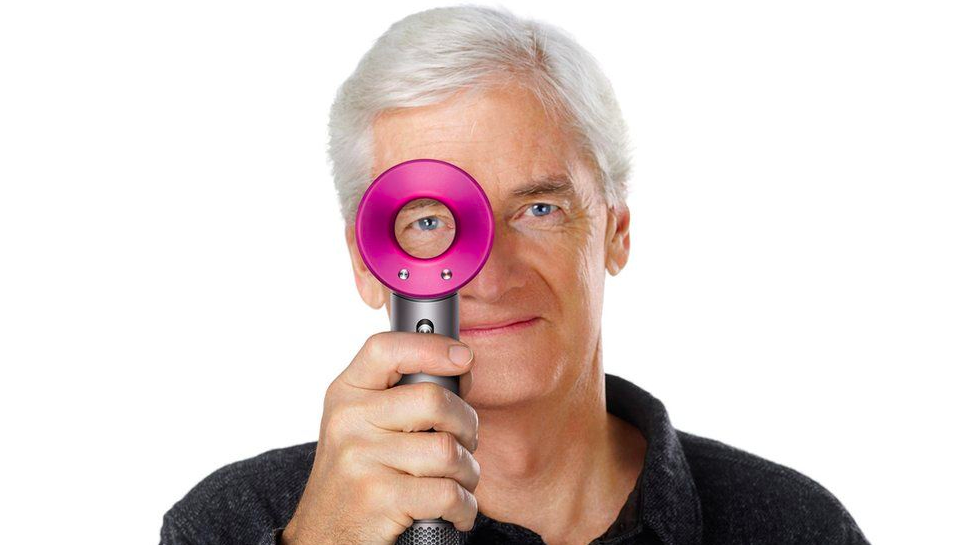

James Dyson, the former richest man in the UK, has a fortune of $15 billion (approximately 107.5 billion yuan), which comes from his shares in Dyson Holdings. To manage his vast assets, he established a single-family office called Weybourne Holdings. Despite the surge of family offices that cater to the needs of global ultra-high-net-worth individuals over the past 20 years, few can match the scale of Weybourne Holdings. Today, “Family Office Insights” takes you into Dyson's family office, Weybourne Holdings.

Like many super-rich individuals around the world, Dyson has strengthened management and preserved his wealth by creating a family office. The family office, Weybourne Holdings Pte Ltd, helps the Dyson family supervise everything from investments (including buying and selling foreign currencies on their behalf) to private jets to personal security. The family office was established in 2013 and was formerly known as Holkham One Limited and Holkham Group Limited.

Its headquarters are located in Singapore, and in addition to Dyson Holdings and its subsidiary Dyson, it also includes Dyson Agriculture. In addition, Weybourne is also involved in financial investments and commercial real estate.

Among them, the real estate investments in the UK include: a 300-acre Georgian manor in Gloucestershire's Doddington Park; a property in Chelsea, London; and a series of properties in Fitzrovia known as The Village, etc.

Weybourne's main subsidiaries in the UK include:

• Weybourne Limited

• Weybourne Finance Limited

• Weybourne Properties Limited

• Dodington Commercial Properties Limited

• New Beeswax Dyson Farming Limited (owns about 35,000 acres of land, including many farms. Dyson has invested heavily in purchasing farmland in Lincolnshire, Oxfordshire, and Gloucestershire, etc.; adopts sustainable farming methods, agriculture + technology)

• Weybourne Investment Nominees Limited

According to relevant registration documents, as of May 2019, Weybourne has assets of £4.5 billion. The company no longer reports financial conditions and is active in real estate, agriculture, and public markets.

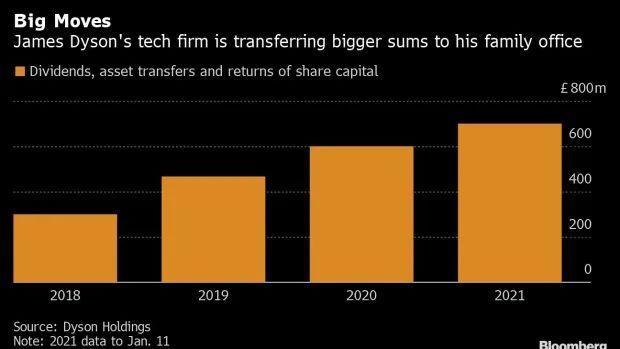

Weybourne's main asset income comes from dividends from Dyson Holdings. In 2018, Weybourne received transferred capital and dividends of £300 million from Dyson Holdings, and in 2019, it was £464 million. At that time, Dyson Holdings stated that it would move its headquarters from the UK to Singapore to focus on the Southeast Asian market.

In 2020, Dyson Holdings saw a 12% increase in profits to £797 million, with revenue growing by 5.7% to £5.7 billion. The company also paid a £400 million dividend to Weybourne. During this period, Weybourne also received £200 million from Dyson Holdings and an additional £700 million through a share transfer in January 2021.

In 2021, Dyson Holdings paid another £1 billion ($1.1 billion) to Weybourne. In addition, Weybourne received an additional £500 million or more through further dividends, which may be allocated to his business interests, art, and charitable causes.

Richard Murphy, a professor of accounting practice at the Sheffield University Management School, commented on this behavior: “In fact, the family is diversifying their interests.”

According to foreign media reports, as of 2022, Dyson has transferred about £4.7 billion (S$7.7 billion) to his single family office. Paul Wester, co-founder of family office headhunter Agreus Group, said: “They are taking a lot of assets out of the operating business, making this entity a professional investment department. They are very diversified.”

Weybourne currently has about 70 employees worldwide, which is about 25% more than in 2019. It recently posted job advertisements, requiring at least six positions to be recruited in southern England (where most of the company's employees are located).

The family office is managed by James Bucknall, a former British military officer born in 1958, who is responsible for managing family affairs, while 57-year-old former fund manager Bjorn Thelander will serve as the Chief Investment Officer.

Bjorn Thelander has previously handled a series of financial issues for the Rausing family's Tetra Pak packaging group and later provided consulting and advice to high-net-worth individuals.

In 2020, Weybourne invested in the WestRiver mezzanine loan co-investment fund.

01 Single office Weybourne Holdings

In January 2019, Dyson relocated its headquarters from Malmesbury in the southwest of England to Singapore to meet the needs of its growing business in Asia. At the same time, it established Weybourne Services Singapore Pte in Singapore and recruited IT and financial services personnel.

Weybourne hired analyst and multi-asset investment manager Brandon Foo, who previously worked at Citigroup. Kelvin Wu, who was also hired, had previously worked at International SOS, a health and safety services company, helping to supervise insurance business.

Additionally, according to documents submitted to the Accounting and Corporate Regulatory Authority of Singapore, Swiss private bank Lombard Odier serves as the private banker for Weybourne, providing relevant services.

Dyson mainly raises funds through dividends and transferring equity to a Singapore holding company. The Singapore holding company does not disclose consolidated performance. Documents show that Weybourne transferred Dyson's main real estate and agricultural business shares from Singapore to the UK at the end of 2021, with a transaction value of £616.8 million.

The transfer of shares may be tax-driven. Mark Davies, a tax advisor in the UK who serves super-rich individuals, said of the stock transaction, “He treats the family office as a piggy bank to collect excess income.”

In addition, media reports have shown that Dyson has paid a total of £600 million in dividends to its Singapore family office twice, becoming the largest expenditure of the company that year. Then, through equity transfer by Dyson, he injected £700 million into the Singapore family office. A total of £1.3 billion (S$2.4 billion), accounting for about 6.86% of the Dyson family's assets.

Singapore, as a popular place for family offices, has many advantages, including good privacy and security, and favorable tax policies. For example, the UK income tax rate for amounts over £150,000 (about $180,000) is 45%, while the Singapore income tax rate for amounts over $320,000 is 22%.

“Weybourne can almost become a boutique representative for managing personal assets,” said Tayyab Mohamed, another co-founder of Agreus Group. “It is ranked the highest among family offices.”

Although Dyson Holdings and Weybourne have expanded their business in Singapore, and Dyson even once wanted to settle in Singapore, including buying a super penthouse at Wallich Residence for S$73.8 million in June 2019, and a high-quality detached house for more than S$41 million in July 2019.

However, only one year later, in 2020, Dyson sold the super penthouse at Wallich Residence and moved his residence back to the UK in 2021.

As for why he moved back to the UK, according to foreign media reports, when Dyson moved its company to Singapore in 2019, it was criticized by British lawmakers. Before that, the Dyson family and its family business were major taxpayers in the UK. In 2018, Dyson contributed £103 million in taxes to the UK.

In March 2020, then-British Prime Minister Boris Johnson texted Dyson, saying that if Dyson's employees could come to the UK to manufacture ventilators during the COVID-19 pandemic, they would not have to pay extra taxes. The ventilator project cost £20 million, and staff from the UK and Singapore worked “around the clock” to manufacture ventilators. However, the project was eventually not carried out.

Although Dyson has moved his residence back to the UK, Singapore remains the headquarters and group focus of Dyson Holdings. The executive team of Dyson Holdings is still located in Singapore, which is the center of the company's sales and manufacturing business.

02 “Love-Hate Entanglements” with Singapore

In 2002, Dyson established the James Dyson Foundation in the UK to support design and engineering education and operates in locations such as the UK, the US, and Japan.

The foundation aims to inspire young people to study engineering and become engineers by encouraging students to think differently. It supports engineering education in schools and universities, as well as medical and scientific research in collaboration with charitable organizations.

In May 2014, the foundation announced a donation of 8 million pounds to create a technology center at the University of Cambridge.

The following March, the foundation also pledged to donate 12 million pounds to Imperial College London to purchase the Post Office building on Exhibition Road from the Science Museum. Imperial College will open the Dyson School of Design Engineering in this building and launch a new four-year Master's degree program in Design Engineering.

The foundation supports the work of young designers through the James Dyson Award, an international design award that “celebrates, encourages, and inspires the next generation of design engineers.” It operates in 20 countries and is aimed at recent graduates in the fields of product design, industrial design, and engineering.

The foundation also supports the development of design and technology schools around the world, as well as educational partnerships. The Dyson business unit has agreed to invest 31 million pounds annually in educational institutions for five years.

In June 2019, the foundation announced a donation of 18.75 million pounds to Dyson's alma mater, Gresham's, to build a new Science, Technology, Engineering, Arts, and Mathematics (STEAM) building.

In addition, Dyson is also a trustee of the James and Deirdre Dyson Trust. The foundation is entirely self-funded and does not accept external donations, mainly supporting charitable projects related to the arts, healthcare, education, and sports.

03 James Dyson Foundation

Weybourne's operating profit margin of nearly 20% is not far from that of Apple. Like Apple, Dyson Holdings also follows a high-end and fashionable path. Dyson founded Dyson Technology in 1991 and opened a research center and factory in Malmesbury, Wiltshire, in June 1993.

In September 2017, Dyson announced plans to produce an electric car, which was scheduled to be launched in 2020. He personally invested 2 billion pounds and assembled a team of more than 400 people for the project, but it ultimately ended in failure. After abandoning the electric car project, Dyson focused more on robotics and machine learning.

Of course, Dyson Holdings is just an important part of Dyson's business empire. Outside of business, in 1999, he also acquired Domaine des Rabelles, an estate and winery located near Vallon de Rabelles and Tourtour in France.

In his private life, Dyson owns the super luxurious yacht Nahlin, which is 91 meters (299 feet) long and ranked 36th in the 2013 global top 100 yacht survey. In addition, he also owns two Gulfstream G650 (G-VIOF), Gulfstream G650ER (G-GSVI) private jets, and an AugustaWestland AW-139 helicopter.

Dyson's wife is the famous artist and carpet designer Deirdre Hindmarsh, and they have two sons and one daughter together.

James Dyson (center), his wife Deirdre, and their children Emily and Jack

Among the three children, only Jack Dyson followed in his father's footsteps, establishing his own lighting company since 2003 and integrating it into the family business. In 2013, he became a non-executive director along with his brother Sam Dyson, who is a musician and producer, which solidified his position as the heir of Dyson Holdings.

Sam Dyson was a songwriter and lead guitarist for the independent band Chemists, and later founded his own record label, Distiller Records. Their daughter, Emily Dyson, runs a fashion boutique in London called Couverture & The Garbstore. The daily attire of her father and brother is almost entirely designed by her and her husband.

04 The Dyson Family

Dyson's three children (from left to right) Jack, Emily, and Sam

In terms of estate planning, Dyson's three descendants were bequeathed a total of 45 million pounds worth of shares in the family business, which is a departure from the trend of entrepreneurs donating large sums to charities and leaving almost nothing to their children. According to documents submitted to Companies House, Dyson's children acquired this wealth through a transaction to repurchase their father's company shares. This transaction occurred before the capital gains tax on such transactions was increased from 10% to 18%.

In response to this, a company spokesperson said, “Over the past 35 years, this family has been involved in the company's work and has supported the company through difficult times. It is natural for James to want to take care of their future.”

Dyson's generous provision for his descendants contrasts sharply with other well-known entrepreneurs, including Bill Gates, who has stated that he will leave 35 billion pounds of Microsoft assets to charities rather than to his children. Dragon's Den star Duncan Bannatyne plans to donate his entire 310 million pounds worth of assets to charity.

In addition to succession planning, Dyson Holdings will also remain independent and will not go public or be sold when its founder retires. Dyson has publicly stated, “The beauty of a family business is that you worry about whether the product is right, rather than any investors with short-term perspectives or other people's ideas. I don't want to be a public company. We can think very long-term and develop technologies that may take years to realize. We can be patient.”