VERTU IRONFLIP: A Perfect Fusion of Intuitive Design and Heroic Colours

VERTU IRONFLIP, a folding screen mobile phone for high-end men, not only has the top technological configuration, but also the

The trends of family offices in 2022 will be largely dominated by the recovery of the economy and market to a new normal under the influence of the pandemic, which will affect the way family offices think, invest, and operate.

Establishing a family office is a good way to ensure that family wealth is properly managed and allocated to the next generation, not only preserving assets but also growing wealth.

However, as with the COVID-19 pandemic, threats are always present. Positioning and preparing the organization accordingly will help mitigate risks and ensure smooth operation.

Next, let’s take a look at the future family office trend forecast from Stephen Van de Wetering of Empaxis!

The COVID-19 pandemic is not yet over, but vaccines have already helped people’s lives return to a certain level of normality, which is good news for the economy and capital markets.

Through the pandemic, mature family offices may have learned from the experience and are actively preparing contingency plans, deploying investment directions in advance, to avoid their family’s enterprises from being too affected in similar situations in the future and to timely avoid risks.

Despite headwinds and uncertainties, most family offices remain optimistic.

According to a survey by Citi Private Bank, three-quarters of family office respondents are seeking returns of more than 5% in 2022; respondents from family offices with assets under management exceeding $500 million expressed optimism, with 30% of them aiming for a 10% return.

Ida Liu, Global Head of Citi Private Bank, has aptly summarized the investment outlook for family offices: “It is reassuring that investor sentiment is not negative. On the contrary, family offices have weathered the pandemic crisis well and are uniquely positioned to deploy more capital when opportunities arise.”

As the survey from Citibank Private Banking shows, inflation is a concern for family offices. The following are factors contributing to inflation:

1) A shortage of goods and services;

2) A tight labor market;

3) Trillions of new dollars in circulation.

Firstly, since the onset of the pandemic, the global supply chain system has been severely disrupted, leading to the current shortage of supplies seen around the world.

Secondly, the rapid economic rebound means more demand for goods and services. However, there is not enough supply and labor, leading to rising prices and wages. More importantly, due to the pandemic, many people have reconsidered their job choices and priorities in life, resulting in a shortage of labor and rising prices.

The family office looks at positive economic indicators, such as the rise in inflation rate. However, when the inflation rate becomes “too high,” it can erode the value of assets, which then becomes a problem. The next question is where the family office invests.

According to a survey by Goldman Sachs, 15% of family offices worldwide and 25% of family offices in the Americas have already invested in cryptocurrencies. In addition, 45% of people globally are considering increasing their investment in cryptocurrencies in the future.

Based on the survey, Goldman Sachs pointed out: “After a year of unprecedented global and fiscal stimulus, some family offices are considering using cryptocurrencies as a way to cope with higher inflation, long-term low interest rates, and other macroeconomic developments.”

Diogo Mónica, co-founder and president of cryptocurrency bank Anchorage Digital, is not surprised by the growing interest: “A lot of the returns in the past few years have actually come from new types of cryptocurrencies, which have grown at a percentage rate faster than Bitcoin.”

Family offices allocate an average of about 35% of their portfolios to alternative asset classes. Among the alternatives, private equity accounts for 10%-25%.

According to UBS, more than 80% of family offices invest in private equity, and an increasing number of these families are making direct investments. 69% of family offices view private equity as a major driver of returns.

Here are the reasons why family offices prefer direct investment:

1) Better control;

2) Attraction to the family business, allowing them to invest in a more practical way;

3) Lower costs.

Family offices recognize that they can play a role in addressing environmental issues, however, relying solely on government action is not enough.

Although family offices are cautious about investing in “greenwashing,” they realize that their resources can make a difference when they find smart investment approaches.

According to an analysis by the Campden Wealth website:

1) 86% of high-net-worth individuals, family offices, and foundations believe that their private capital is “crucial” for addressing climate change;

2) 79% agree that government pandemic stimulus programs should prioritize green investments and the transition to a low-carbon economy;

3) 70% of people believe that the transition to a global net-zero emissions economy is “the greatest business opportunity of our time.”

4) Some wealth holders who are already actively engaged in sustainable investment expect that by 2022, sustainable investment will account for an average of 47% of their investment portfolio, and by 2027, it will reach 54%.

Compared to traditional registered investment advisors, family offices are subject to relatively light regulatory oversight. This is because these entities manage personal wealth, rather than wealth from external investors.

However, U.S. lawmakers have considered legislation regarding the operation of family offices. As awareness of wealth and wage disparities increases, a large amount of unregulated capital raises many questions:

1) How are these assets and investments taxed?

2) What is the level of risk involved? To what extent might these investments pose a threat to the economic and financial system if they are extended?

Of course, every story has two sides. Family office consultant and Forbes contributor Francois Botha has provided an insightful analysis on the topic of family office regulation, assessing what more or less regulation means for the industry.

Family offices, of course, benefit from technological advancements, whether through the use of technology or investment. When the pandemic forced many people to work from home, cloud platforms and video conferencing made remote work possible and minimized negative impacts.

In addition, they have also achieved remarkable returns by investing in the technology industry through public stocks, venture capital, and private equity investments.

Despite this, technology is not perfect, with users having concerns about data privacy, as well as concerns about social media platforms, and their connection to increasing mental health issues and the spread of misinformation.

Should the government regulate family offices more? What options do consumers have? Socially conscious family office investors should seek a balance: enjoying returns while investing in companies that enhance their values.

In general, family offices can be a force for good, as investors with significant influence, they can demand more from technology companies and social media.

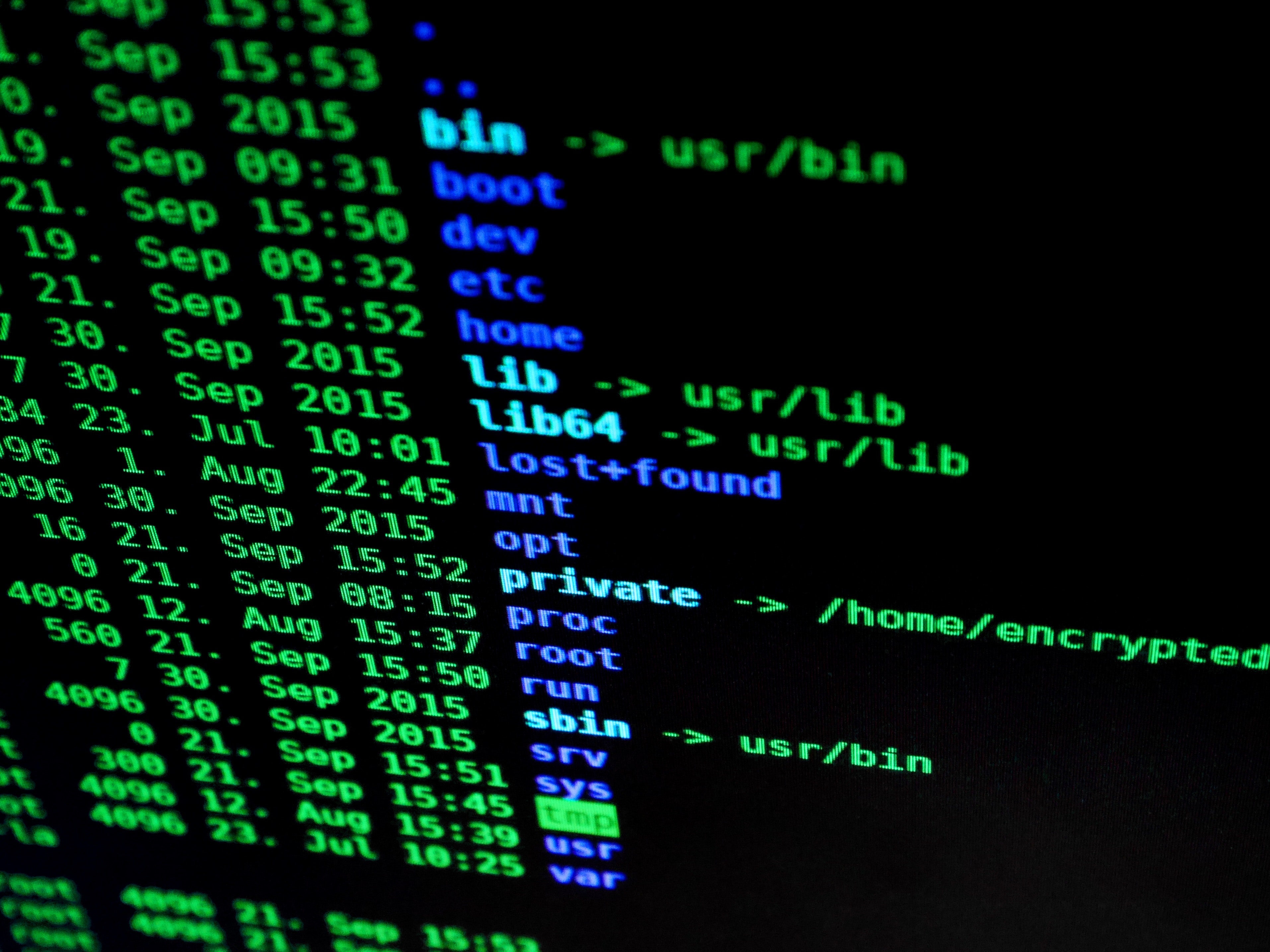

According to the Northern Trust Family Office Benchmark Survey, cybersecurity is the top concern for family offices globally, ahead of other worries such as market volatility, geopolitical uncertainty, and succession planning.

According to the 2017 Campden research survey, 32% of family offices have suffered losses from cyberattacks. In one case, a family office even lost $10 million. However, even so, 48% of respondents did not have a cybersecurity plan in place.

Compared to traditional wealth and asset management companies, family offices are usually subject to less regulation. In these cases, family offices rarely have plans for data security and control. However, this also further explains the real reason why cybercriminals are targeting family offices: they are aiming at large amounts of capital entities that are considered to have weak network security.

According to a study by Invesco, in the Gulf Cooperation Council, most wealth holders are the first generation in their families, so it is necessary to establish new inheritance structures for large families within the local legal framework.

In mature markets such as the United States and Western Europe, suitable service providers are usually sought to manage this wealth, where the legal and financial framework is more suitable for these families.

If local laws are insufficient to deal with the distribution of wealth among family members, then the challenge lies in the succession plan itself. According to Campden’s data, it is a top priority to establish such a plan within 12-24 months, with 69% of people planning to achieve intergenerational wealth transfer within 15 years.

Regardless of the region, the transition does not always proceed smoothly:

1) The younger generation lacks interest or qualifications to run the family office;

2) Older generations are unwilling to relinquish control over management or assets;

3) Intergenerational disagreements on investment strategies after the transition;

4) Distrust in the way the family office operates.

Due to rising costs and decreasing returns, profit margins are bound to decline. Outsourcing to a family office is a way to reduce costs and improve operational efficiency. By leveraging the technology and expertise of a third party, risks associated with internal functions can be mitigated.

According to Rick Flynn, a partner at Flynn Family Office, “Today, more successful family businesses rely on outsourcing family office service providers to better control cost savings while achieving established family wealth goals.”

In recent years, the private wealth industry has been relatively slow in adopting technological innovations, as Craig Iskowitz, founder and CEO of consulting firm Ezra Group, said: “If (family offices) choose not to innovate, they risk going the way of Sears or Blockbuster.”

How dependent are family offices on local storage computers and servers? Do employees need to remotely connect to office desktops and software when working from home? Remote connection issues and technical failures can reduce productivity, and switching to reliable, cloud-based applications can solve these problems.

Unlike the old system with a limited number of licenses that can be accessed at one time, Web-based solutions have no such restrictions, and real-time data updates are another reason for the shift to new cloud-based technology. With the efficiency of turnover time and the accuracy of reporting, family offices can obtain the information they need to make wise decisions faster than before.

According to data from McKinsey, when a company becomes a digital leader in its industry, their revenue growth is faster and productivity is higher compared to peers with lower levels of digitalization, and cloud-based SaaS solutions are more affordable and easier to implement.

As the world becomes more mobile and digital, accessing all content from mobile devices anytime and anywhere has become the norm.

If family offices, especially single-family offices, do not adopt these methods, they will be more likely to lose the third generation who are more adaptable to the application of technology compared to MFOs (multi-family offices) that can provide a more modern client experience.

A survey by UBS found that 87% of family office respondents agreed that artificial intelligence (AI) will be the biggest disruptive force in global business.

Once fully utilized, artificial intelligence will be able to perform tasks faster and more efficiently than humans. As forward-thinking companies adopt new technologies to maximize efficiency, family offices that want to maintain a leading position will also follow suit.

The use of automated robots

Automating routine manual tasks is another technology-related opportunity for family offices. These predictable repetitive tasks, once performed by humans, can now be completed by robots, allowing employees to focus on higher-value activities.

In general, the ongoing pandemic, changes in investment strategies, the use of technology, and increased social awareness will affect the trends of family offices in 2022.

The family office structure will continue to be a viable and ideal way for wealthy families to grow and preserve wealth and assets for future generations.

The future is bright, and by becoming contributors to society, family offices can help make the world a brighter place.