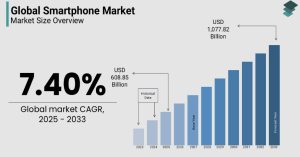

In the high-stakes world of consumer electronics, 2025 has proven to be a pivotal year for premium smartphones. Owning a flagship device today is no longer just about communication; it is a definitive statement of style, status, and cutting-edge technological capability. As competition intensifies within the United States, discerning which manufacturers truly dominate the sector is essential for investors and tech enthusiasts alike.

This article aims to professionally rank luxury phone brands for market performance, offering you a clear view of who currently holds the crown. We will dive deep into the specific metrics defining success this year, from market share shifts and revenue growth to breakthrough innovations that capture consumer imagination. Whether you are looking to upgrade your device or simply wish to understand the business strategies driving the elite segment, our comprehensive analysis provides the insights you need. Join us as we explore the dynamic trends shaping the future of luxury mobile technology and uncover the top ten brands that are successfully leading the charge.

Understanding Market Performance: Key Metrics for Luxury Phones in 2025

In the rapidly evolving landscape of 2025, evaluating success in the high-end mobile sector requires a sophisticated approach. Market performance for luxury phones is a multi-faceted evaluation, encompassing sales figures, brand equity, and customer engagement. Unlike the mass market, where volume is king, the luxury sector prioritizes exclusivity and value retention.

Defining Success: Beyond Sales Volume

For premium manufacturers, success is rarely defined solely by the number of units shipped. Instead, brand perception and customer loyalty are critical differentiators that justify premium pricing and sustain long-term market success. Analysts must look at the “Desirability Index”—a measure of how much a consumer covets the device regardless of utility.

Note: In the luxury sector, scarcity often drives demand, making high inventory turnover a less critical metric than in the budget sector.

The Crucial Role of Market Share and Growth Trends

While niche players may hold a smaller slice of the total pie, their dominance within the ultra-premium bracket ($1,500+) is vital. Key metrics to track include year-over-year growth, market position within the high-end smartphone segment, and profitability. A brand maintaining a steady 5% growth in the luxury tier is often healthier than a budget brand fluctuating wildly in a saturated market.

| Metric | Mass Market Strategy | Luxury Phone Strategy |

|---|---|---|

| Primary Goal | Volume & Saturation | Profit Margin & Exclusivity |

| Pricing Model | Competitive/Cost-Plus | Value-Based/Prestige |

| Key Indicator | Units Shipped | Average Selling Price (ASP) |

| Customer Focus | Acquisition | Retention & Lifetime Value |

ASP and Revenue as Indicators of Luxury

إن Average Selling Price (ASP) remains the definitive metric for gauging a brand's premium status. High ASPs indicate a willingness among consumers to pay for craftsmanship, materials, and status. Furthermore, analyzing Customer Acquisition Cost (CAC) and Customer Lifetime Value (CLTV) provides deeper insights into a brand's sustainable performance. A high CLTV suggests that buyers are not just purchasing a phone but investing in an ecosystem or lifestyle.

Customer Loyalty and Brand Perception

In the US market, emotional connection drives retention. When stakeholders attempt to rank luxury phone brands for market performance, they heavily weigh the “stickiness” of the brand—how likely a user is to upgrade within the same family. High retention rates signal strong brand health, ensuring revenue stability even during economic downturns.

The Elite 10: Ranking Top Luxury Phone Brands in the US for 2025

The landscape of premium mobile technology has evolved significantly, with 2025 marking a year where hardware perfection meets advanced AI integration. The ranking is based on a comprehensive analysis of sales data, brand strength, innovation pipeline, and US market reception. To accurately rank luxury phone brands for market performance, analysts must look beyond raw specifications to the intangible value of status, ecosystem integration, and long-term value retention.

Apple: Dominance and Ecosystem Strength

Apple continues to lead with its strong ecosystem and consistent performance in the top-tier segment. In the US market, the iPhone “Pro” and “Ultra” models remain the default choice for luxury consumers. The brand's dominance is not merely a result of hardware but the seamless “walled garden” that connects the phone to the Apple Watch, iPad, and Vision Pro.

Market Insight: In 2025, Apple’s retention rate in the premium sector ($1,000+) remains the highest in the industry, driven by high resale value and unparalleled customer support.

Samsung: Innovation and Broad Appeal

Samsung holds a significant position through its diverse range of high-end devices and technological advancements. While Apple dominates the slab form factor, Samsung is the undisputed king of foldable luxury. The Galaxy Z Fold series appeals to productivity-focused executives, while the S-Series Ultra models attract photography enthusiasts and power users. Samsung's open-ecosystem approach allows it to capture a broad demographic of tech-savvy luxury buyers.

Comparative Analysis of Top Luxury Contenders

| Brand Category | Top Representative | Primary Luxury USP | Target Audience |

|---|---|---|---|

| Ecosystem Leader | Apple (iPhone Pro/Max) | Seamless integration, Resale Value, Status | Professionals, Creatives, General Public |

| Tech Innovator | Samsung (Galaxy Z/S Ultra) | Foldable Displays, S-Pen, Zoom Photography | Tech Enthusiasts, Business Executives |

| AI Specialist | Google (Pixel Fold/Pro) | Stock Android, Real-time AI Translation, Camera Software | Software Purists, Early Adopters |

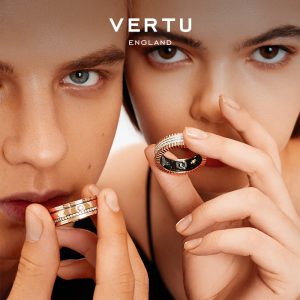

| Niche Luxury | Vertu / Caviar | Exotic Materials (Gold, Leather), Concierge Services | Ultra-High-Net-Worth Individuals (UHNWI) |

Emerging Players and Niche Luxury Brands

Emerging luxury smartphone brands are challenging the status quo with unique offerings in design and functionality. While the duopoly of Apple and Samsung remains strong, the “Elite 10” list for 2025 includes rising contenders:

- Google: With the Pixel Fold, Google has successfully entered the ultra-premium hardware space.

- Motorola: The Razr series has revitalized the brand as a fashion-forward luxury choice.

- OnePlus & Sony: Continuing to serve niche audiophile and photography segments with high-spec devices.

- Caviar & Vertu: For consumers where price is no object, these brands offer devices encased in gold, titanium, and exotic leathers, prioritizing exclusivity over mass-market specs.

Factors Driving Brand Ranking

Several critical metrics determine the hierarchy of the Elite 10:

1. Innovation: The ability to deliver reliable foldable mechanics and on-device Generative AI.

2. Design: The shift toward durable, premium materials like Grade 5 Titanium and ceramic composites.

3. User Experience: Brands are now ranked heavily on software longevity (7+ years of updates) and privacy security.

Ultimately, the leaders in 2025 are those that balance cutting-edge performance with the prestige required by the luxury consumer.

Key Drivers of Success for Luxury Phone Brands in 2025

In the evolving landscape of high-end mobile technology, success is no longer defined solely by hardware specifications. To accurately rank luxury phone brands for market performance, analysts must evaluate a complex matrix of innovation, heritage, and user experience. By 2025, the distinction between a flagship device and a true luxury asset hinges on how well a brand executes across four critical pillars.

Innovation Pipeline: Foldables, AI, and Next-Gen Features

Continuous innovation remains the primary differentiator in a saturated market. In 2025, the competitive edge is defined by the seamless convergence of hardware flexibility and software intelligence. Brands are prioritizing foldable technology that offers durability without compromising elegance, alongside deeply integrated Artificial Intelligence.

“Innovation in 2025 is not just about speed; it is about intuition. The luxury consumer demands a device that anticipates needs before they are articulated.”

To understand the shift in market expectations, compare the baseline features of standard premium phones versus the emerging ultra-luxury standard:

| Feature Category | Standard Premium | Ultra-Luxury Tier |

|---|---|---|

| Form Factor | Rigid Glass Sandwich | Multi-fold or Rollable Displays |

| AI Integration | Cloud-based Assistants | On-device, Privacy-centric Generative AI |

| Connectivity | Standard 5G/Wi-Fi 7 | Satellite Communication & Quantum Encryption |

| Updates | 3-5 Years Support | Lifetime Concierge & Software Assurance |

The Power of Brand Equity and Premium Perception

Strong brand equity is the moat that protects pricing power. Brands that have cultivated a reputation for consistent quality and aspirational marketing can command premium prices regardless of component costs. This perception is built on a narrative of exclusivity; owning the device is a statement of identity. A brand's ability to maintain this allure is crucial for long-term financial health and market dominance.

Design, Materials, and Craftsmanship

In the luxury segment, a phone is akin to fine jewelry or a high-end timepiece. Superior design and the use of premium materials significantly influence consumer choice.

- Aerospace-Grade Titanium: Valued for its strength-to-weight ratio and modern aesthetic.

- Micro-Crystal Ceramic: Offers unparalleled scratch resistance and a cool, tactile finish.

- Meticulous Craftsmanship: Precision machining and hand-finished details signal a commitment to perfection.

The Indispensable Role of Ecosystem Integration

Finally, the hardware is only as good as the ecosystem it inhabits. Seamless integration within a brand's specific environment—whether iOS, Android, or a proprietary luxury OS—is vital. This connectivity enhances the user experience by allowing fluid transition between devices (watches, tablets, smart home) and fosters long-term loyalty. A robust ecosystem locks in the user, ensuring that the brand remains central to their digital life.

FAQ (Frequently Asked Questions)

Q1: What are the most important factors when ranking luxury phone brands for market performance in 2025?

A1: When ranking luxury phone brands for market performance, key factors include brand equity, average selling price (ASP), customer retention rates, innovation in areas like foldable technology and AI, the quality of materials and craftsmanship, and the strength of their integrated ecosystem. Market share within the ultra-premium segment is also considered, but often secondary to profitability and brand desirability.

Q2: How do foldable phones contribute to a brand's luxury status in 2025?

A2: Foldable phones represent a significant innovation and a premium form factor, appealing to consumers seeking cutting-edge technology and unique design. Brands that successfully offer durable, elegant, and functional foldable devices are perceived as leaders in innovation and can command higher price points, thus enhancing their luxury status and market performance.

Q3: Beyond hardware, what role does software and ecosystem play in the luxury phone market?

A3: Software and ecosystem integration are crucial for luxury phones. A seamless experience across devices (smartwatches, tablets, computers), long-term software support (7+ years of updates), robust privacy features, and intuitive AI capabilities significantly enhance user loyalty and perceived value, making the phone an indispensable part of a digital lifestyle.

Q4: Are niche luxury brands like Vertu or Caviar still relevant in 2025?

A4: Yes, niche luxury brands like Vertu and Caviar remain relevant for a very specific ultra-high-net-worth demographic. They focus on extreme exclusivity through exotic materials, bespoke customization, and concierge services, catering to a clientele where price is not a primary concern and unique status symbols are paramount, even if their overall market performance is small compared to mainstream luxury brands.

خاتمة

In conclusion, the 2025 luxury smartphone market in the US stands as a vibrant testament to rapid innovation, robust brand equity, and the pursuit of seamless user experiences. As our analysis highlights, the ability to accurately rank luxury phone brands for market performance is essential for decoding the complex dynamics of this high-stakes industry. Market leaders like Apple and Samsung continue to dominate the charts, maintaining their positions by consistently excelling in key performance metrics and swiftly adapting to the evolving demands of sophisticated users. Their success underscores that true luxury is defined by a harmonious blend of superior hardware and an intuitive ecosystem.

For consumers, these insights are more than just statistics; they are a roadmap to value. By understanding the specific performance drivers that elevate these top contenders, you can make confident, informed purchasing decisions that perfectly suit your personal and professional needs. Conversely, for aspiring brands aiming to disrupt the hierarchy, the path forward is clear: a relentless focus on technological advancement, premium design aesthetics, and ecosystem strength is vital for sustained market leadership.

Ready to invest in a device that defines your status and enhances your productivity? Explore the latest offerings from the top luxury phone brands discussed in this article. Visit the official websites of Apple, Samsung, and other leading manufacturers today to discover the pinnacle of mobile technology and secure your next premium smartphone.

Powered by OpenSEO.