What Is the Current AI Chatbot Market Share in 2026?

According to the latest Similarweb data released in January 2026, ChatGPT holds 68% of the AI chatbot market share, down dramatically from 87.2% one year ago. Google Gemini has emerged as the fastest-growing competitor, capturing 18.2% market share compared to just 5.4% in January 2025. This 19.2 percentage point decline in ChatGPT's dominance marks the most significant market shift in generative AI history and signals the end of OpenAI's near-monopolistic position.

The data reveals a rapidly evolving competitive landscape where distribution advantages, ecosystem integration, and continuous innovation are displacing first-mover advantages. For businesses, marketers, and investors tracking AI adoption, these market dynamics represent fundamental changes in how consumers access and interact with artificial intelligence.

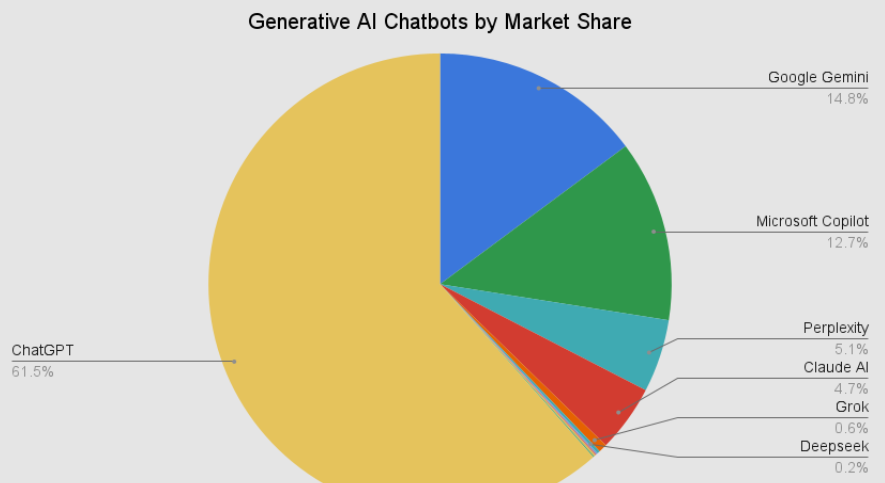

Complete AI Chatbot Market Share Breakdown: January 2026

Similarweb's comprehensive analysis of website traffic and app usage patterns reveals the following market distribution across major AI platforms:

ChatGPT (OpenAI): 68% market share

- 800 million weekly active users

- 5.8 billion monthly website visits

- Year-over-year website traffic growth: +49%

- Mobile app daily active users growth: +114.6%

Google Gemini: 18.2% market share

- 650 million monthly active users (up from 450M in July 2025)

- Year-over-year growth: +237% (largest among major platforms)

- Referral traffic growth: +388% year-over-year

DeepSeek: 4% market share

- Strong presence in Asian markets

- Competitive pricing strategy driving adoption

Grok (X.AI): 2.9% market share

- Modest but steady growth

- Integration with X platform (formerly Twitter)

Perplexity: 2% market share

- 370% year-over-year growth

- Mobile app strategy showing strong results

- “Year of the app” transformation in 2025

Claude (Anthropic): 2% market share

- 190% year-over-year growth

- Strong enterprise adoption

- $2.2 billion projected 2025 revenue (159% growth)

Microsoft Copilot: 1.2% market share

- Remains flat despite Windows and Office integration

- Distribution alone proving insufficient for growth

These figures represent website visit shares as measured by Similarweb through December 2025 and January 2026, analyzing billions of web and app signals globally.

Why Is ChatGPT Losing Market Share?

ChatGPT's decline from 87.2% to 68% market share represents a 19.2 percentage point drop in just twelve months—the steepest decline for any dominant technology platform in recent memory. Multiple structural factors contribute to this erosion.

Competition Catches Up in Capability

The capability gap that once defined ChatGPT's competitive moat has narrowed substantially. Google's aggressive model releases throughout 2025—particularly Gemini 3 Flash and the integration of Nano Banana Pro for image generation—closed performance differences that previously drove users exclusively to ChatGPT.

When AI models reach functional parity for most use cases, users gravitate toward platforms offering superior convenience rather than marginal quality differences. ChatGPT no longer possesses the clear technical superiority that justified the friction of adopting a standalone platform.

Distribution Disadvantages

OpenAI lacks the distribution infrastructure that Google leverages effortlessly. ChatGPT requires conscious adoption—users must visit a website, download an app, or integrate the API. Gemini embeds directly into:

- Android operating system (default assistant)

- Google Search (reaching 2 billion users through AI Overviews)

- Chrome browser

- Gmail, Google Docs, and Workspace applications

- YouTube and all Google properties

Similarweb data demonstrates this advantage quantitatively: twice as many U.S. Android users engage with Gemini through the operating system compared to the standalone app. This built-in accessibility eliminates adoption friction entirely.

Subscription Growth Plateau

Despite 800 million weekly users, only approximately 5% maintain paid ChatGPT subscriptions (ChatGPT Plus or higher tiers). Paid subscriptions have plateaued across major European markets since May 2025 with no recovery trajectory.

This plateau creates a dual challenge: declining market share indicates ChatGPT is losing the attention battle, while flat subscription growth reveals monetization struggles. Revenue growth cannot sustain if both metrics deteriorate simultaneously.

OpenAI's “Code Red” Response

Sam Altman's December “code red” memo to OpenAI staff explicitly addressed competitive threats, instructing teams to focus on personalization, reliability, and image generation—areas where Gemini has gained ground. The internal alarm confirms that competitive pressure has moved beyond theoretical concern into operational urgency.

How Google Gemini Achieved 237% Growth

Gemini's surge from 5.4% to 18.2% market share represents the fastest growth trajectory of any major AI platform. Google's strategic approach combines multiple competitive advantages that compound synergistically.

Native Ecosystem Integration

Gemini benefits from integration across Google's entire digital ecosystem, creating what industry analysts term “ambient AI”—artificial intelligence that users encounter naturally within existing workflows rather than through deliberate activation.

Search Integration: Gemini powers AI Overviews in Google Search, reaching approximately 2 billion users daily. Users obtain AI-generated summaries without leaving search results, eliminating any reason to visit competitor platforms for basic queries.

Android Dominance: With approximately 71% global smartphone market share, Android provides distribution reaching over 3 billion devices. Gemini functions as the default assistant on recent Android versions, ensuring billions of encounters monthly.

Workspace Productivity: Organizations using Google Workspace (Gmail, Docs, Sheets, Slides) access Gemini features without additional subscriptions or context switching. Enterprise customers receive AI capabilities as integrated productivity enhancements rather than separate purchases.

Technological Innovation: Nano Banana Pro

The December 2025 launch of Nano Banana Pro—Google's image generation model built on Gemini 3 Pro—addressed a critical weakness plaguing all AI image generators: legible text rendering within images.

Nano Banana Pro generates images with accurate, readable text directly embedded, solving problems that frustrated users across competing platforms. Integration across Gemini, Google Search, NotebookLM, and Workspace tools provided immediate distribution to hundreds of millions of users.

Even after ChatGPT introduced its own image update in response, Similarweb data indicates Gemini maintained leadership on image quality metrics through year-end 2025.

User Growth Metrics

Gemini's monthly active user base expanded from 450 million in July 2025 to 650 million by October—representing 44% growth over just three months. This growth rate dramatically exceeds ChatGPT's approximately 5% expansion during the same period.

More significantly, Similarweb found referral traffic from Gemini to external websites grew 388% year-over-year compared to 52% for ChatGPT. This differential reveals deeper engagement patterns: Gemini users aren't just visiting the platform casually but actively using it to discover and navigate to external resources.

Mobile-First Design Philosophy

Gemini's mobile experience prioritizes speed and convenience over comprehensive features, aligning with how most consumers actually use AI assistants. While ChatGPT emphasizes desktop workflows for complex tasks, Gemini optimizes for quick queries, voice interaction, and seamless handoffs between Google services.

Global desktop visit data from Sensor Tower reveals this strategy's effectiveness: between August and November 2025, Gemini's global desktop visits doubled while ChatGPT's rose approximately 1%. Mobile usage patterns show even starker differentiation.

AI Chatbot Market Share by Country: Geographic Analysis

ChatGPT maintains global leadership across virtually all surveyed markets, but regional variations reveal interesting adoption patterns and competitive dynamics.

United States Market Share

According to November 2025 Similarweb data, ChatGPT holds 66% of U.S. AI chatbot traffic (some sources cite up to 75.91%), with Gemini claiming second position. Microsoft Copilot shows stronger performance in the U.S. (9.35% in some datasets) compared to global averages, likely reflecting Microsoft's enterprise relationships and Windows market share.

The U.S. market demonstrates sophisticated AI adoption with users actively testing multiple platforms rather than defaulting exclusively to first-mover ChatGPT.

European Market Dynamics

ChatGPT dominates European markets with approximately 80.02% market share, slightly higher than global averages. Germany represents ChatGPT's strongest European user base at 3.39% of global traffic, highlighting widespread adoption across German-speaking regions.

European users show preference for privacy-conscious platforms, with Claude gaining traction among organizations prioritizing data governance compliance.

Asian Market Patterns

India contributes 7.99% of global ChatGPT traffic, representing the second-largest user base after the United States. Japan accounts for 3.7%, showing strong AI adoption in technologically advanced Asian markets.

China's market operates distinctly due to regulatory constraints, with DeepSeek capturing approximately 4% global market share primarily through Chinese users and cost-conscious developers in broader Asian markets.

Latin American Adoption

Brazil emerges as ChatGPT's fourth-largest market globally at 5.73% of total traffic. Latin American markets demonstrate enthusiastic AI adoption with users embracing platforms offering Portuguese and Spanish language support.

Russian Market Specificity

Russia shows unique preferences for Yandex-related AI tools, reflecting the country's distinct digital ecosystem and geopolitical factors influencing technology adoption.

Mobile vs Desktop: Platform Usage Patterns

Similarweb data reveals significant differences in how users access AI chatbots across device types, with implications for platform strategy and competitive positioning.

Desktop Dominance for ChatGPT

ChatGPT sees 71.74% of traffic from desktop computers compared to 28.26% from mobile devices. This desktop preference suggests users rely on ChatGPT for complex, extended tasks requiring larger screens and full keyboard input.

Typical desktop use cases include:

- Software development and code generation

- Long-form content creation and editing

- Academic research and writing

- Business analysis and strategic planning

- Multi-step workflows requiring sustained focus

Mobile-First Usage for Gemini

Gemini demonstrates stronger mobile engagement, reflecting its design philosophy and integration advantages. Android users access Gemini through voice commands, quick queries, and contextual suggestions without switching apps.

Mobile use cases trend toward:

- Quick factual queries

- Voice-activated assistance

- Shopping and local search

- Translation and language support

- Brief content generation

The “Year of the App” for Perplexity

Perplexity experienced dramatic transformation in 2025, which Similarweb characterizes as “the year of the app” for the platform. January 2025 data showed similar usage between the app and website. Twelve months later, app engagement had skyrocketed while website traffic remained comparatively flat.

This mobile-first pivot demonstrates that AI platforms can successfully transition user bases from web-based experimentation to daily mobile habits when product experiences justify the switch.

AI Referral Traffic: The New Discovery Channel

Beyond market share metrics, referral traffic patterns reveal how AI chatbots function as discovery and navigation tools, creating entirely new pathways for users to reach external websites.

Gemini's 388% Referral Traffic Growth

From September to November 2025, Gemini's referral traffic to external websites grew 388% year-over-year, according to Similarweb data shared with Digiday. This explosive growth vastly exceeds ChatGPT's 52% increase during the same period.

High referral traffic growth indicates users trust Gemini's recommendations and actively click through to sources, products, and resources the AI suggests. For publishers, e-commerce platforms, and content creators, this represents a crucial new traffic channel.

ChatGPT Generated 1.1 Billion Referral Visits

Despite slower growth rates, ChatGPT's absolute referral volume remains substantial. The platform generated over 1.1 billion referral visits in June 2025, up 357% year-over-year from June 2024 baseline.

Publishers report that while AI referral traffic remains small compared to traditional search and social channels (typically under 1% of total traffic), these visitors demonstrate high engagement and conversion rates.

Conversion Rates Approaching 7%

Similarweb's 2025 Generative AI Landscape report reveals that referrals from AI chatbots to transactional sites convert at approximately 7%—significantly higher than typical website traffic sources. This elevated conversion rate suggests AI-referred visitors arrive with clear intent and specific needs.

E-commerce businesses particularly benefit from this high-intent traffic, as users who ask AI for product recommendations have already progressed through awareness stages of the buying journey.

AI as a Discovery Layer

Or Offer, Co-Founder and CEO of Similarweb, framed the shift succinctly: “The center of gravity in digital discovery is shifting. Consumers are now starting their journeys inside AI assistants, asking questions, shaping preferences and choosing who to trust before they reach a website.”

This represents fundamental change in digital discovery patterns. Traditional search engine optimization (SEO) strategies that focused exclusively on Google Search rankings now require complementary AI optimization strategies to maintain visibility.

Generative Engine Optimization (GEO): The New Marketing Discipline

The emergence of AI chatbots as primary discovery tools necessitates new optimization strategies distinct from traditional SEO.

What Is GEO?

Generative Engine Optimization refers to practices that improve brand visibility, accuracy, and favorability within AI-generated responses across platforms like ChatGPT, Gemini, Perplexity, and Claude.

Unlike traditional SEO which optimizes for search engine algorithms and rankings, GEO focuses on ensuring AI models accurately represent brands, cite appropriate sources, and recommend relevant products or services when answering user queries.

Measuring AI Visibility

Similarweb's Gen AI Intelligence Toolkit represents the first comprehensive measurement framework for brand presence across AI platforms. The system tracks:

Citation Frequency: How often AI platforms cite specific brands or sources when answering related queries Share of Voice: Brand presence relative to competitors in AI responses Referral Traffic: Actual clicks from AI platforms to brand websites Conversion Tracking: User actions after arriving from AI referrals

Baruch Toledano, GM of Web Intelligence at Similarweb, explained: “Gen AI is the new discovery layer, and now it's measurable. By connecting AI brand visibility with traffic and competitive signals, we give companies a clear scoreboard: where you show up, who's being recommended, and what to do next.”

GEO Strategy Fundamentals

Effective GEO requires understanding how AI models process and prioritize information:

Authoritative Content: AI platforms favor original sources, expert content, and well-documented information over aggregators and secondary sources.

Structured Data: Information presented in clear, well-organized formats with proper metadata improves AI parsing accuracy.

Entity Recognition: Consistent brand names, product identifiers, and proper nouns help AI models accurately associate information with correct entities.

Citation-Worthy Claims: Specific statistics, unique insights, and proprietary research increase likelihood of citation in AI responses.

Comprehensive Coverage: AI models synthesize information across multiple sources. Brands with detailed, thorough content on topics appear more frequently in responses.

Microsoft Copilot: The Surprising Underperformer

Despite Microsoft's $13 billion investment in OpenAI and deep integration across Windows and Office products, Copilot commands only 1.2% global market share—remaining virtually flat throughout 2025.

Integration Without Adoption

Copilot's stagnation demonstrates that distribution advantages alone cannot guarantee success. The platform integrates into:

- Windows 11 operating system

- Microsoft Office suite (Word, Excel, PowerPoint)

- Microsoft Edge browser

- Bing search engine

Yet this extensive integration failed to translate into significant user adoption or engagement.

Competing Products Confusion

Microsoft's AI strategy suffers from product proliferation and brand confusion:

- Copilot (consumer AI assistant)

- Copilot Pro (subscription service)

- GitHub Copilot (developer tool)

- Microsoft 365 Copilot (enterprise productivity)

- Bing Chat (rebranded to Copilot)

Users struggle to differentiate between offerings and understand value propositions for each product variation.

Strategic Implications

The Copilot underperformance raises questions about Microsoft's AI strategy and return on its OpenAI partnership. The company captures approximately 20% of OpenAI's revenue through their arrangement but has failed to convert this investment into consumer AI market share.

Enterprise adoption shows more promise, with Microsoft 365 Copilot gaining traction in large organizations. However, consumer-facing Copilot remains a marginal player in the AI chatbot landscape.

Emerging Competitors: Claude, Perplexity, and DeepSeek

While ChatGPT and Gemini dominate with combined 86.2% market control, specialized competitors demonstrate that focused positioning can drive substantial growth.

Claude: Enterprise-Focused Growth

Anthropic's Claude maintains approximately 2% market share but generated $850 million in annualized revenue in 2024, with projections reaching $2.2 billion in 2025—representing 159% growth.

The strategy prioritizes enterprise customers with customized contracts, emphasizing:

- Enhanced safety and alignment

- Transparent model behavior

- Constitutional AI principles

- Extended context windows (200,000 tokens)

- Superior performance on reasoning tasks

Claude demonstrates that specialized positioning targeting high-value customers can generate substantial revenue despite smaller overall market share. The 190% year-over-year growth indicates this strategy resonates with organizations prioritizing responsible AI deployment.

Perplexity: AI-First Search Innovation

Perplexity experienced 370% year-over-year growth by positioning as an AI-first search engine rather than a general chatbot. This differentiation strategy targets users seeking research and information discovery.

Key differentiators include:

- Citation-backed responses with source links

- Real-time web search integration

- Academic and research-focused features

- Clean, minimalist interface prioritizing information over conversation

The platform's transformation into a mobile-first product in 2025 dramatically accelerated growth, with app usage surpassing website traffic by year-end.

DeepSeek: Price Competition

Chinese competitor DeepSeek maintains approximately 4% market share by offering competitive pricing and performance, particularly appealing to cost-conscious users and developers in Asian markets.

DeepSeek's strategy focuses on:

- Aggressive pricing below Western competitors

- Localization for Chinese language and culture

- Developer-friendly APIs and documentation

- Academic and research partnerships

While regulatory constraints limit DeepSeek's growth in Western markets, the platform demonstrates sustained traction in Asia.

AI Chatbot Revenue and Business Models

Market share metrics tell only part of the story. Revenue generation and monetization strategies vary dramatically across platforms.

ChatGPT Revenue: $10 Billion Annual Run Rate

OpenAI reached $10 billion in annual recurring revenue (ARR) as of June 2025, making it one of the fastest-growing software companies in history. Revenue streams include:

ChatGPT Plus: $20/month subscription (approximately 40 million subscribers) ChatGPT Team: $25-30/user/month for businesses ChatGPT Enterprise: Custom pricing for large organizations ChatGPT Pro: $200/month for research-grade access (launched December 2025) API Access: Usage-based pricing for developers Microsoft Partnership: 20% revenue share arrangement

Despite 800 million weekly users, only approximately 5% maintain paid subscriptions—revealing significant monetization challenges. The vast majority of ChatGPT usage occurs through free tiers.

Google Gemini: Ecosystem Monetization

Google doesn't disclose separate Gemini revenue but monetizes the platform through:

Google One AI Premium: $19.99/month bundled subscription Google Workspace Add-ons: Enterprise AI features Advertising Integration: Sponsored recommendations in responses Cloud Platform Services: Vertex AI enterprise offerings Indirect Value: Enhanced engagement across Google properties

Google's monetization strategy differs fundamentally from OpenAI's. Rather than maximizing direct AI subscription revenue, Google leverages Gemini to strengthen ecosystem lock-in, increase time spent in Google properties, and enhance advertising targeting.

Freemium vs Integration Models

The competitive landscape reveals two distinct monetization philosophies:

Freemium Model (ChatGPT, Claude, Perplexity): Offer free basic access, convert users to paid subscriptions for enhanced features.

Integration Model (Gemini, Copilot): Embed AI capabilities into existing paid products, increasing value of broader platform subscriptions.

Early evidence suggests integration models may generate more sustainable revenue at scale, as users demonstrate willingness to pay for comprehensive productivity suites with AI features but resist subscribing to multiple standalone AI services.

The Future AI Market: What's Next for 2026-2027

Current trends suggest several developments likely to shape the AI chatbot landscape over the next 12-24 months.

Market Consolidation Accelerates

The top two platforms (ChatGPT and Gemini) control 86.2% of market share, with the next eight competitors sharing just 13.8%. This winner-takes-most dynamic typically leads to further consolidation.

Expect:

- Smaller platforms struggling to maintain independent operations

- Acquisition opportunities for major technology companies

- Specialized players focusing on niche markets

AI Agent Capabilities Expand

Both ChatGPT (with GPT-5 agentic features) and Gemini (with agentic API capabilities) are developing autonomous task execution. These “agent” systems will:

- Manage calendars and schedules automatically

- Execute multi-step workflows without supervision

- Integrate with third-party applications

- Handle complex research and analysis tasks

The platform that delivers reliable, useful agentic capabilities first may gain significant competitive advantage.

Mobile-First Design Becomes Standard

Perplexity's successful mobile pivot and Gemini's strong mobile engagement demonstrate user preference for accessible, convenient AI access. Expect:

- Voice interaction improvements across platforms

- Tighter integration with mobile operating systems

- Faster, more efficient mobile interfaces

- Cross-device conversation synchronization

Privacy and Regulation Impact

Growing regulatory scrutiny of AI systems will influence platform strategies:

- Data retention and usage policies

- Content moderation and safety features

- Transparency in training data sources

- Geographic compliance variations

Platforms that proactively address privacy concerns may gain trust-based competitive advantages.

Vertical AI Assistants Emerge

Rather than general-purpose chatbots, specialized AI assistants targeting specific industries or use cases will proliferate:

- Medical diagnosis and treatment planning

- Legal research and contract analysis

- Financial planning and investment advice

- Software development and code generation

- Creative content production

These vertical solutions may capture value by delivering superior performance for specific tasks rather than competing for general market share.

Business Implications: Strategies for 2026

Organizations must adapt strategies to account for shifting AI adoption patterns and new discovery channels.

For Marketers: Develop GEO Strategies

Traditional SEO alone no longer suffices for digital visibility. Marketing teams should:

- Audit brand presence across AI platforms

- Track citation frequency and share of voice

- Optimize content for AI parsing and citation

- Monitor referral traffic from AI sources

- Test different content formats for AI visibility

Similarweb's data indicates brands optimizing for AI discovery gain early-mover advantages in this emerging channel.

For Product Teams: Platform Strategy Decisions

Organizations building AI-powered features must choose between:

- Developing proprietary AI capabilities

- Integrating ChatGPT via API

- Adopting Gemini through Google Cloud

- Using multiple platforms for different features

The market shift toward Gemini suggests developers should evaluate Google's AI offerings more seriously rather than defaulting to OpenAI integrations.

For Enterprises: Vendor Risk Assessment

ChatGPT's market share decline doesn't diminish OpenAI's importance but highlights concentration risk. Enterprises should:

- Develop multi-vendor AI strategies

- Ensure platform-agnostic implementations

- Monitor competitive developments continuously

- Maintain flexibility to switch providers

Organizations locked into single AI vendors face strategic risk as market dynamics evolve rapidly.

For Investors: Market Structure Evolution

Investment theses must account for changing competitive dynamics:

- First-mover advantages prove temporary

- Distribution and ecosystem integration matter more than early leads

- Specialized players can generate substantial revenue at smaller scale

- Enterprise and consumer markets follow different dynamics

The AI market is maturing faster than initially projected, with competitive structures emerging earlier than anticipated.

Key Takeaways: AI Chatbot Market Share 2026

The Similarweb data released in January 2026 documents fundamental shifts in generative AI adoption and competition:

ChatGPT's Decline Is Real: The 19.2 percentage point market share drop from 87.2% to 68% represents OpenAI's most significant competitive challenge since launch. While 800 million weekly users demonstrates continued relevance, the trajectory clearly favors competitors.

Google's Distribution Advantage Materializes: Gemini's surge from 5.4% to 18.2% market share—growth of 237% year-over-year—proves that ecosystem integration and native distribution overcome first-mover advantages when capability gaps narrow.

AI Discovery Transforms Digital Marketing: With over 1.1 billion monthly referral visits from AI platforms and 388% growth in Gemini referrals, artificial intelligence has emerged as a legitimate discovery and traffic channel requiring dedicated optimization strategies.

Market Consolidation Accelerates: ChatGPT and Gemini together control 86.2% of the market, leaving limited room for third-tier competitors. The industry is consolidating into a duopoly faster than observers predicted.

Mobile Engagement Drives Growth: Platforms optimizing for mobile-first experiences (Gemini, Perplexity) demonstrate stronger growth than desktop-focused competitors, reflecting how consumers actually use AI assistants.

Specialized Positioning Remains Viable: Despite small market shares, Claude (2%), Perplexity (2%), and DeepSeek (4%) show that focused strategies targeting specific user segments can generate substantial revenue and growth.

Distribution Matters More Than Innovation: Microsoft Copilot's stagnation at 1.2% market share despite extensive Windows and Office integration proves that distribution alone is insufficient—platforms need clear value propositions and compelling user experiences.

The AI chatbot market has moved beyond early adopter experimentation into mainstream competition. The platforms winning in 2026 combine technological capability with ecosystem integration, continuous innovation, and clear user value propositions. As this market matures, expect further consolidation around winners while specialized players carve profitable niches serving specific use cases and customer segments.

For businesses, marketers, developers, and investors, the Similarweb data provides clear evidence: the AI competitive landscape has fundamentally changed, and strategies must adapt accordingly.