Introduction: The Sleeping Giant Awakens

On November 18, 2025, the AI landscape shifted dramatically. Google released Gemini 3 Pro—and within hours, it topped the prestigious LMArena leaderboard with a record-breaking score of 1501, surpassing OpenAI's ChatGPT for the first time. The response was immediate and visceral: Salesforce CEO Marc Benioff, who had used ChatGPT daily for three years, posted on X: “I'm not going back. The leap is insane. It feels like the world just changed, again.”

Meanwhile, inside OpenAI's headquarters, CEO Sam Altman issued an urgent internal directive that sources described as “code red,” warning staff of “temporary economic headwinds” and “rough vibes” as the company scrambled to respond to Google's unexpected dominance.

This wasn't just another product launch—it was the culmination of Google's strategic advantages finally converging: the world's most powerful search engine, an integrated ecosystem touching billions of users, aggressive free trial periods that harvested massive training data, and the financial muscle to outspend any competitor. The sleeping giant that ChatGPT had awakened in 2022 had finally struck back.

The result? An AI arms race that's accelerating faster than any technology competition in history, with profound implications for innovation, market valuations, and the future of artificial intelligence itself.

Part 1: Google's Natural Advantages – The Search Engine Moat

The Data Monopoly Nobody Talks About

When discussing AI capabilities, most analyses focus on model architecture, training techniques, or computational resources. But Google possesses an advantage so fundamental that it's often overlooked: unparalleled access to real-world data at internet scale.

Google's Data Empire (2025):

- 8.5 billion searches per day (Google Search alone)

- 2+ billion active Gmail users

- 2.7 billion YouTube monthly viewers

- 1.5 billion Google Maps users

- 3 billion Android devices globally

- 9 million businesses using Google Workspace

This isn't just quantity—it's diversity and quality. Every search query represents a human attempting to solve a problem, learn something, or make a decision. Every YouTube view reveals content preferences. Every Gmail thread demonstrates professional communication patterns. Every Maps navigation shows real-world spatial reasoning.

As one analyst noted: “Gemini is trained on a wider array of specialized topics” because Google's training corpus naturally includes the entire indexed web, augmented by proprietary user interaction data that no competitor can access.

Search Integration: The Unfair Advantage

Gemini's most significant competitive edge isn't just the data Google already has—it's the real-time search integration that fundamentally changes how AI operates.

How Gemini 3 Search Integration Works:

- Native Google Search access: Direct API calls to Google's search infrastructure

- Query fan-out techniques: Performs multiple nuanced searches simultaneously

- Deep contextual understanding: Goes beyond keywords to understand intent

- Fresh information retrieval: Accesses the most current data automatically

- Source verification: Cross-references multiple authoritative sources

Real-World Impact: In head-to-head testing, when asked about “significant advancements in quantum computing in Q1 2025”:

- Gemini 3: Provided current, sourced information with specific dates, breakthroughs, and research papers from early 2025

- ChatGPT-5.1: Relied on its March 2025 training cutoff, missing developments from subsequent months

One tester noted: “Gemini's direct Google Search access provides an advantage for queries requiring current information. It uses over 20 sources and focuses on data from 2024 and 2025, making it feel really relevant.”

The Technical Breakdown: According to Tom's Guide: “Google's also reworked how Search finds information behind the scenes; a complete game-changer for the way we Google things. Gemini 3 digs deeper and genuinely understands what you're actually asking for in terms of context, not just keywords. Gemini 3's deeper reasoning allows Search to perform more background queries, uncover sources older models would have missed and better understand the intent behind your question.”

This isn't a minor feature—it's an architectural advantage. While ChatGPT requires explicit web search triggers or relies on static training data, Gemini natively integrates search as part of its reasoning process.

The Ecosystem Lock-In Strategy

Google hasn't just built an AI model—it's embedded Gemini across an ecosystem that touches billions of users daily.

Gemini Integration Points (December 2025):

- Google Search: Native integration for enhanced search results

- Gmail: Smart compose, summarization, and email drafting

- Google Docs: Real-time writing assistance and document analysis

- Google Sheets: Data analysis, formula generation, and visualization

- Google Meet: Live transcription, translation, and meeting summaries

- Google Maps: Enhanced navigation and location recommendations

- Android: System-level AI assistance on 3+ billion devices

- Chrome: Integrated browser AI for web tasks

- YouTube: Video summarization and content recommendations

Distribution Power: As one X post emphasized: “Google's ability to embed AI across its ecosystem accelerates adoption without additional marketing costs.” This means Gemini reaches users who never deliberately chose an AI assistant—they simply encounter it as part of services they already use daily.

The Network Effect:

- Users generate queries → Gemini responds → User behavior improves training data → Gemini gets better → More users adopt → Cycle repeats

This flywheel is inaccessible to competitors. OpenAI can partner with Microsoft, but it doesn't own the operating system, search engine, or email platform. Anthropic has no consumer ecosystem. Google's integrated approach creates a moat that's nearly impossible to cross.

Part 2: The Free Trial Masterstroke – Data Harvesting at Scale

How Free Access Became a Competitive Weapon

While competitors charged premium prices for frontier models, Google took a different approach: make Gemini extensively available for free.

Gemini's Free Tier (2025):

- Gemini 3 Flash: Completely free with daily limits

- Google AI Studio: Free developer access with generous quotas

- Android Integration: No cost for billions of device users

- Workspace Basic: Free tier includes Gemini features

The Strategic Calculation: Google wasn't being altruistic—it was executing a data acquisition strategy at unprecedented scale. Every free query represents:

- Training signal: User intent, phrasing patterns, and desired outcomes

- Evaluation data: What prompts succeed vs. fail

- Edge case discovery: Unusual queries that reveal model weaknesses

- Human preference signals: Which responses users find helpful

The Numbers Tell the Story: By offering free access, Google achieved:

- 650 million monthly active users for Gemini (as of late 2025)

- Billions of queries processed daily

- Diverse use cases: From student homework to enterprise research

- Global coverage: Data from 180+ countries and 100+ languages

One market analysis noted: “Sentiment on social platforms reflects this momentum shift. Posts on X highlight Gemini's growing monthly active users nearing 650 million, contrasting with ChatGPT's figures and underscoring Google's distribution prowess.”

The Data Quality Advantage

The free tier didn't just provide volume—it provided diversity that money can't buy.

What Google Learned from Free Users:

- How students use AI for homework (education patterns)

- How professionals draft emails (business communication)

- How developers debug code (programming workflows)

- How researchers analyze papers (academic reasoning)

- How creators generate content (creative processes)

- How non-native speakers translate (language nuances)

- How elderly users interact with technology (accessibility needs)

This isn't data you can purchase or synthesize. It's authentic human-AI interaction across the full spectrum of use cases.

The Competitive Gap:

- OpenAI's ChatGPT: ~800 million weekly users, but most on free/limited tier with restricted access

- Anthropic's Claude: Primarily paid or developer-focused, smaller user base

- Google's Gemini: Massive free tier usage + enterprise adoption + device integration

As one analyst put it: “Google has nearly every structural advantage: vast revenue and cloud scale, plus the resources to distribute new AI features to billions of users overnight.”

The Reinforcement Learning Loop

Free access enabled something even more powerful: continuous reinforcement learning from human feedback (RLHF) at scale.

How It Works:

- User submits query → Gemini responds

- User accepts/rejects/modifies response (implicit feedback)

- User continues conversation or starts new one (satisfaction signal)

- Patterns aggregated across millions of users

- Model updated to prefer high-satisfaction response patterns

The Scale Advantage:

- Google: Processes billions of interactions daily, updating continuously

- Competitors: Smaller user bases mean slower learning cycles

This creates a compounding advantage. Every day, Gemini learns from more diverse interactions than competitors see in a week. After months of free access, the cumulative knowledge gap becomes insurmountable.

Part 3: From Underdog to Top Dog – The Benchmark Revolution

The LMArena Triumph

On November 18, 2025, Gemini 3 achieved what many thought impossible: it topped the LMArena leaderboard—the gold standard for AI model comparisons.

LMArena Score (November 2025):

- Gemini 3 Pro: 1501 (first place)

- GPT-5.1: ~1480-1490 range

- Claude Opus 4.5: ~1470-1485 range

For context, LMArena uses human evaluators to compare models in blind head-to-head matchups. It's not a synthetic benchmark—it's real users making real choices about which model response they prefer.

What the Rankings Mean: As Tom's Guide reported: “Gemini 3 Pro boasts a groundbreaking score of 1501 on LMArena and claims PhD-level reasoning capabilities.”

This wasn't a fluke. Across multiple independent testing platforms, Gemini 3 consistently matched or exceeded ChatGPT:

Comprehensive Benchmark Performance

| Benchmark | Gemini 3 Pro | ChatGPT-5.1/GPT-5 | Winner |

|---|---|---|---|

| LMArena | 1501 | ~1485 | Gemini |

| MMMU Pro (multimodal) | SOTA | Strong | Gemini |

| GPQA Diamond (grad-level science) | 93.8% | ~90% | Gemini |

| ARC-AGI-2 (novel challenges) | 45.1% | ~40% | Gemini |

| Humanity's Last Exam | 41.0% | ~38% | Gemini |

| Video Understanding | SOTA | N/A | Gemini |

| Document Reasoning | 80.5% (CharXiv) | N/A | Gemini |

| Context Window | 1M tokens | 128K tokens | Gemini |

The Artificial Analysis Intelligence Index:

- Gemini 3 Pro: 73 points (highest)

- Claude Opus 4.5: 70 points

- GPT-5.1: 70 points

Where Gemini Dominates

1. Multimodal Understanding Gemini 3 Pro's native multimodal architecture gives it decisive advantages:

- Vision: State-of-the-art on MMMU Pro, Video MMMU

- Video processing: Frame-by-frame analysis up to 10 FPS

- Document comprehension: Derendering complex PDFs, handwriting recognition

- Spatial reasoning: Pixel-precise object location and pose estimation

2. Knowledge & Current Information

- AA-Omniscience Index: 13 (vs Claude's 10, GPT's ~11)

- Real-time search integration: Accesses current data automatically

- Broader training corpus: Google's indexed web + proprietary data

3. Context Handling

- 1 million token context window (vs ChatGPT's 128K)

- Enables processing of entire codebases, books, or document sets

- 64,000 token output limit for comprehensive responses

Where Competition Remains Fierce

Coding & Software Engineering:

- ChatGPT/GPT-5: Slight edge on SWE-bench, code completion

- Claude Opus 4.5: Dominates with 80.9% on SWE-bench Verified

- Gemini 3: Competitive but not leading (~75%)

Agentic Workflows:

- Claude Opus 4.5: Clear leader (62.3% on Scaled Tool Use)

- ChatGPT-5.1: Strong agentic capabilities

- Gemini 3: Improving but behind in autonomous task execution

Part 4: The Market Earthquake – Wall Street Reacts

The $250 Billion Message

When Google announced Gemini 3, financial markets delivered an unambiguous verdict about the AI power shift.

Market Reaction (Week of November 18-25, 2025):

- Nvidia: Lost ~$250 billion in market cap (-4% post-Gemini 3, -9% for the month)

- Alphabet (Google): Up 11% in 5 days, +19% for the month

- Stock surge value: Google added ~$240+ billion in market capitalization

Why Nvidia Fell: Markets interpreted Gemini 3's success as a signal that OpenAI—Nvidia's biggest customer for GPUs—might face headwinds. If Google can match or exceed ChatGPT's capabilities using its own TPU chips and more efficient architectures, the insatiable demand for Nvidia's H100 chips might slow.

As Fortune reported: “As much as $250 billion was wiped off Nvidia's market cap in Tuesday morning trading as markets digested the reality that maybe the search empire is striking back in the race to win the AI space.”

Analyst Perspectives

Investment Firm D.A. Davidson: Characterized Gemini 3 as “current state of the art” and “our favorite model generally available today.”

Bank of America Securities: Called Gemini 3 “another positive step” for Google as it works to close any “perceived LLM performance gap” to rivals including OpenAI.

Bloomberg Analysis: Noted that despite OpenAI's setbacks, its user base provides a “winning edge”—but only if the company can sustain continuous innovation.

Google's Stock Surge Explained

Why Markets Rewarded Google:

- Validated AI strategy: Years of investment paying off

- Competitive moat strengthened: Search + AI integration defensible

- Revenue opportunities: Gemini can monetize across entire ecosystem

- Cloud competitiveness: Google Cloud now has leading AI offering

- Hardware independence: TPU chips reduce Nvidia dependency

The 67% Annual Gain: Google's stock surged 67% throughout 2025, with AI advancements as the primary driver. This outpaced:

- S&P 500: ~24% gain in 2025

- Nasdaq: ~35% gain in 2025

- Microsoft: ~42% gain (also AI-driven)

Part 5: OpenAI's Code Red – The Panic Inside ChatGPT's Creator

The Internal Directive

According to The Information and multiple sources familiar with the matter, OpenAI CEO Sam Altman issued what insiders described as a “code red” directive immediately following Gemini 3's launch.

What “Code Red” Meant:

- Halt non-critical projects: Resources redirected to ChatGPT enhancement

- Accelerated release schedule: GPT-5.2/GPT-6 development prioritized

- Defensive feature development: Rush to match Gemini's capabilities

- Retention efforts: Counter aggressive recruiting by Google

Altman's Warning to Staff: As reported: “CEO Sam Altman told staffers to brace for ‘rough vibes' and ‘temporary economic headwinds' as the company works to catch up.”

This represented a dramatic shift. For three years, OpenAI had operated with the confidence of the category leader. Now, they were playing defense.

The Traffic Problem

Beyond benchmarks, OpenAI faced a more existential threat: declining user engagement.

Warning Signs:

- Sources.news reported declining ChatGPT engagement even before Gemini 3

- Content restrictions designed for safety were “squeezing consumption”

- User complaints about overly cautious responses

- Perception of ChatGPT becoming “too filtered”

The Competitive Dynamic:

- Google's advantage: Embedded in tools users already use (no explicit choice needed)

- OpenAI's challenge: Requires deliberate user decision to visit ChatGPT

One analysis noted: “OpenAI retains strong brand loyalty from a user base of around 800 million weekly active users. Yes, but: Google has nearly every structural advantage: vast revenue and cloud scale, plus the resources to distribute new AI features to billions of users overnight.”

The Talent War Intensifies

The competition extended beyond product to people.

Google's Recruiting Advantages:

- Historical claim: “Generative AI arguably began with Google's 2017 Transformer paper”

- Alumni return: Many OpenAI/Anthropic researchers started careers at Google

- Compensation: Google can outbid with stock and long-term incentives

- Resources: Unmatched computing infrastructure and research budgets

The Brain Drain Risk: Axios noted: “Much of the technology underlying OpenAI and Anthropic's models traces back to Google, and many current and former researchers at both companies started their careers there.”

For OpenAI, losing top researchers to Google would compound the performance gap—creating a talent-technology doom loop.

Financial Pressure Mounts

OpenAI's Challenges:

- Delayed monetization: Company reportedly postponing revenue plans to focus on product

- Valuation pressure: Private valuations under threat from public market signals

- Burn rate: Heavy spending on compute and talent without proportional revenue growth

Google's Advantages:

- Profitable core business: Search revenue funds AI R&D indefinitely

- Patient capital: No pressure for immediate AI monetization

- Integrated revenue: Gemini enhances existing products (Search, Workspace, Cloud)

Part 6: The AI Development Boom – Competition Breeds Innovation

Accelerated Release Cycles

The Google-OpenAI rivalry has compressed AI development timelines to unprecedented speeds.

2023-2025 Major Release Timeline:

- March 2023: GPT-4 launch

- March 2023: Google Bard/Gemini 1.0 launch

- December 2023: Gemini 1.5 with 1M context

- May 2024: GPT-4o multimodal

- August 2025: GPT-5 release

- November 2025: GPT-5.1 update

- November 2025: Gemini 3 launch

- December 2025: Gemini 3 Deep Think

The Pattern: Major model releases every 3-4 months, with significant updates monthly.

Compare this to traditional software:

- Microsoft Windows: ~3 years between major versions

- Apple iOS: Annual major releases

- Google Android: Annual major releases

AI Models: Meaningful improvements every quarter, revolutionary updates 2-3 times per year.

The Feature Arms Race

Competition has driven rapid feature expansion across all models:

Multimodal Capabilities:

- 2023: Text-only models dominant

- 2024: Image understanding becomes standard

- 2025: Video analysis, audio processing, cross-modal reasoning

Context Windows:

- 2023: 8K-16K tokens standard

- 2024: 128K-200K becomes common

- 2025: 1M+ tokens (Gemini 3), 10M on roadmap

Specialized Modes:

- Deep Think / o1: Extended reasoning for complex problems

- Canvas Mode: Interactive editing and collaboration

- Voice Conversations: Natural spoken interaction

- Vision Tools: Real-time screen understanding

The Benchmark Wars

The competitive pressure created an ecosystem of increasingly sophisticated evaluation methods:

Key Benchmarking Platforms (2025):

- LMArena: Human preference rankings

- Artificial Analysis: Comprehensive performance indexing

- MMMU/GPQA: Academic-level testing

- SWE-bench: Real-world coding evaluation

- CORE-Bench: Scientific reproducibility

The Virtuous Cycle: Better benchmarks → Models optimize for real capabilities → Better products → More ambitious benchmarks → Repeat

Third-Party Innovation Explosion

The Google-OpenAI competition created opportunities for other players:

Anthropic (Claude):

- Carved niche in safety and coding (Claude Opus 4.5 leads SWE-bench)

- 62.3% on Scaled Tool Use (far ahead of Google/OpenAI)

- Best prompt injection resistance

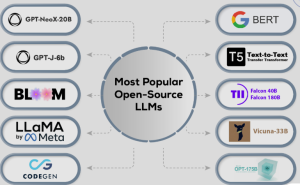

Open Source Community:

- Stable Diffusion, Llama, Mistral benefited from talent exodus

- Open models improved from <30% GPT-4 capability to >70% in 18 months

Specialized Players:

- Perplexity (search-focused AI)

- Character.AI (conversational AI)

- Midjourney/Runway (creative AI)

- Replit/Cursor (coding AI)

The Ecosystem Effect: The Google-OpenAI competition created a “rising tide lifts all boats” dynamic. Investment poured into AI startups, talent became available from “losers” in the arms race, and infrastructure (cloud, APIs, tools) improved for everyone.

Part 7: The Technology Leapfrogging

How Gemini Caught Up So Fast

For two years after ChatGPT's November 2022 launch, Google was widely perceived as behind. How did they leapfrog so quickly?

1. Scale Advantages

- TPU v5/v6 chips: Google's proprietary AI accelerators

- Jupiter supercomputer: Custom networking for distributed training

- Data center scale: Already built for internet-scale services

2. Architectural Innovation

- Native multimodal design: Gemini processes text/image/video/audio simultaneously

- Mixture of Experts: Efficiently scales model capacity

- Advanced attention mechanisms: Better context understanding

3. Strategic Focus While OpenAI chased AGI broadly, Google focused on winning specific battles:

- Document understanding (beat ChatGPT)

- Video processing (ChatGPT doesn't have it)

- Search integration (structural advantage)

- Context length (1M tokens vs 128K)

4. The Late-Mover Advantage Google learned from OpenAI's mistakes:

- Avoided over-filtering (ChatGPT's “too safe” reputation)

- Prioritized multimodal from start (GPT added it later)

- Built tighter ecosystem integration (OpenAI partnered with Microsoft)

- Launched with longer context windows (caught OpenAI off guard)

The Deep Think Innovation

Gemini 3 Deep Think represents a new frontier in AI reasoning.

How It Works:

- Spends more time “thinking” before responding

- Shows reasoning process transparently

- Adapts computation to problem complexity

- Achieves breakthrough scores on reasoning benchmarks

Performance:

- Humanity's Last Exam: 41.0% (previous best ~35%)

- GPQA Diamond: 93.8% (graduate-level science)

- ARC-AGI-2: 45.1% (unprecedented for novel challenge solving)

The Significance: Deep Think suggests Google found a way to trade compute for accuracy—spending more resources on hard problems to achieve human-expert-level performance.

Part 8: The Broader Implications

For Consumers: The Golden Age of AI

What Users Gain:

- Better quality: Competition drives both companies to improve

- Lower prices: Google's free tier pressures OpenAI pricing

- More features: Arms race creates rapid feature expansion

- Faster innovation: Quarterly breakthroughs instead of annual

The Choice Benefit: Unlike monopolistic markets, consumers can:

- Use Gemini for multimodal tasks and current information

- Use ChatGPT for creative writing and coding

- Use Claude for safety-critical applications

- Switch seamlessly based on task requirements

For Developers: API Wars Drive Value

Price Competition:

- Gemini 3 Pro: $2-4 per million input tokens

- Claude Opus 4.5: $5 per million input tokens

- GPT-5.1: Starting at $1.25 per million tokens

Capability Competition: All three now offer:

- Long context windows (128K-1M tokens)

- Multimodal processing

- Function calling

- Streaming responses

- Batch processing discounts

The Developer Win: 2025's AI API landscape offers more capability at lower cost than seemed possible in 2023—driven entirely by competitive pressure.

For Enterprises: Hedging Strategies

The Multi-Model Approach: Savvy enterprises now deploy:

- Gemini: Document processing, research, current info retrieval

- Claude: Mission-critical coding, agentic workflows

- GPT: Creative content, customer service

Why Diversification Matters:

- No single model excels at everything

- Vendor lock-in risk reduced

- Pricing leverage through competition

- Redundancy if one provider has outages

For Society: The Acceleration Question

The Optimistic View: Competition drives:

- Faster capability improvements

- Better safety (companies compete on trust too)

- Lower costs (democratizing AI access)

- More specialized solutions

The Concerning View: Rapid competition might cause:

- Insufficient safety testing (speed over caution)

- Race-to-the-bottom on alignment

- Concentration risk (winner-take-all dynamics)

- Unemployment disruption accelerated

Where We Stand (December 2025): The pace is breathtaking but not yet reckless. All major players maintain safety teams, though the pressure is evident.

Part 9: What Comes Next – The 2026 Battleground

OpenAI's Likely Moves

Expected Counterpunches:

- GPT-6 Early Release: Originally planned for mid-2026, likely accelerated to Q1

- Multimodal Parity: Major video understanding investment

- Context Window Expansion: Matching or exceeding Gemini's 1M tokens

- Ecosystem Partnerships: Deeper Microsoft/GitHub/LinkedIn integration

- Specialized Models: Domain-specific variants (medical, legal, financial)

Strategic Shifts:

- Less emphasis on “AGI someday” rhetoric

- More focus on “best tool for X” positioning

- Aggressive developer outreach

- Enterprise feature development

Google's Next Moves

Maintaining Momentum:

- Gemini 3 Flash: Faster, cheaper variant for everyday tasks

- Deeper Workspace Integration: Gemini becomes invisible but omnipresent

- Android System Integration: AI at OS level for all devices

- Search AI Enhancement: Making search results increasingly AI-generated

- YouTube AI Tools: Creator tools powered by Gemini

The Hardware Play:

- TPU v7: Next-generation chips for 10x training efficiency

- Edge AI: On-device Gemini for privacy and speed

- Quantum advantage: Leveraging Google's quantum computing lead

The Wild Card: Open Source

Meta's Llama 4: Rumored for Q1 2026, could be first truly open GPT-5-class model.

Implications:

- Democratizes frontier capabilities

- Reduces Google/OpenAI pricing power

- Accelerates specialized fine-tuning

- May force closed model providers to differentiate on services, not just model quality

The Regulatory Dimension

Increasing Government Attention:

- EU AI Act enforcement begins 2026

- US considering AI safety legislation

- China's AI regulations influencing global development

How This Affects Competition:

- Compliance costs favor large players (Google, OpenAI, Microsoft)

- Open source might face restrictions

- Safety requirements could slow release cycles

- International fragmentation possible

Part 10: Key Takeaways – What This Means for You

For Individual Users

The Action Plan:

- Don't be loyal to one AI: Use the best tool for each task

- Leverage free tiers: Gemini and ChatGPT both offer generous free access

- Stay informed: Capabilities change monthly; what was true in November may not hold by January

- Experiment actively: Try both for your specific use cases

Current Recommendations (December 2025):

- Research & current events: Gemini 3 (search integration advantage)

- Creative writing: ChatGPT-5.1 (slight conversational edge)

- Video analysis: Gemini 3 (only major model with this feature)

- Complex reasoning: Gemini 3 Deep Think or ChatGPT Thinking mode

- Multimodal tasks: Gemini 3 (stronger native multimodal)

For Developers

Strategic Considerations:

- Multi-model strategy: Don't build on just one API

- Cost optimization: Use cheaper models for simple tasks, frontier models for complex ones

- Monitor benchmarks: Capabilities shift rapidly; reassess quarterly

- Ecosystem integration: Consider where your users already are (Google vs Microsoft)

Technical Recommendations:

- Context handling: Use Gemini for long-document tasks (1M tokens)

- Coding assistance: Claude Opus 4.5 leads, but GPT/Gemini competitive

- Multimodal apps: Gemini 3 Pro currently strongest

- Agentic workflows: Claude Opus 4.5 until Google/OpenAI catch up

For Businesses

Decision Framework:

- Google ecosystem users: Gemini integration is seamless and powerful

- Microsoft ecosystem: ChatGPT through Microsoft Foundry/Azure

- Best-of-breed approach: Use multiple models for different functions

- Privacy-critical: Evaluate each provider's data policies carefully

Cost Considerations:

- Gemini 3 Pro: Most cost-effective for high-volume multimodal work

- Claude Opus 4.5: Premium pricing but best for mission-critical coding

- GPT models: Competitive pricing with strong overall capabilities

Conclusion: The AI Cambrian Explosion

Google's Gemini 3 Pro leveraged three irreplaceable advantages—search dominance, free trial data harvesting, and ecosystem integration—to challenge ChatGPT's throne. The result isn't just a competitive product launch; it's the ignition of an AI arms race that's accelerating innovation at unprecedented speed.

The Scorecard (December 2025):

- Benchmarks: Gemini 3 leads overall, slight edge over ChatGPT

- Real-world usage: Roughly tied, with task-specific advantages

- Market momentum: Google surging, OpenAI defending

- Innovation pace: Both companies releasing major updates quarterly

- Consumer benefit: Massive—more capability, lower cost, rapid improvement

The Broader Pattern: This mirrors other great technology rivalries:

- Microsoft vs Apple in PCs (1980s-90s)

- Google vs Microsoft in search/browsers (2000s)

- iOS vs Android in mobile (2010s)

- Now: Gemini vs ChatGPT in AI (2020s)

History shows these competitions drive more innovation than monopolies ever do. The AI field will be stronger, safer, and more useful because Google and OpenAI are locked in fierce competition—each forced to outinnovate the other or face irrelevance.

The Question Ahead: Can OpenAI defend its first-mover advantage against Google's structural moats? Can Google maintain momentum, or will OpenAI's agility allow a counterpunch? Will a dark horse like Anthropic's Claude or open-source models disrupt both?

The only certainty: AI development has entered a period of explosive growth that will define the 2020s. We're witnessing not just product competition, but a race to shape humanity's most transformative technology.

The sleeping giant has awakened. The race is on. And the pace will only accelerate from here.

Stay Updated: The AI landscape changes weekly. Bookmark independent benchmarking sites like Artificial Analysis and LMArena to track real-time model performance as this rivalry unfolds.

Try for Yourself: Don't trust reviews—test both Gemini 3 Pro and ChatGPT-5.1 with your specific use cases. The best AI is the one that works best for your needs, not what benchmarks or analysts say.

The AI wars have begun. Choose your weapons wisely.