banks have issued bonds for many countries in Europe. Recently, J. Stern & Co. has developed an emerging market corporate bond strategy aimed at protecting and creating wealth by investing in a high-quality portfolio of emerging market businesses. The specific investment targets are:

The total return net income is generated from mid-term income and capital appreciation, with a net return of 4-6% (after fees).

Maintain a lower overall volatility, with a standard deviation of 4-6% (about 50% lower than global stocks).

Provide other diversified asset classes (especially developed market stocks and fixed income).

The strategy is quite flexible and can invest in special opportunities that arise at any time. The typical characteristics of the strategy are:

Concentrated investment portfolio, with a shareholding ratio of 30-50%;

Short duration (average less than 5 years);

Hard currency, publicly traded liquid bonds denominated in US dollars;

Staged investment, high returns.

02 How does a family office invest in bonds?

100% Corporate/Quasi-Sovereign Bond Issuers (Quasi-sovereign bonds, that is, bonds issued by companies that are at least partially owned by the government);

Industry and geographical diversification;

Based on a rigorous bottom-up selection process, including ESG.

In addition to the Stern family, other high-net-worth individuals also invest in some high-quality corporate bonds. Private wealth management firm Affinity Wealth representatives will advise clients to invest in some corporate bonds, and the investment portfolios of these clients usually range from $800,000 to $40 million.

For clients with self-managed super funds or family trusts, or those who are retired and living off their own income, corporate bonds can provide a good income and, overall, have high stability without the significant fluctuations seen in stocks, according to O'Leary, a senior financial advisor at Affinity Wealth.

In general, about one-third of the capital in Affinity's client portfolios is allocated to fixed income, another third to stocks, and the final third to real estate and infrastructure.

Affinity's bond investment strategy is not to directly purchase corporate bonds for income, but to increase the total return on their bonds by reselling them at a price higher than the purchase price.

In bond portfolio management, family offices can adopt four management strategies:

(1) Passive Bond Management Strategy. In the passive strategy, no assumptions are made about the future direction of interest rates, and any changes in the current value of bonds due to changes in yield are considered unimportant. Bonds can be purchased at a premium or discount initially, with the assumption that the full face value will be received at maturity. The only change in total returns compared to the actual coupon yield is the reinvestment of coupons.

At first glance, this may seem like a lazy investment approach, but in reality, passive bond portfolios provide a stable anchor during severe financial storms, and they can minimize or eliminate transaction costs.

(2) Index Bond Strategy. The main goal of bond portfolio indexing is to provide returns and risk characteristics closely related to the target index. Although this strategy has a passive buying feature, it has a certain degree of flexibility.

(3) Immunization Strategy. The immunization strategy has the characteristics of both active and passive strategies, that is, to match the duration of assets and liabilities (such as the discounting of future cash flows required by the portfolio) to protect against interest rate fluctuations. By definition, pure immunization means that the portfolio will achieve a certain return during a specific period, regardless of any external factors, such as changes in interest rates.

In fact, the purest form of immunization is to invest in zero-coupon bonds and match the maturity date of the bonds with the date when the cash flow is expected to be needed.

(4) Active Bond Strategy. The goal of active management is to maximize the total return. The basic premise of all active strategies is that investors are willing to bet on the future, rather than accept the lower returns that passive strategies can provide.

According to Campden Wealth, it is estimated that by 2026, 37% of family office funds will flow into sustainable investments, including ESG and impact investments.

Green bonds, social bonds, sustainable bonds, sustainable development-linked bonds, and climate bonds all provide clear targets and scope for family office investment in ESG.

Climate Bonds Market Intelligence believes that by 2025, the issuance scale of green bonds will increase from $517 billion in 2021 to $5 trillion, providing investment targets for family offices. In addition, more and more governments will issue such bonds to fund climate-friendly projects.

For example, in 2019, GPIF (Japan's Government Pension Investment Fund) shifted its focus to ESG bonds, investing over $3 billion in green, social, and sustainable development bonds within just one year.

Furthermore, in the second half of 2020, influenced by the significant turmoil in the financial markets, many European and American family asset allocations were urgently adjusted. On one hand, they would carefully select individual stocks with relatively high growth potential, relatively stable performance growth, and industries in a high prosperity phase to include in their stock pool for allocation. On the other hand, in terms of fixed-income plus investment, they increased investment in high credit rating bonds and also increased investment returns through IPO lotteries.

Emerging products that family offices typically establish for a sustainable investment portfolio include:

Green bonds and structured loans with contractually guaranteed key performance indicators (KPIs): While equity products with dual returns are an area of innovation, and currently stocks account for over 50% of total ESG investments, bonds and structured loans that are built on contract-based indicators and targets provide a more direct way to create change.

Multi-asset class dual-return products: Combining stocks and bonds in multi-asset class solutions (MACS) is currently one of the fastest-growing product areas in the investment management industry, with a compound annual growth rate of 11% over the past five years. These solutions aim to replace core investment portfolios by integrating ESG data to better inform decision-making. They also include robust management strategies, including engaging with companies' ESG performance through proxy voting and direct involvement.

Currently, in terms of bond issuance, large companies such as Walmart and Apple have offered sustainable development bonds to further achieve climate-conscious goals.

03 Bond investment in the ESG field

Bond investment is a safe and reliable investment that can generate income through interest or resale, but there are also some risks:

Firstly, the credit or default risk of the issuer.

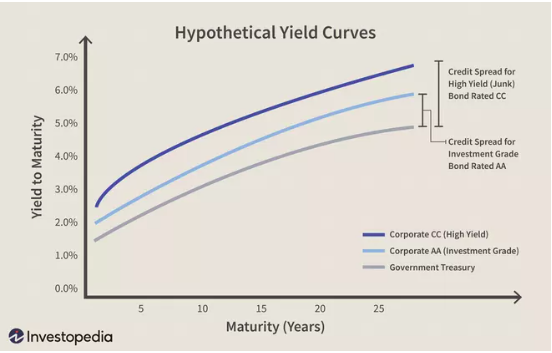

Credit risk, also known as default risk, is the risk that the bond issuer defaults on interest and principal payments. When the bond issuer defaults on payments, bondholders may lose most of their principal. Generally, the highest investment-grade bonds are AAA-rated bonds. Bonds rated BB or worse and companies are mostly speculative and have a high risk of default.

Oaktree Capital noted that bonds rated BB now account for 53% of the US high-yield bond market, up from 43% in 2012. Additionally, according to BofA Research, since February 2022, there has been no market clearance for a refinancing of CCC-rated bonds (referring to a market where commodity prices have sufficient flexibility to quickly balance supply and demand). Leveraged Commentary & Data (LCD) stated that the overall issuance of high-yield bonds has slowed down to a near standstill.

Secondly, bond returns are lower than stock returns.

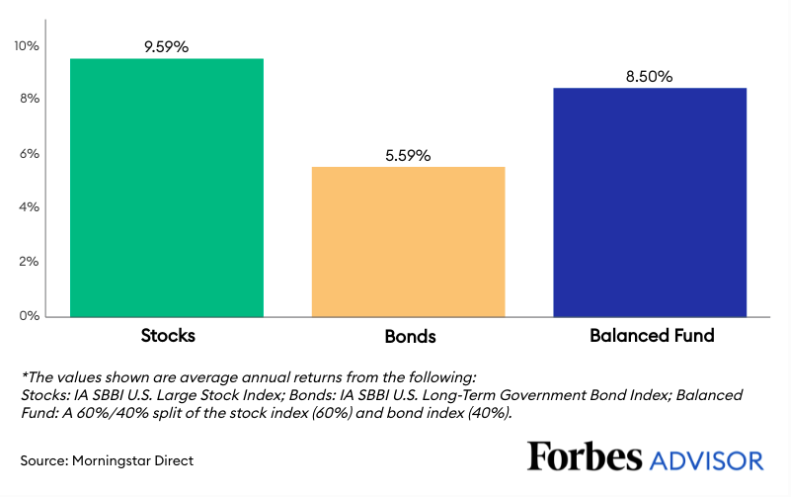

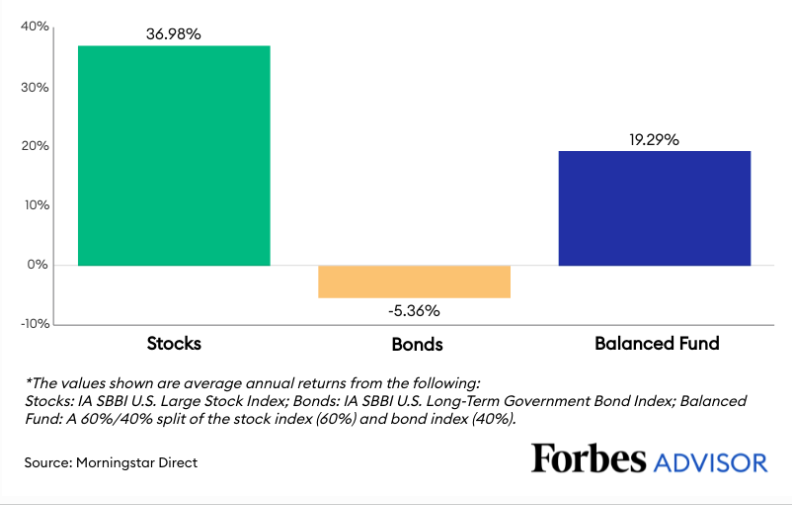

In the long term, the investment returns of bonds are lower than those of stocks. The most severe economic collapse in US history began in 1929, followed by the Great Depression, with stocks falling by up to 80% of their pre-crisis value. In the years since, the average annual return for stocks has been 9.59%, which is more than 40% higher than the average annual return for bonds, and more than 10% higher than a balanced investment portfolio of stocks and bonds.

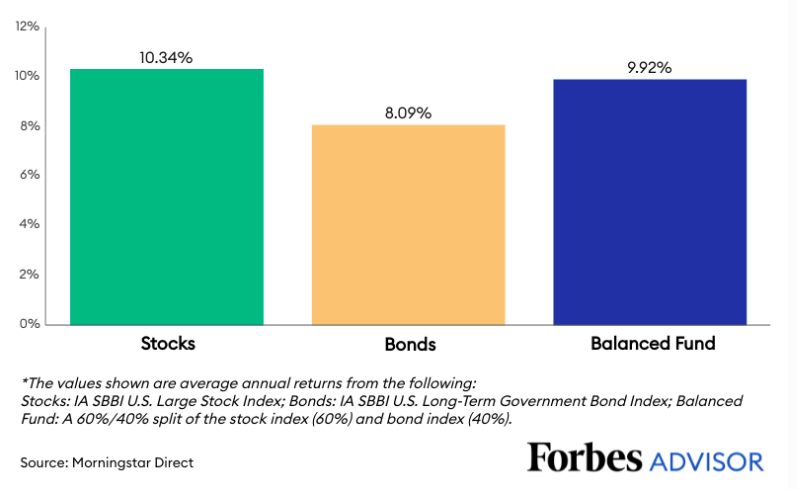

On Monday, October 19, 1987, the Dow Jones Industrial Average plummeted by 23%, marking the largest single-day drop in history. Since “Black Monday,” stocks have outperformed bonds by approximately 20%, with an average annual return of 10.34%. A balanced investment portfolio of stocks and bonds followed closely behind, with a return of 9.92%.

04 Risks of family office investment in bonds

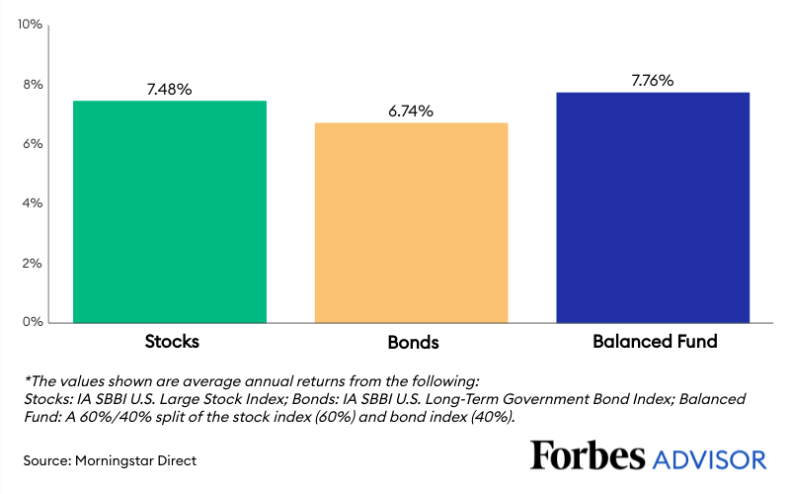

In 2000, the United States experienced another crash in its history. The average annual return rate of stocks was still nearly 8% higher than that of bonds. However, for the first time, the return rate of a portfolio consisting of both stocks and bonds surpassed the return rate of stocks alone.

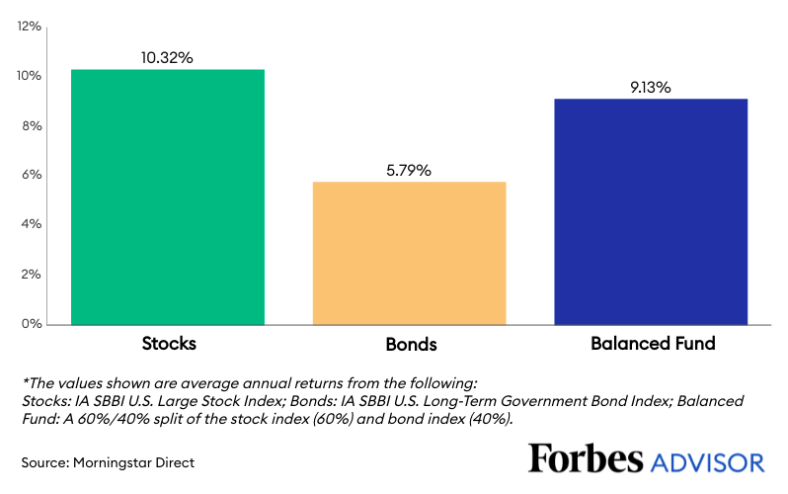

After 2000, the annual average performance of stocks gradually approached their long-term historical average and once again surpassed a balanced investment portfolio by about 10%. The slow recovery of the domestic economy in the United States and the general weakness of global economic growth have reduced the attractiveness of bonds to investors.

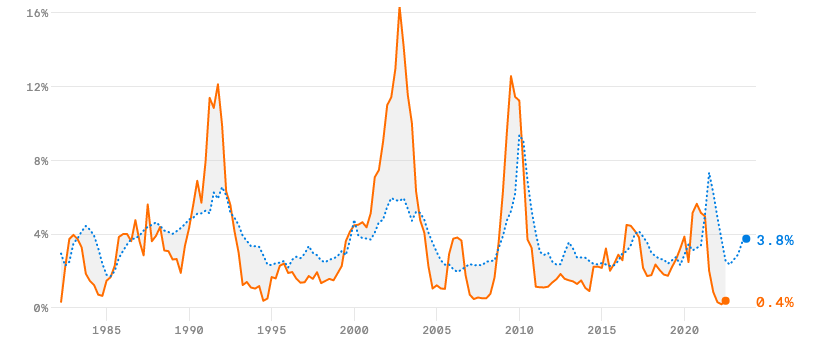

In 2020, with the outbreak of the COVID-19 pandemic, bond yields fell again.

Again, Inflation Risk.

Traditionally, a 60% stock and 40% bond allocation is considered appropriate. However, in an environment of rising inflation and historically low interest rates, investors who want to hedge against inflation and achieve long-term asset growth may need to consider allocating more assets to stocks, as they have the most enduring ability to outperform inflation.

If the interest rate paid by bonds exceeds the expected inflation rate of 3%, the risk is relatively high, especially for bonds with long maturities or high sensitivity to interest rate changes. These bonds have traditionally been the core of the bond allocation in a 60/40 portfolio, but they have suffered significant losses as the Federal Reserve is raising interest rates to combat inflation.

So far this year, Morningstar (an authoritative rating agency in the United States that conducts independent investment research on global capital markets and funds) has seen an average loss of about 8% for its intermediate core bond fund category, as the yield on the 10-year U.S. Treasury bond has risen from 1.5% to nearly 2.75%.

In addition, once the Federal Reserve tightens its policy and the economy goes into recession, bonds with lower credit quality and ratings will face a higher risk of default. Currently, many professionals are recommending short-term bond funds.

Finally, there is liquidity risk.

The liquidity of some bonds is far less than that of blue-chip stocks. This means that once investors have purchased bonds, it will be difficult for them to sell them at a high price.

Since the global financial crisis of 2008-2009, the size of the corporate bond market has expanded significantly due to ultra-low interest rates and reduced bank lending, which has encouraged global companies to use more debt to finance their activities.

However, the liquidity of bonds remains an issue. In most jurisdictions, the trading frequency of corporate bonds is lower than that of stocks or government bonds, as the corporate bond market heavily relies on a small number of dealers.

Because bonds have a long investment period, they are not a good tool for accumulating wealth. If a family office wants to seek higher returns, it may need to invest less in bonds and more in stocks and other assets.

It is important that the family office should determine the proportion of bonds to invest in, as well as what type of bonds to buy, based on their financial goals and risk tolerance.

When investing in bonds, here are some suggestions.

First, find a trustworthy financial advisor who can help the family office make wise decisions and achieve their investment goals.

Secondly, pay attention to the timing of investment. Investors often say, “In a bear market, earn interest, and in a bull market, earn the difference.” Buy short-term bonds during a bear market for bonds, and buy long-term bonds during a bull market for bonds.

During a bear market for stocks, purchasing U.S. government bonds may be more profitable than cash. When it is expected that the bear market is about to end, purchasing junk bonds usually offers higher returns and lower risks than stocks. In addition, a highly diversified bond portfolio is a method that can earn more money than cash but carries greater risk.

Thirdly, due diligence is key when investing in corporate bonds.

It is very important to understand the basic financial condition of a company, such as the level of debt the company has and its ability to pay interest. In addition, the family office also needs to conduct a comprehensive assessment of the business and frequently meet with the senior management of the bond issuer and conduct on-site inspections.

For example, in 2018, before investing in the bond issued by NEXTDC, a data center operator, the private wealth management company Affinity Wealth and its team visited the company's data center to personally inspect the quality of the assets.

Fourth, build awareness and technical capabilities for risk prevention. The family office needs to prevent liquidity risks of bonds by ensuring the use of strict governance structures, cutting-edge technology, and building an investment portfolio with risk awareness.

(1) Strict governance structure. An effective governance process should include: review of internal price difference checks and anomaly reports; the governance team should regularly analyze and discuss pricing and liquidity data with the portfolio management team on a monthly basis; the liquidity of the portfolio should be assessed through stress testing under different scenarios, etc.

(2) Technological innovation. Some forward-looking bond managers have changed the way of research and trading, upgrading to digital and automated processes.

(3) Portfolio construction. A risk-aware portfolio construction should control costs and risks by minimizing individual risk exposure and diversifying investments among multiple issuers.

05 Guide to avoiding pitfalls in family offices

Please note that the above content and viewpoints are for reference only and do not represent any position of our company. They do not constitute investment advice. Please treat them with caution.