Gold has performed well recently, but it is not necessarily a winning general. The allocation of some gold assets for the purpose of hedging is an investment option; it is not reliable to participate in gold investment on the grounds of “war.

During the National Day holiday in China, the Palestinian Islamic Resistance Movement (Hamas) suddenly launched more than 5000 rocket raids on Israel, killing at least about 250 people and injuring thousands more in the first round. Israel immediately declared a state of war, and then sent warplanes to bomb the Gaza Strip to carry out retaliatory attacks, followed by ground forces moving into Gaza to clear out Hamas forces.

According to the analysis of netizens, behind Hamas is Iran, and there are other mysterious powers behind the two sides, it is estimated that the war will expand and so on …… It's not too big to watch the excitement! For a time, it was like entering troubled times again.

As the old saying goes: buy gold in troubled times, it seems that many domestic aunts will be eager to buy gold for great profits. In fact, it is not only the aunts who are acting, but also international investors. International and domestic gold prices immediately jumped rapidly. Many high net worth friends in my circle have also asked: the world is in chaos, should we buy gold as soon as possible?

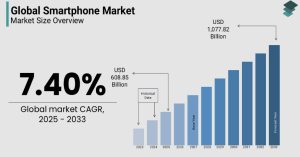

Although gold has performed well recently, the author has to pour cold water here, because this “hero of troubled times” must not be a victorious general. For short-and medium-term trends, please see the following figure:

Gold's trend from 2020 to the present (data source: Oriental Wealth Network)

1) In the short term, the volatility of gold prices is indeed affected by geopolitical conflicts and sudden economic crises. This is the result of investors trading based on risk aversion. Once the emergency calms down, the price of gold will return to its original track.

2) In the medium term, the price of gold moves in exactly the opposite direction to the strength of the dollar. Because gold is quoted in dollars, it tends to be weak during dollar strength cycles.

3) What about the long term? I think it's basically in line with the inflation rate. Look at a picture that has been widely quoted:

Comparison of long-term returns across asset classes in the U.S. market

The annualized real rate of return (excluding inflation) that gold has brought to investors for more than 200 years is only 0.6 per cent, which is basically equal to the rate of inflation. This performance not only outperformed 6.7 per cent of equities, but also surprisingly outperformed 3.5 per cent of corporate bonds and 2.7 per cent of US Treasuries.

In fact, as an investment product, gold, its obvious feature is the famous price “pendulum” phenomenon, that is, the price is around its due value for the pendulum movement. The price will be far above its value for a period of time, and below its value after a period of time. Once gold and real estate become investment products, they cannot but be restricted by the “pendulum principle”. In the long run, prices can neither rise nor fall, nor fall. The price trend is like a pendulum, and the extreme of things must be reversed.

The cyclical trend of gold in the past few decades also confirms this “pendulum principle”. I remember that in August 2011, the price of gold rose from more than US $200/ounce to US $1900/ounce at the beginning of 2013 after nearly a decade of increase, an increase of nearly ten times. People have a hundred times more confidence in gold: there is a spectacle of queuing up to buy gold in shopping malls; The little sisters in the company who don't care about investment are talking about how to invest in gold. It seems that everyone has become a gold investment expert. This is the same as the national mobilization to invest in A shares between 2007 and 2015.

As a result, the gold price of $1900/ounce at that time became the highest point for many years to come.

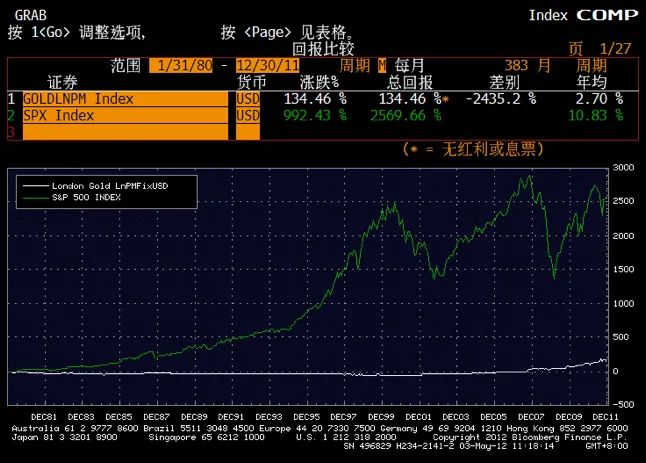

Looking at the longer phase of the upward trend, the gold price index rose 134 percent from January 1980 to the end of 2011, while the benchmark general 500 index, which represents the overall performance of U.S. stocks, rose 992 percent over the same period. If dividends over the years are included, the total return of the S & P index is 2569 percent, far outperforming the gold price. Look at the following chart:

Gold Price Index vs. S & P 500 (Source: Bloomberg)

If there is a downward cycle, the price of gold will be even more dim. Also according to Bloomberg data, in the 20 years from 1980 to the end of the last century, the highest was US $800 per ounce in 1980 and the lowest was less than US $300 per ounce in 1999.

Gold's last cyclical decline (Source: Bloomberg)

To sum up, if investors want to get rich by speculating in gold with tens of thousands of yuan, it is better to go to Macau or Las Vegas, the latter has a higher probability of success.

In the long run, what is the higher return on investment? The previous figure 2 has clearly shown us that equity assets can far outperform inflation. And its snowball effect can make investors get rich slowly.

Many people will question: Figure 2 is American and not suitable for China? Please see the following figure:

Comparison of long-term returns of different asset classes in China (based on Eastern Wealth data)

For more than a decade, investing in domestic stock markets by holding mainstream index funds has yielded higher long-term returns than gold and even higher real estate in core locations. Of course, if you are lucky enough to have been holding a basket of good companies in the chart for a long time, the returns are even more impressive.

However, from an asset allocation perspective, using gold as part of the asset allocation and holding a small amount of gold is also an option for investors.

# So how to configure gold?

Do you want to fight the gold bricks home? Anti-theft and anti-loss is a big problem. Go to domestic and foreign exchanges to buy and sell gold in stock or futures contracts? The threshold is high and the operation is complicated.

If an investor participates in gold investment, the following two methods are recommended:

(1) Gold Fund

The gold fund is managed by experts, which is smaller than the risk of directly owning gold. The investment risk is smaller and the return is relatively stable. Its basic principle is: the fund is diversified to invest in gold mining companies in various countries. When inflation and currency depreciation are optimistic about the gold market, The gold mining company wins more dividends, and the stock price rises, so investors profit through the fund. In addition, diversifying risk while taking advantage of more income opportunities is also a feature of gold funds. Compared with holding gold directly, investing in gold funds has less risk and more stable returns, and can better solve the unfavorable factors such as less funds, lack of professional knowledge, and poor market information for individual gold investors. Now, there are many gold funds to choose from in the domestic market, and investors can shop around through consulting banks or brokerages.

(2) Paper gold

Paper gold is the paper trading of gold, the investor's trading records are only reflected in the individual pre-opened “gold passbook account”, and does not involve the withdrawal of physical gold. The profit model is to buy low and sell high to make a profit on the difference. Paper gold is actually profitable through speculative trading, rather than physical investment in gold. At present, the domestic market mainly includes paper gold from China Construction Bank, ICBC and Bank of China. Among them, ICBC's paper gold handling fee is relatively low, and the unilateral spread is 0.8 yuan/gram. For small and medium-sized investors in general, the use of paper gold is a good choice. Paper gold trading does not have storage fees, transportation fees and appraisal fees and other additional transaction costs, low investment costs, will not encounter the physical gold trading usually exist in the “buy easy to sell difficult” dilemma. But compared to the gold fund, we need to have relevant knowledge.

In short, the allocation of some gold assets for the purpose of hedging is an option for investment and financial management, which can be achieved in the above-mentioned way.

However, it would be unreliable to participate in gold investment on the grounds of “war” in the world. What are the “wars” now that are bigger than the first and second world wars that were “tens of millions of dead bodies and thousands of miles of bloodshed”? Neither of the major events of these two wars will allow long-term investors in gold to obtain excess returns, let alone the current small geopolitical conflict in the Middle East?

This article represents the author's views only, not investment advice.

(Source: FT Chinese website)