Artificial intelligence has revolutionized fraud detection by enabling you to identify fraudulent activities with unmatched speed and precision. For example, AI-powered fraud analysts now review documents in just 72 seconds, compared to the 10 minutes required by human reviewers. Additionally, AI systems improve detection accuracy by over 50% compared to traditional methods, making them indispensable in 2025. Businesses using AI in fraud detection also report a 70% reduction in detection time, helping them stay ahead of increasingly sophisticated fraud tactics.

Key Takeaways

-

AI makes finding fraud much faster, cutting review time to 72 seconds.

-

Companies using AI see a 70% faster detection time. This helps them stop tricky fraud methods early.

-

AI improves fraud detection accuracy by over 50%. It reduces mistakes and helps work run smoother.

The Evolving Landscape of Fraud Detection

Sophistication of Modern Fraud Tactics

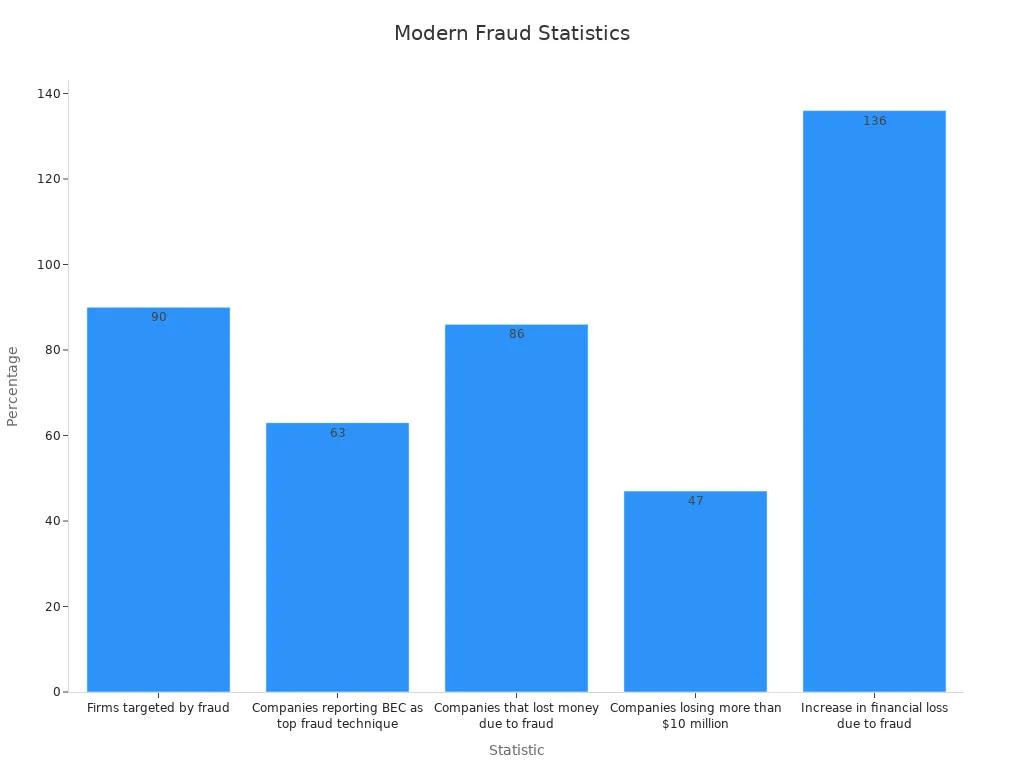

Fraudsters have become more resourceful, leveraging advanced technologies to exploit vulnerabilities. In 2024, 90% of firms reported being targeted by fraud, a sharp increase from 79% in 2023. Business email compromise (BEC) emerged as the top fraud technique, with a staggering 103% year-over-year growth. Financial losses also surged by 136%, with 47% of companies losing over $10 million. These statistics highlight the growing complexity of fraud patterns and the need for robust fraud detection strategies.

Fraudsters now use tactics like synthetic identities, deepfake technology, and AI-generated phishing emails. These methods make it harder for traditional systems to differentiate between legitimate and fraudulent activities. To combat this, you need adaptive tools capable of analyzing fraud patterns in real time.

Challenges of Traditional Fraud Detection Methods

Traditional fraud detection systems rely heavily on rule-based approaches. While these systems were effective in the past, they struggle to keep up with evolving fraud tactics. Once fraudsters understand the rules, they can easily bypass them. Additionally, maintaining these systems is costly and time-consuming, further limiting their effectiveness.

For example, healthcare fraud detection systems often fail to adapt to new schemes, leaving organizations vulnerable. The static nature of these systems makes them ill-suited for the dynamic landscape of modern fraud. You need more flexible and intelligent solutions to address these challenges.

Role of AI in Addressing Emerging Fraud Risks

Artificial intelligence has become a game-changer in fraud detection. AI-enabled fraud detection systems excel at identifying anomalies and monitoring transactions in real time. These systems adapt to new fraud patterns, ensuring they remain effective even as tactics evolve. For instance, AI in fraud detection plays a critical role in banking, where real-time monitoring is essential to prevent financial losses.

AI-driven solutions also integrate seamlessly with traditional methods, offering a comprehensive approach to fraud risk management. By leveraging AI-enabled fraud detection, you can enhance accuracy, reduce false positives, and stay ahead of emerging threats. Continuous improvement of AI models ensures they remain effective, making artificial intelligence an indispensable tool in combating fraud.

AI Technologies Revolutionizing Fraud Detection

Machine Learning for Pattern Recognition

Machine learning techniques have become a cornerstone of fraud detection. These models analyze vast datasets to uncover patterns that humans might overlook. By training on both legitimate and fraudulent transactions, machine learning systems learn to identify complex correlations and anomalous patterns. For example, they can detect subtle changes in transaction behavior, such as unusual spending spikes or location mismatches, which often indicate fraud.

Unlike traditional systems, machine learning adapts to new data. This continuous learning process refines its ability to spot suspicious activity, reducing false positives and improving accuracy. Many forensic accounting firms now rely on these tools, with approximately 60% integrating artificial intelligence into their investigations. This shift highlights the growing importance of AI in fraud detection and its ability to transform reactive processes into proactive fraud prevention.

Anomaly Detection and Behavioral Analysis

Anomaly detection plays a critical role in identifying fraudulent activities. It focuses on deviations from normal behavior, such as unusual login times or unexpected transaction amounts. Behavioral analysis enhances this process by examining user actions, like the sequence of clicks during an online banking session. Together, these methods provide a powerful approach to uncovering hidden threats.

Research shows that advanced anomaly detection algorithms can analyze high-dimensional data sets with hundreds of features. For instance, a study on e-banking fraud detection used a Bagged Decision Tree Model to extract 147 key features from nearly 800 initial ones. This level of detail allows AI systems to detect even the most subtle anomalies, making them far more effective than traditional methods. By leveraging these tools, you can stay ahead of fraudsters who constantly evolve their tactics.

Real-Time Monitoring and Predictive Analytics

Real-time analysis has revolutionized fraud detection by enabling immediate responses to suspicious activities. AI systems monitor transactions as they occur, identifying unusual patterns and preventing fraud before it causes significant damage. Predictive analytics takes this a step further by forecasting potential risks based on historical data. For example, banks use machine learning to predict future fraud scenarios, allowing them to implement preventive measures proactively.

These technologies significantly reduce manual tasks, freeing up resources for more strategic initiatives. They also minimize revenue losses by addressing threats in real time. The combination of real-time monitoring and predictive analytics ensures that your fraud detection efforts remain one step ahead of cybercriminals.

Types of Fraud AI Can Detect

Financial Fraud and Money Laundering

AI has become a vital tool for detecting financial fraud and money laundering schemes. These crimes often involve complex networks and hidden patterns that traditional systems struggle to uncover. AI-powered fraud detection systems analyze vast amounts of data to identify suspicious transactions, such as unusual account activity or large transfers between unrelated parties. By leveraging machine learning and statistical modeling, you can detect organized crime activities and prevent financial losses.

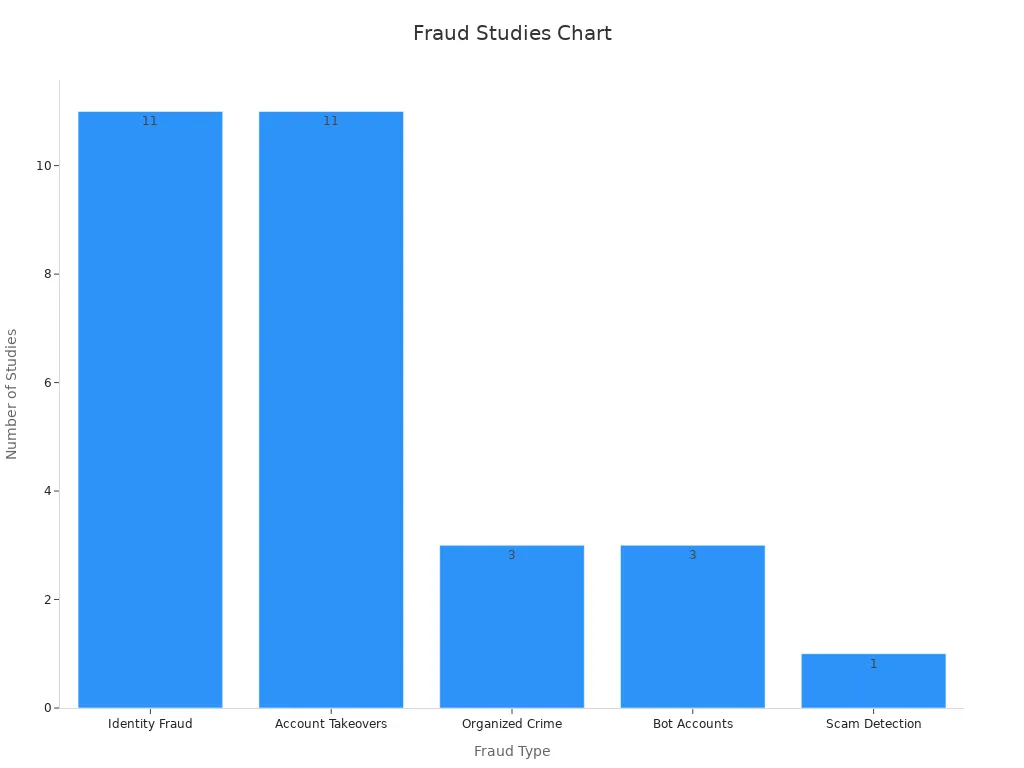

A study of fraud detection techniques highlights the effectiveness of AI in combating various types of fraud. For example, machine learning models excel at identifying organized crime and bot accounts, which are common in money laundering schemes. The table below summarizes the findings:

|

Type of Fraud |

Number of Studies |

Techniques Used |

|---|---|---|

|

Identity Fraud |

11 |

User behavior anomaly detection |

|

Account Takeovers |

11 |

Machine learning, deep learning |

|

Organized Crime |

3 |

Machine learning, statistical modeling |

|

Bot Accounts |

3 |

Machine learning, deep learning |

|

Scam Detection |

1 |

Machine learning |

AI systems also play a critical role in detecting healthcare fraud and insurance fraud. These systems analyze billing patterns and claim histories to identify anomalies, such as duplicate claims or inflated charges. By implementing AI-driven solutions, you can reduce payment fraud and safeguard your financial operations.

Identity Theft and Account Takeover

Identity theft and account takeover incidents have surged in recent years, making them a top priority for fraud detection efforts. AI-powered systems provide a robust defense against these threats by analyzing user behavior and transaction contexts. For example, they assess keystroke speed, device settings, and session duration to identify unusual activity. These systems also confirm liveness and detect deepfake images, ensuring that fraudulent attempts are flagged before they cause harm.

AI solutions significantly improve detection accuracy while reducing false positives. For instance:

-

They achieve a 77% improvement in false positive rates at logins over three months.

-

A major airline reported that AI detected 94% of account takeover attempts.

-

Trusted users experienced a 99% login pass rate, ensuring a seamless experience.

The LexisNexis® Digital Identity Network® revealed that third-party account takeover attempts account for 28.7% of attacks. By leveraging AI, you can protect your customers from identity theft and transaction fraud while maintaining their trust.

E-commerce Fraud and Cybersecurity Threats

E-commerce platforms face unique challenges in combating fraud, including bot attacks, fake accounts, and fraudulent transactions. AI-driven cybersecurity measures have proven highly effective in addressing these threats. For example, AI systems thwarted $4 billion in fraud attempts and blocked 1.6 million bot signup attempts per hour. They also rejected 49,000 fraudulent partnership enrollments, showcasing their ability to safeguard online marketplaces.

|

Metric |

1TP15التالي |

|---|---|

|

Fraud attempts thwarted |

$4 billion |

|

Fraudulent partnership enrollments rejected |

49,000 |

|

Bot signup attempts blocked per hour |

1.6 million |

AI systems use anomaly detection and behavioral analysis to identify e-commerce fraud. They monitor user actions, such as browsing patterns and payment methods, to detect suspicious transactions. These systems also adapt to emerging threats, ensuring that your platform remains secure against evolving fraud tactics.

By integrating AI into your fraud detection strategy, you can protect your business from application fraud, credit card fraud, and other cybersecurity threats. This proactive approach minimizes revenue losses and enhances customer trust, making AI an indispensable asset for e-commerce platforms.

Benefits of AI in Fraud Detection

Enhanced Accuracy and Reduced False Positives

Artificial intelligence enhances fraud detection accuracy by analyzing transaction behaviors and identifying anomalies. AI systems establish a baseline of normal activity, allowing them to detect fraudulent actions with precision. For example, machine learning algorithms improve fraud detection rates by 30% and reduce false positives by 7%. These advancements minimize operational costs and streamline fraud prevention efforts.

|

Benefit |

|

|---|---|

|

Increase in Fraud Detection |

30% |

|

Decrease in False Positives |

7% |

|

Increase in Daily Reporting |

40% |

AI-driven systems also excel at reducing false positives across various detection types. For instance, they achieve a 94% reduction in false positives for account takeovers and a 99.5% reduction for bradycardia-related fraud. These improvements align with consumer expectations and enhance operational efficiency.

Scalability for Large-Scale Data Analysis

AI systems offer unmatched scalability for analyzing large datasets. They process billions of records in real time, enabling faster responses to fraud attempts. Technologies like graph neural networks identify intricate fraud patterns that traditional methods often miss. This capability is essential for businesses handling vast amounts of data, such as financial institutions and e-commerce platforms.

-

AI systems excel at recognizing complex patterns in large datasets.

-

They enable real-time analysis, ensuring quicker fraud prevention responses.

-

Graph neural networks analyze billions of records to detect hidden fraud schemes.

By leveraging AI for fraud detection, you can scale your anti-fraud systems to meet the demands of growing data volumes without compromising accuracy or speed.

Real-Time Fraud Prevention and Response

AI systems revolutionize fraud prevention by enabling real-time monitoring and immediate responses. Organizations like Eastern Bank have reduced fraud losses by 23% and false positives by 67%, enhancing security and customer experience. Mastercard improved fraud detection rates by 50%, while a travel booking company reduced order declines by 86% and chargeback rates to just 0.05%.

|

Organization |

Fraud Loss Reduction |

False Positive Reduction |

Additional Impact |

|---|---|---|---|

|

Eastern Bank |

23% |

67% |

Enhanced security and improved customer experience |

|

Mastercard |

N/A |

50% |

Improved fraud detection rates |

|

Travel Booking Company |

N/A |

N/A |

Reduced order declines by 86% and chargeback rates to 0.05% |

AI-driven fraud prevention systems adapt to emerging threats, ensuring your business stays ahead of fraudsters. Real-time fraud detection accuracy improves operational efficiency, reduces backlogs, and aligns with customer expectations.

Challenges of AI for Fraud Detection

Ethical Concerns and Bias in AI Models

AI systems are not immune to ethical challenges, especially when it comes to bias. These biases often stem from flawed training data or poorly designed models. For example, historical biases in datasets can lead to discriminatory outcomes, as seen in the COMPAS algorithm, which misclassified Black defendants as higher risk for recidivism compared to white defendants. Such issues highlight the importance of designing models that account for sensitive features and ensure fairness.

To address these concerns, you should:

-

Conduct regular audits of AI outputs to identify and mitigate bias.

-

Test models on diverse datasets to ensure they represent all customer groups.

-

Periodically review fairness definitions, especially in high-risk systems like fraud detection.

Without these measures, AI systems risk perpetuating existing inequalities, leading to false positives or negatives that harm both businesses and customers.

Data Privacy and Security Challenges

AI fraud detection systems rely on vast amounts of data, which raises significant privacy and security concerns. These systems must comply with regulations like the Gramm-Leach-Bliley Act (GLBA) and the California Privacy Act (CPA). However, balancing security needs with ethical data use remains a challenge.

|

Challenge Type |

الوصف |

|---|---|

|

Privacy and Ethical Concerns |

Large data requirements raise questions about ethical use and compliance with privacy laws. |

|

Implementation Challenges |

High costs and technical difficulties hinder seamless integration with existing systems. |

|

Continuous Improvement |

AI systems need regular updates to counter evolving fraud tactics, requiring ongoing resources. |

Transparency is another issue. Many AI models operate as “black boxes,” making it difficult to explain their decisions. To overcome these challenges, you should prioritize transparency, train models on diverse datasets, and stay updated on evolving privacy laws.

Importance of Human Oversight in AI Systems

While AI excels at analyzing large datasets and detecting fraud in real time, it struggles with false positives. These errors can frustrate customers and lead to financial losses. For instance, research from MIT revealed that traditional fraud detection models often generate inaccurate alerts, costing e-commerce merchants millions annually.

Human oversight plays a critical role in mitigating these errors. A model developed by MIT reduced false positives by 54%, saving institutions substantial amounts. By combining AI's speed with human judgment, you can ensure more accurate fraud detection and maintain customer trust.

Real-World Applications of AI in Fraud Detection

Financial Institutions Leveraging AI for Fraud Prevention

Financial institutions use AI to combat fraud effectively. AI automates processes, detects patterns, and analyzes data at high speeds. It identifies anomalies in transactions and maps connections between accounts to uncover fraudulent behaviors. Machine learning achieves up to 99% accuracy in data entry and analysis, reducing errors that could lead to fraud. Some banks explore blockchain technology to collect evidence and prevent fraud.

|

Evidence Description |

Application Area |

|---|---|

|

AI automates processes, detects patterns, and analyzes data at high speeds. |

Financial Fraud Detection |

|

AI tools analyze vast data in real-time, identifying anomalies in transactions. |

Financial Fraud Detection |

|

Machine learning maps connections between accounts to detect fraudulent behaviors. |

Financial Fraud Detection |

|

AI achieves up to 99% accuracy in data entry and analysis, reducing errors. |

Financial Fraud Detection |

|

Blockchain technology is explored for evidence collection and fraud prevention. |

Financial Fraud Detection |

Several institutions have implemented AI-driven solutions to enhance fraud prevention:

-

JPMorgan Chase uses COiN, an AI system that reviews loan agreements and detects anomalies.

-

Bank of America employs Erica, a virtual assistant that alerts customers to unusual transaction activities.

-

HSBC partnered with Quantexa to analyze transactions for complex fraud schemes.

These examples highlight how AI strengthens fraud detection and improves risk management across the financial sector.

E-commerce Platforms Using AI to Combat Fraud

E-commerce platforms face challenges like bot attacks, fake accounts, and fraudulent transactions. AI systems address these issues by assigning dynamic risk scores to transactions, improving assessment accuracy. Real-time monitoring continuously analyzes transactions, enabling quicker identification of suspicious activities. AI also reduces false positives, ensuring legitimate transactions proceed smoothly.

|

Evidence Description |

Impact on Fraud Detection |

|---|---|

|

Dynamic Risk Scoring |

Assigns risk scores to transactions, improving accuracy. |

|

Real-time Monitoring |

Quickly identifies suspicious activities. |

|

Reduced False Positives |

Improves customer satisfaction and trust. |

|

Adaptability to New Patterns |

Learns from new data to adjust to emerging fraud tactics. |

|

Scalability |

Handles increased transaction volumes without performance loss. |

AI systems adapt to new fraud patterns, ensuring platforms remain secure. By leveraging these technologies, you can protect your business from fraud while enhancing customer trust.

AI in Cybersecurity for Fraud Detection

AI plays a vital role in cybersecurity by detecting and preventing fraud. It monitors network activity to identify unusual behaviors, such as unauthorized access attempts or data breaches. Machine learning algorithms analyze vast amounts of data to detect hidden threats. AI systems also predict potential risks, allowing you to implement preventive measures before fraud occurs.

For example, AI-driven cybersecurity tools block bot attacks and detect phishing attempts. They also safeguard sensitive customer data by identifying vulnerabilities in real time. By integrating AI into your cybersecurity strategy, you can protect your business from fraud and ensure operational security.

Artificial intelligence transforms fraud detection by improving accuracy and efficiency. AI systems adapt to evolving cyber threats, ensuring long-term effectiveness. Automation reduces costs, making AI for fraud detection a cost-effective solution. Addressing challenges like ethical concerns and data quality ensures successful implementation. By adopting AI in fraud detection, you protect operations and build customer trust.

التعليمات

How does AI improve fraud detection accuracy?

AI analyzes transaction patterns and detects anomalies. It adapts to new fraud tactics, ensuring precise identification and fewer false positives.

Can AI detect fraud in real time?

Yes, AI monitors transactions instantly. It flags suspicious activities and prevents fraud before it causes harm.

Is AI suitable for small businesses?

Absolutely! AI tools scale to fit your needs. They offer cost-effective fraud prevention solutions for businesses of all sizes.