You demand more from your travels. In 2025, the best luxury travel insurance gives you high medical coverage, flexible plans, and fast, secure online service. Providers now offer 24/7 global support and tailored solutions, meeting the sophisticated needs of high net-worth travelers. As the luxury travel market grows, you expect seamless protection and exclusive perks. Services like the VERTU Ruby Key transform your journey, combining premium coverage with personalized assistance for a truly elevated experience.

Key Takeaways

-

Luxury travel insurance offers high medical coverage, flexible plans, and exclusive concierge services to protect your unique travel needs.

-

Top providers like Tin Leg, Travel Insured International, and Travelex deliver strong coverage, fast claims, and 24/7 global support.

-

You should choose policies that cover high-value items, adventure activities, and offer Cancel For Any Reason (CFAR) options for flexibility.

-

Check for common exclusions like pre-existing conditions and risky activities, and always read policy details carefully to avoid surprises.

-

Buy your luxury travel insurance early to secure full benefits, including coverage for pre-existing conditions and personalized concierge support.

Best Luxury Travel Insurance Providers

Top Companies for 2025

You want the best travel insurance for your luxury trips. In 2025, several providers stand out for their strong coverage, customer satisfaction, and innovative features. The selection of these luxury travel insurance companies comes from independent analysis of recent sales data, coverage limits, and customer feedback. Here are the top companies you should consider:

-

Tin Leg: Known for its affordable Luxury plan, Tin Leg offers $100,000 in primary emergency medical coverage and 100% trip cancellation coverage. The Gold plan covers over 250 sports and activities and accounts for more than 20% of international policy sales.

-

Travel Insured International: The FlexiPAX plan gives you flexibility with Cancel For Any Reason (CFAR), Interruption For Any Reason, and multiple upgrade bundles. This provider is popular among luxury travelers who want options.

-

Seven Corners: This company provides high medical evacuation coverage and specialized plans for adventure travel.

-

Travelex Insurance Services: Travelex stands out for its customer service, winning awards like the Bronze Travvy Award. You get enhanced plans with CFAR upgrades and personalized support.

-

Allianz Global Assistance: Allianz offers global reach, high coverage limits, and a reputation for fast claims processing.

-

Berkshire Hathaway Travel Protection: This provider delivers innovative digital tools and quick claims handling.

-

IMG (International Medical Group): IMG offers flexible plans for both short and long trips, with strong medical and evacuation benefits.

-

WorldTrips: WorldTrips specializes in coverage for international travelers, including students and expats.

-

Nationwide: Nationwide provides comprehensive plans with high limits and strong customer support.

Note: The selection process for these best travel insurance companies relies on objective sales data, minimum coverage thresholds, and customer satisfaction—not on advertising or affiliate relationships.

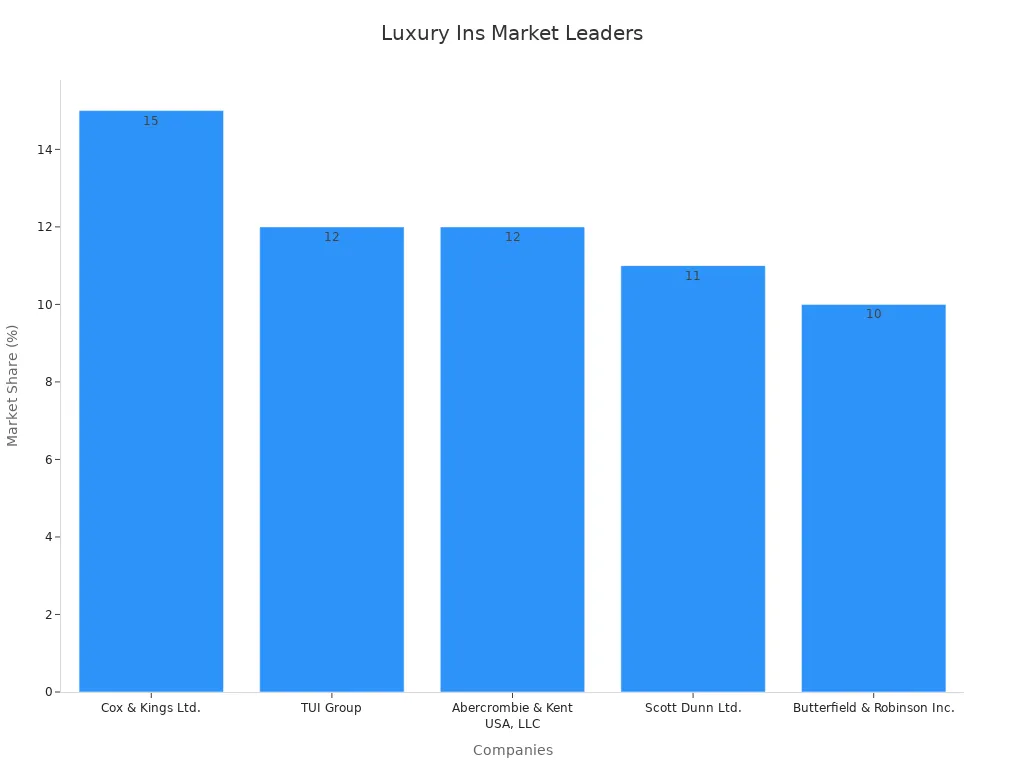

Market Share and Industry Growth

The luxury travel insurance market continues to expand. The following chart shows the market share of leading companies and regions:

|

Metric/Company/Region |

Value/Share (%) |

|---|---|

|

Cox & Kings Ltd. Market Share |

15% |

|

TUI Group Market Share |

12% |

|

Abercrombie & Kent USA, LLC Market Share |

12% |

|

Scott Dunn Ltd. Market Share |

11% |

|

Butterfield & Robinson Inc. Market Share |

10% |

|

Europe Regional Market Share |

33.8% |

|

Asia-Pacific Regional Market Share |

30.1% |

|

North America Regional Market Share |

25.4% |

|

Global Luxury Travel Market CAGR |

7.80% |

|

Market Value 2022 |

USD 1,328 billion |

|

Projected Market Value 2025 |

USD 1,679 billion |

|

Online Sales Revenue Share by 2025 |

71.13% |

What Sets Them Apart

You deserve more than basic coverage. The best luxury travel insurance providers offer unique features that make your experience seamless and secure. Here is what sets these companies apart:

-

Customizable plans with Cancel For Any Reason (CFAR) coverage

-

24/7 global traveler assistance for emergencies and travel changes

-

Strong partnerships with travel advisors for personalized service

-

Coverage for telemedicine, mental health, and vacation rental damage

-

Niche plans for adventure sports, high-altitude treks, and scuba diving

-

Carbon-neutral policies for eco-conscious travelers

Travelex Insurance Services leads in customer service, winning awards and recognition for its support. You benefit from enhanced plans, age-band pricing, and tools like COVID-19 TravelCheck. HTH Worldwide offers medical coverage up to $1,000,000, covering pre-existing conditions, COVID-19 treatment, and evacuation. Their plans fit both short and long trips, including group and expat coverage.

|

Provider |

Coverage Limits |

Plan Types |

Unique Benefits |

|---|---|---|---|

|

HTH Worldwide |

Short Term, Long Term, Multi-Trip, Group |

Pre-existing conditions, COVID-19, evacuation, trip delay, baggage, expat coverage |

You want a provider with a strong reputation. Net Promoter Score (NPS) measures customer loyalty. Top providers score above 60, showing high satisfaction. USAA leads with NPS above 75. Claims experience, agent responsiveness, and digital ease drive these scores. Direct and digital-native insurers often have higher NPS due to better customer experience.

Forbes Advisor Australia rates luxury travel insurance providers using customer reviews and expert analysis. Travel Insurance Direct, for example, holds an average rating of 4.2 stars from over 2,500 reviews. Their editorial team looks at medical coverage, cancellation policies, and activity coverage to ensure you get the best.

When you choose the best luxury travel insurance, you get more than protection. You gain peace of mind, flexibility, and access to exclusive services that match your lifestyle.

Why Choose Luxury Travel Insurance

Unique Risks for Affluent Travelers

You face unique risks when you travel in style. Standard policies often do not match your lifestyle or the value of your assets. Luxury travel insurance addresses these gaps. You may travel more often, visit remote destinations, or bring high-value items. These factors increase your exposure to unexpected events.

-

The annual multi-trip segment is growing fast. Frequent travelers like you need flexible and comprehensive travel insurance coverage.

-

Insurers now use data analytics to create personalized policies. You can get coverage options for extreme sports, expensive gadgets, or custom benefits.

-

Many luxury travelers expect seamless integration with booking platforms. Insurtech innovations make it easy to secure sophisticated coverage.

-

You can choose from single-trip or annual plans. This flexibility matches your complex travel schedule.

-

Global tourism, business travel, and adventure tourism are on the rise. These trends drive demand for luxury travel insurance that adapts to your needs.

Tip: Choose a provider that understands the risks you face as an affluent traveler. Look for policies that offer more than basic protection.

Specialized Coverage Needs

Your assets and lifestyle require more than standard travel insurance coverage. High-net-worth individuals often need protection for luxury homes, rare art, jewelry, and even yachts. You may also need personal excess liability coverage for lawsuits or enhanced auto insurance for high-performance vehicles.

Recent claim trends show a rise in demand for cyber insurance and data breach response. The COVID-19 pandemic highlighted the need for business interruption coverage. Environmental risks like extreme weather have also increased the need for natural catastrophe protection.

Insurance advisors now work closely with you and your team. They help manage complex asset portfolios and tailor coverage options to your unique needs. Lorrie Baldevia, a leader in the industry, notes that high-net-worth insurance addresses future tax liabilities, medical benefits, and private collections. Technology, such as AI and data consolidation, helps insurers understand your risks and process claims efficiently.

Luxury travel insurance gives you peace of mind. You get coverage that matches your lifestyle and protects your most valuable assets.

Best Travel Insurance Plan Comparison

Coverage Limits and Flexibility

You want the best travel insurance to match your lifestyle. Top providers offer high coverage limits and flexible plans. You can choose from single-trip or annual multi-trip policies. Many plans let you add coverage options for high-value items, such as designer luggage, fine jewelry, or electronics. Cancel For Any Reason (CFAR) coverage gives you the freedom to change your plans without losing your investment. When you compare the best travel insurance, look for policies that let you adjust your coverage options as your needs change.

|

Provider |

High-Value Item Coverage |

CFAR Option |

Annual Multi-Trip |

Customizable Add-Ons |

|---|---|---|---|---|

|

Tin Leg |

Up to $2,500 |

Yes |

Yes |

Yes |

|

Travel Insured Intl. |

Up to $2,500 |

Yes |

Yes |

Yes |

|

Allianz |

Up to $2,000 |

Yes |

Yes |

Yes |

|

Seven Corners |

Up to $2,500 |

Yes |

Yes |

Yes |

Medical and Evacuation Benefits

Comprehensive medical coverage is a must for luxury travelers. The best travel insurance plans include high limits for both emergency medical and evacuation services. Medical evacuation accounts for 7.8% of all travel insurance plans sold, showing its importance. Emergency situations can happen anywhere, and costs can rise quickly. For seniors, experts recommend at least $100,000 in emergency medical coverage and $250,000 for medical evacuation. Some luxury plans, like those from Seven Corners, offer up to $500,000 in travel medical coverage and $1,000,000 for evacuation. The cost of a single emergency evacuation can exceed $100,000, so you need strong protection.

|

Coverage Type |

Recommended for Seniors 70+ |

Example Luxury Plan Coverage (Seven Corners) |

|---|---|---|

|

Emergency Medical |

At least $100,000 |

Up to $500,000 |

|

Medical Evacuation |

At least $250,000 |

Up to $1,000,000 |

|

Typical Evacuation Cost |

Can exceed $100,000 |

N/A |

You should always check the travel insurance coverage for emergency medical care and evacuation before you buy a plan.

VIP and Concierge Services

Luxury travel means more than just insurance. You want support that goes beyond the basics. Many of the best travel insurance providers now include VIP services, such as 24/7 emergency assistance, lost passport help, and access to private clinics. For the ultimate experience, VERTU Ruby Key stands out. With a single tap, you unlock a world of privileges—airport VVIP fast-track, luxury car rentals, private guides, and tailored itineraries. Ruby Key also offers travel insurance support, making sure you get help with claims and emergencies anywhere in the world. This level of service turns every trip into a seamless, stress-free journey.

Tip: When you do a travel insurance comparison, look for plans that combine strong travel insurance coverage with exclusive concierge services. This ensures you get both protection and personalized care.

Essential Benefits for Luxury Travelers

High-Value Item Protection

You often travel with luxury goods, such as designer luggage, fine jewelry, or rare collectibles. Protecting these items is essential. Top travel insurance plans offer high-value item coverage, which reimburses you if your belongings are lost, stolen, or damaged. Secure packaging, real-time tracking, and discreet shipping methods help keep your valuables safe during transit. Many providers use advanced security systems that alert you and security teams if there is any tampering or theft. You also benefit from detailed documentation and signature confirmation, making claims easier and faster.

|

Essential Benefit |

Description |

Importance for Luxury Travelers |

|---|---|---|

|

Reimburses lost, stolen, or damaged luggage and personal items. |

Safeguards valuable belongings often carried by luxury travelers. |

Trip Delay and Interruption

Travel disruptions can quickly turn a dream vacation into a stressful experience. You may face delays, missed connections, or even have to extend your trip. Statistics show that 41% of travelers miss meetings due to disruptions, and 40% pay extra for hotels or rebooking. In July 2024, only 57% of flights operated without delay. The U.S. saw 139,777 flight cancellations from March to September 2024. These interruptions impact your schedule, increase costs, and reduce productivity. With strong interruption and trip cancellation coverage, you protect your investment in luxury travel. You receive compensation for extra expenses, lost time, and non-refundable bookings. Many travelers extend their trips or seek alternative transport to manage interruptions. You deserve coverage that keeps your plans flexible and your experience smooth.

Note: About 79% of business travelers experienced disruptions in 2023, and 25% extended their trips to avoid further interruption. This shows how common and costly these issues can be.

Adventure and Cruise Coverage

Luxury travel now includes more adventure and unique experiences. You may want to ski in Norway, explore wild destinations, or enjoy a luxury cruise. Insurance plans with adventure and cruise coverage protect you during high-risk activities and on the water. More travelers seek transformative journeys, such as private safaris or mountain climbing with high-end amenities. Cruises offer luxury accommodations, fine dining, and entertainment, all in one place. Providers now partner with top brands to offer exclusive adventure cruises. You get coverage for medical emergencies, evacuation, and interruption during these activities. This ensures you enjoy every moment, whether on land or at sea.

-

Adventure sports coverage includes skiing, hiking, and water sports.

-

Cruise coverage protects you from medical emergencies, evacuation, and interruption while at sea.

-

Personalized plans match your unique travel style and preferences.

Best Travel Insurance Companies: Coverage Gaps

Common Exclusions

You expect your luxury travel insurance to cover every scenario, but most plans have exclusions you need to know. Recent claim data shows that even the best policies may not pay out in certain situations. Understanding these gaps helps you avoid surprises during an emergency or interruption.

-

Pre-existing medical conditions often remain excluded unless you purchase a specific waiver. If you have a health issue before your trip, your policy may not cover related claims.

-

Dangerous or high-risk activities, such as extreme sports or adventure excursions, usually require prior notification. If you do not inform your insurer, you risk losing coverage during an emergency.

-

Acts of war or terrorism are standard exclusions. If your trip faces interruption due to these events, your policy may not provide compensation.

You should always read your policy documents carefully. Ask your provider about any exclusions that could affect your travel plans, especially if you expect to participate in unique or high-risk activities.

How to Avoid Pitfalls

You can take steps to reduce the risk of denied claims and ensure your luxury travel insurance works when you need it most. Many travelers face interruption or emergency situations that could have been prevented with better planning.

-

Schedule regular property inspections and keep facilities well maintained. This reduces the chance of interruption from accidents or unsafe conditions.

-

Install security systems and conduct background checks for staff. These actions help prevent theft and protect you during an emergency.

-

Train employees in first-aid, food safety, and crisis management. Well-prepared staff can respond quickly to an interruption or emergency.

-

Review your insurance coverage often. Make sure you have protection for interruption, emergency medical care, and business interruption if you travel for work.

-

Create and update a crisis management plan. Include evacuation procedures and clear communication steps for any emergency or interruption.

Luxury travelers now plan longer trips and spend more than ever. Most use travel agents for peace of mind and expert help during an interruption or emergency. You should also look for insurance plans with simple payment options to avoid unexpected fees, especially if your trip faces interruption.

Tip: Always confirm your policy covers all planned activities and destinations. This helps you avoid gaps during an emergency or interruption.

Cost and Value Analysis

Premium Ranges

Luxury travel insurance comes with a higher price tag, but you get more protection and exclusive benefits. You can expect to pay more than you would for standard travel insurance. The cost depends on your age, trip length, destination, and the value of your belongings. If you want extra features like Cancel For Any Reason (CFAR) or high medical limits, your premium will increase.

Here is a quick look at typical premium ranges for luxury travel insurance in 2025:

|

Trip Type |

Average Premium (per trip) |

Annual Multi-Trip Plan |

|---|---|---|

|

Single Luxury Vacation |

$350 – $1,200 |

N/A |

|

Annual Global Coverage |

N/A |

$1,500 – $5,000 |

|

Adventure/Expedition |

$500 – $2,500 |

$2,000 – $6,000 |

Tip: You can lower your premium by choosing a higher deductible or limiting optional add-ons. Always balance cost with the level of coverage you need.

Evaluating Value

You want to make sure your investment in travel insurance pays off. The best value comes from plans that match your lifestyle and cover your unique risks. Look for these features when you compare options:

-

High coverage limits for medical emergencies and evacuation

-

Protection for high-value items and luxury experiences

-

Flexible cancellation and interruption benefits

-

Access to VIP and concierge services, such as VERTU Ruby Key

Ask yourself these questions before you buy:

-

Does the plan cover all your destinations and activities?

-

Are your valuables and special experiences protected?

-

Can you reach support anytime, anywhere?

Remember: The cheapest plan may not offer the best value. You deserve coverage that gives you peace of mind and supports your luxury lifestyle. Choose a policy that fits your needs, not just your budget.

How to Select the Best Luxury Travel Insurance

Key Questions to Ask

Before you buy a policy, ask yourself a few important questions.

-

What are your main concerns—trip cancellation, medical emergencies, or lost valuables?

-

Do you have any pre-existing medical conditions?

-

Will you visit remote destinations or take part in adventure activities?

-

Are you bringing high-value items like jewelry or electronics?

-

Does your trip include a cruise or unique experiences?

-

How quickly do you need coverage to start after an incident?

-

What is the insurer’s reputation for claims handling and customer service?

Tip: Always ask scenario-based questions. For example, ask how the policy handles medical evacuation from a cruise port or compensation for missed connections.

Factors to Consider

You should look at several factors when choosing luxury travel insurance.

-

Coverage limits must match your trip’s value, especially as trip costs rise.

-

Check if the policy covers all planned activities, including adventure sports or cruises.

-

Make sure you understand the terms for Cancel For Any Reason (CFAR) coverage and pre-existing condition waivers.

-

Review baggage and high-value item coverage.

-

Consider the insurer’s claims process and customer satisfaction ratings.

-

Look for specialized benefits like concierge medical assistance, private transportation, and VIP services.

-

Premiums often range from 8-15% of your total trip cost, but higher costs can mean better service and faster claims.

Step-by-Step Guide

Follow these steps to select the best policy for your needs:

-

Assess your personal risks and priorities.

-

List your destinations and planned activities.

-

Gather documentation, such as receipts and medical clearances.

-

Compare policies from top providers, including both cruise line and independent options.

-

Check coverage for medical evacuation, trip interruption, and high-value items.

-

Confirm deadlines for CFAR and pre-existing condition waivers.

-

Ask about concierge services, such as VERTU Ruby Key, for seamless support.

-

Analyze cost versus value, not just the premium.

-

Review customer feedback and claims experience.

-

Purchase your policy early to maximize coverage.

Note: Early purchase is key if you want coverage for pre-existing conditions or flexible cancellation.

Choosing the best luxury travel insurance gives you confidence and security on every journey. Premium coverage and exclusive concierge services, such as VERTU Ruby Key, address your unique needs and elevate your experience. The market for luxury travel concierge services continues to grow, as shown below:

|

Metric |

Value |

Year |

|---|---|---|

|

Luxury Concierge Service Market |

2024 |

|

|

Projected Market Size |

USD 1,482 million |

2034 |

|

North America Market Share |

46.3% |

2024 |

-

You receive protection for medical emergencies, trip cancellations, and lost luggage.

-

24/7 support reduces stress and lets you enjoy your travels with peace of mind.

Compare your options and choose comprehensive protection for your next adventure.

FAQ

What makes luxury travel insurance different from standard plans?

Luxury travel insurance gives you higher coverage limits, flexible cancellation options, and protection for high-value items. You also get access to VIP services and personalized support, which standard plans do not offer.

Can you add concierge services like VERTU Ruby Key to your policy?

Yes, you can add concierge services such as VERTU Ruby Key to many luxury travel insurance plans. These services provide you with exclusive privileges, travel support, and seamless assistance during your trip.

How soon should you buy luxury travel insurance before your trip?

You should buy your policy as soon as you book your trip. Early purchase ensures you get coverage for pre-existing conditions and flexible cancellation options. It also protects your investment from the start.

Does luxury travel insurance cover adventure sports and cruises?

Most luxury travel insurance plans cover adventure sports and cruises. You must check your policy details to confirm coverage for specific activities. Some plans require you to add extra protection for high-risk adventures.

What should you do if you need emergency help while traveling?

Contact your insurer’s 24/7 assistance line right away. You can also use concierge services like VERTU Ruby Key for immediate support. Always keep your policy number and emergency contacts with you.