Corporate risk management means identifying and addressing risks to safeguard your business’s operations, reputation, and financial stability. In 2025, the rapid advancement of technology and global shifts make this more critical than ever. Businesses face evolving regulations and cyber threats that demand innovative solutions. Proactive planning is essential to mitigate issues and maintain resilience. Tools like AI play a key role in detecting risks early and resolving them efficiently. Vertu corporate risk management services empower businesses to navigate these complex challenges with expertise and confidence.

Key Takeaways

-

Managing risks is important to keep your business safe from problems like hacking and new rules.

-

Smart tools like AI can find risks early and help make better choices, improving money results.

-

Teaching workers is key for good risk management. Trained staff can handle problems and use new tools well.

-

Working with tech experts helps by giving smart ideas and solutions that fit your business.

-

Using machines and people together makes risk management work well while staying fair and thoughtful.

The Current State of Enterprise Risk Management

Traditional Approaches to the Risk Management Process

Risk management has been around for centuries. Ancient groups like the Egyptians and Babylonians used early methods to handle risks in farming, trade, and building. For instance, Babylonians made early insurance deals to protect traders from losing goods. Later, the industrial revolution brought better ways to manage risks in factories and businesses.

The old risk management process has three main steps:

|

Principle |

What It Means |

Examples of Tools Used |

|---|---|---|

|

Risk Identification |

Finding out what risks might happen |

Lists, Surveys, Inspections |

|

Risk Assessment |

Checking how often and how bad risks could be |

Risk Charts, Probability Studies |

|

Risk Management |

Planning how to reduce or share risks |

Insurance, Avoiding Risks, Reducing Risks |

These methods mostly focus on risks that can be insured. They often work separately in different departments, which makes it harder to solve big problems.

Why Old Methods Struggle in Today’s World

The world is changing fast, and old ways have problems. They depend too much on past data, which might not show future risks. This is a big issue in industries with fast tech changes or global problems. Traditional methods also focus too much on money risks and miss other dangers like political problems, social issues, or cyberattacks.

Another problem is that old systems are slow to change. They can’t quickly handle new risks, leaving businesses open to harm. For example, companies using outdated methods may struggle with new risks in healthcare, banking, or shopping industries.

Why Businesses Need New Risk Management Ideas

Today’s risks are more complicated, so businesses need better tools. Using advanced tech like AI can make risk management faster and more accurate. Companies that try new ideas often save money and do better financially.

Real-life examples show why change is needed. A medium-sized insurance company in North America had to pay 20% more claims because of natural disasters. In Europe, a luxury fashion brand faced market problems and poor risk planning. These stories show why modern risk management is so important.

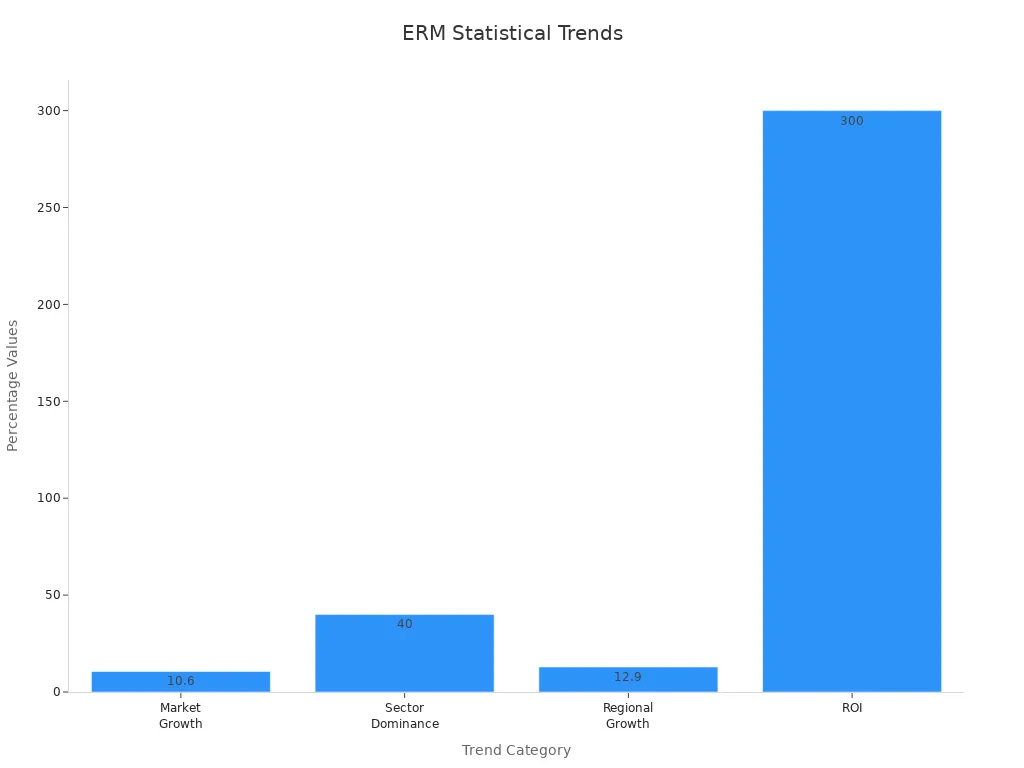

The global risk management market is growing fast. It could reach $38.94 billion by 2028, with a yearly growth rate of 10.6%. Companies with strong risk programs do better financially and spot risks early. This proves how important it is to use new ideas in risk management.

The Role of Emerging Technologies in Corporate Risk Management

AI-Powered Risk Assessments and Predictive Analytics

New technologies like AI are changing how risks are managed. AI helps businesses check risks faster and more accurately. It can study huge amounts of data quickly, finding patterns and warning about problems before they happen. This helps companies make smart choices and use their resources wisely.

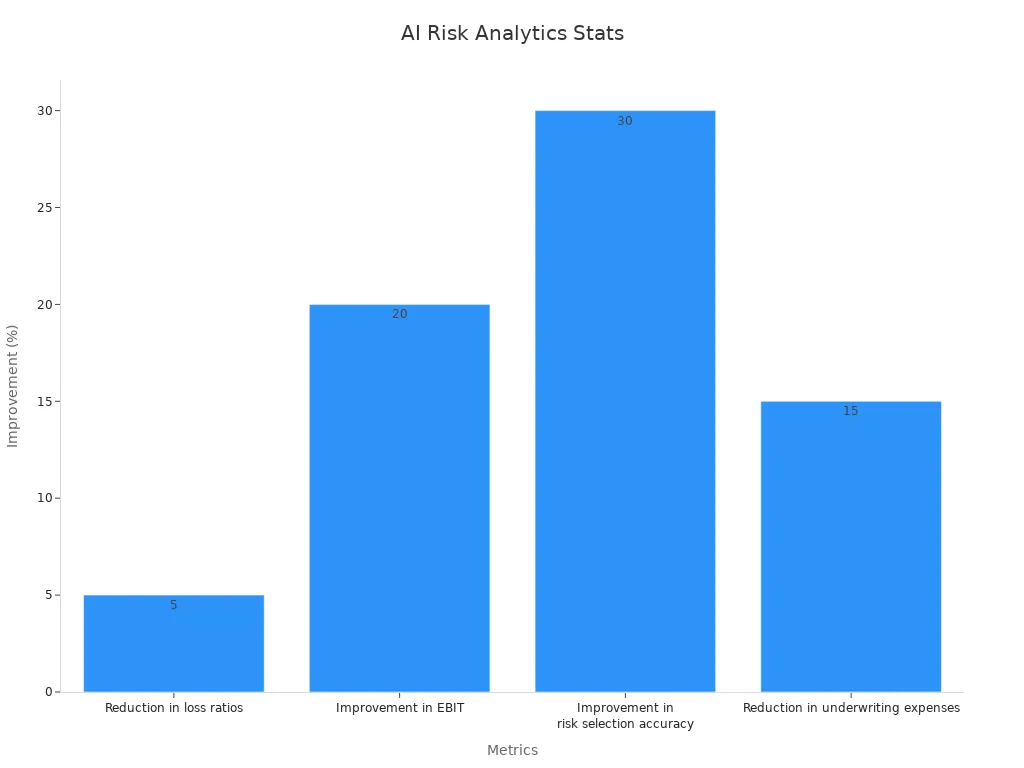

For example, AI can look at old data to guess future market changes. It can also spot unusual activities that might mean a cyberattack is coming. Businesses using AI for risk management have seen big improvements in how they work and their profits.

|

Metric |

Improvement |

|---|---|

|

Reduction in loss ratios |

Up to 5% |

|

Improvement in EBIT |

|

|

Improvement in risk selection accuracy |

Up to 30% |

|

Reduction in underwriting expenses |

Up to 15% |

Using AI helps businesses stay ready for challenges. It also helps them handle risks that aren’t about money, like environmental or social issues. This makes businesses stronger and more prepared for the future.

Enhancing Fraud Detection with Machine Learning

Stopping fraud is very important for businesses today. Machine learning (ML) is great at finding fraud by studying data and spotting strange patterns. Unlike older methods, ML keeps learning and improving, making it better at catching tricky fraud schemes.

For example, ML can watch transactions as they happen and flag anything suspicious. Research shows that ML is much better at finding fraud, especially in industries like banking and insurance.

|

Study Title |

Focus Area |

Key Findings |

|---|---|---|

|

Machine Learning Models for Fraud Detection: A Comprehensive Review and Empirical Analysis |

General Fraud Detection |

This study reviews and analyzes various ML and DL models for fraud detection, highlighting their performance metrics and practical implications in real-time scenarios. |

|

Leveraging Machine Learning Techniques for Enhanced Detection of Insurance Fraud Claims |

Insurance Fraud Claims |

This research implements ML techniques to improve the detection of fraudulent insurance claims, demonstrating the effectiveness of these models in practical applications. |

Adding ML to your risk plan can help stop fraud and protect your business from losing money or trust.

Strengthening Cybersecurity Through Advanced Technologies

Cybersecurity is a big deal because cyber threats keep growing. Advanced tools like AI are key to keeping data safe and stopping cyberattacks. These tools can find weak spots, watch networks, and react to threats right away.

إن FAIR model, for example, helps businesses spend their cybersecurity money wisely. It shows how much risk can be reduced for every dollar spent.

-

Most risk managers feel good about handling compliance risks.

-

Using new tech improves security and keeps businesses following rules.

By sorting threats by how often they happen and how bad they are, businesses can focus on the most important ones. Advanced tools not only protect against attacks but also help avoid fines by meeting rules and standards.

How Blockchain Helps with Transparency and Reducing Risks

Blockchain is changing how businesses stay clear and avoid risks. It uses a shared ledger that cannot be changed or hacked. Every transaction is recorded and checked, making data safe and trustworthy.

Blockchain improves transparency in many ways:

-

Aeternity and PayPerMile use smart contracts for insurance payments. This stops fake claims and ensures fair payouts.

-

Impact investments use blockchain to show how money is spent. This prevents misuse and builds trust with investors.

-

ImpactPPA uses blockchain to check renewable energy project results. This helps investors see if promises are kept.

-

Estonia's e-governance uses blockchain for secure government records. This sets a high standard for digital systems worldwide.

-

IBM and Veridium use blockchain for carbon credits. This makes carbon markets clear and helps meet green goals.

Blockchain also helps reduce risks by spotting problems early. Smart contracts can run tasks automatically, lowering mistakes and following rules. Its shared system keeps data safe from hackers by removing single points of attack.

Using blockchain boosts trust, stops fraud, and makes work smoother. Whether tracking investments, checking projects, or following rules, blockchain is a strong tool for reducing risks and building confidence.

Challenges in Using New Risk Management Tools

Ethical Issues with AI Decisions

AI has changed how risks are managed, but it brings problems. It’s hard to make sure AI is fair and clear. Sometimes, AI gives unfair results if trained on bad data. This can cause wrong decisions, like in fraud checks. Also, AI decisions can be hard to explain to others. This makes it tricky to defend them to bosses or regulators. To fix this, AI must follow rules and match society’s values.

Problems with Too Much Automation

Automation makes risk management easier, but it has downsides. It can give wrong alerts, making teams ignore real dangers. Automated tools might miss new threats, leaving companies at risk. Relying too much on automation can weaken human skills. Fewer workers may know how to handle these systems. This can create false confidence, thinking automation catches everything. Mixing automation with human checks helps make better choices.

Risks to Data Privacy and Security

Using new tech means more worries about data safety. Over half of experts say cyber-attacks are rising. Many companies skip regular checks, making them easy targets. Following data rules gets harder as sensitive info grows. Strong cybersecurity is key to stopping money loss and bad press. Regular checks and following rules can help keep your company safe.

Addressing Resistance to Change Within Organizations

Resistance to change happens often when new tools are introduced. Workers may feel worried if they don’t understand the reasons for change. To fix this, leaders need clear communication and thoughtful strategies.

One big reason for resistance is lack of information. Workers may feel left out if they don’t know why changes happen. They might also fear losing their jobs to new tools or systems. Leaders who seem uninterested or unclear can make workers feel unsure. Fear of new things and emotions like frustration can make resistance worse.

Tip: Explain the benefits of change clearly to reduce fear and build trust.

To handle resistance, include workers in the process. Let them share ideas and feedback to feel involved. Train managers to lead teams through changes with care. Teach workers how to use new tools to boost their confidence.

Mentorship programs can help nervous workers. Pair them with skilled coworkers to ease their worries. Making changes step-by-step gives everyone time to adjust without stress.

By dealing with resistance carefully, you can create a workplace that welcomes new ideas. Workers will feel more secure and ready for modern risk management systems.

Strategies for Businesses to Adapt and Thrive

Building a Culture of Innovation and Agility

To succeed today, businesses must embrace innovation and agility. This means using smart strategies to prepare for different situations. Here are some examples:

-

Scenario Analysis: Imagine possible futures to plan for various outcomes.

-

Wargaming: Practice handling risks to find weak spots in plans.

-

Microsimulations: Test risks in real-time to improve readiness.

Gathering real-time data is key to staying ahead of changes. This helps businesses prepare for challenges and stay flexible. For instance, WellPower, a health care group, faced issues with patient records. By working with Iliff Innovation Lab, they used AI to cut record time by 60%. This shows how new ideas can make big improvements.

To build an innovative culture, follow these steps:

-

Focus: Identify the problem or opportunity clearly.

-

Ideation: Think of creative solutions.

-

Ranking: Pick the best ideas using clear criteria.

-

Execution: Test and apply the chosen ideas.

Adding these steps to your risk management plan keeps your business ready for the future.

Investing in Employee Training and Skill Development

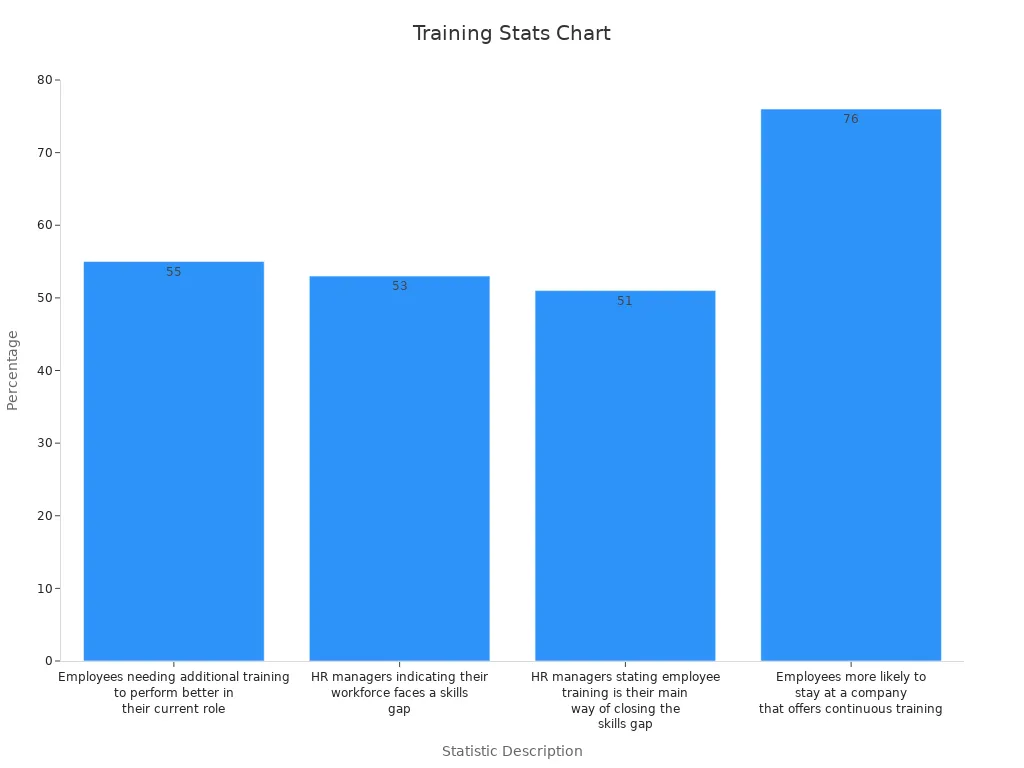

Your employees are your best resource for managing risks. Training them improves their skills and helps your business handle challenges better. Here are some key stats:

|

Statistic |

What It Means |

|---|---|

|

Workers need more training to do their jobs well. |

|

|

53% |

HR leaders say their teams lack important skills. |

|

51% |

Training is the main way to close skill gaps. |

|

76% |

Workers stay longer at companies offering training. |

Case studies show that using tech and personal learning boosts worker skills. This helps businesses manage risks better. Focus on training programs that match your risk goals. Teach workers to use tools like AI for spotting risks and fraud. This builds their confidence and keeps your business strong in a changing world.

Collaborating with Technology Partners and Experts

Working with tech partners and experts can improve how you handle risks. These partnerships bring special knowledge and tools to your business. Benefits include:

-

Early Risk Identification: Spot risks in supply chains before they cause problems.

-

Comprehensive Risk Assessment: Study risks deeply to create better plans.

-

Enhanced Resilience: Prepare for disruptions with backup plans and diverse suppliers.

-

Innovative Solutions: Use expert advice to solve risks in new ways.

-

Shared Resources and Expertise: Share tools and invest in advanced tech together.

-

Continuous Improvement: Keep improving through regular feedback and updates.

For example, financial companies use real-time data to adjust investments and stop fraud. In factories, tracking machines and supply chains reduces delays and boosts output.

By teaming up with the right partners, you can use tools like AI in your risk plans. This keeps your business strong and ready for future challenges.

Balancing Automation with Human Oversight

Automation has changed how businesses handle risks. It makes work faster, reduces mistakes, and improves results. But depending only on automation can cause problems. Humans are needed to make fair decisions and solve tricky issues. Mixing automation with human help is key for strong risk management.

Why Balance Is Important

Automation is great for simple tasks and big data. It finds patterns and predicts risks quickly. However, it cannot understand context or handle surprises. People are needed to think through tough situations and make choices that match company values. This mix keeps risk management both smart and flexible.

Here’s a comparison:

|

Aspect |

Automation Strengths |

Human Strengths |

|---|---|---|

|

Efficiency |

Speeds up work |

Ensures fair decisions |

|

Decision-Making Quality |

Uses data for better choices |

Adds context and unique insights |

|

Risk Mitigation |

Lowers mistakes in simple tasks |

Spots risks automation might miss |

|

Handling Complexity |

Handles easy jobs |

Solves tough and unexpected problems |

The table shows how automation and humans work well together. Automation does the easy stuff, while people handle fairness and hard decisions.

Things to Think About for Balance

-

Efficiency: Automation saves time and money. Humans make sure choices are fair and fit company goals.

-

Fair Decisions: Machines follow rules but miss moral details. People ensure fairness and responsibility.

-

Risk Spotting: Automation avoids errors in simple tasks. Humans catch risks that tech might overlook.

-

Flexibility: Automation struggles with surprises. People use creativity to solve tricky problems.

Tip: Use both automation and human skills for a strong risk system.

By combining automation and human judgment, you get the best of both. Automation makes things fast and accurate. Humans ensure decisions are fair and thoughtful. This balance makes your risk management stronger and ready for future challenges.

How VERTU Corporate Risk Management Services Can Help

Using Ruby Key for Better Business Security

The Ruby Key by VERTU is a special tool for managing risks. This high-end device mixes smart technology with unique features to keep your business safe. It offers strong security to protect important data. With its built-in help services, the Ruby Key makes handling rules and laws easier. It also helps you find risks early and take steps to avoid problems.

The Ruby Key boosts your defense against cyber threats. Its strong encryption and safe communication tools protect your business activities. This keeps your company strong against modern dangers. Adding the Ruby Key to your risk plan gives you a powerful way to guard your assets and reputation.

Custom Risk Solutions Just for Your Business

VERTU risk services give you plans made for your needs. These custom solutions solve the specific problems your business faces. Whether you work in banking, health, or retail, VERTU has strategies that fit your industry.

With VERTU, you get help from experts who know all about risks and rules. They team up with you to create plans that reduce weak spots and find new chances. This personal approach keeps your business ready and strong for the future.

Mixing Style and Usefulness in Risk Tools

VERTU risk services change how you handle risks. The Ruby Key shows this by combining style with smart features. Its ruby buttons look fancy but also have real benefits. This device is more than just a phone; it gives you special perks and strong security.

The Ruby Key makes managing risks simple with easy-to-use tools. Its mix of luxury and tech helps you stay ahead in a tough market. Choosing VERTU means getting a solution that improves both your business and your lifestyle.

In 2025, managing risks is key for business success. Planning ahead helps avoid problems and builds a strong company. For example, checking political and economic risks before entering new markets can prevent issues. This also helps teams work better together, saving time and money.

New tools like AI are changing risk management. AI looks at large amounts of data to find risks early. It also handles simple tasks, making work faster and with fewer mistakes. AI improves cybersecurity by spotting strange activities and blocking threats. These tools help businesses follow rules and stay safe.

Using smart plans and new technology helps businesses face challenges. Staying prepared for risks makes companies stronger and ready to grow in a changing world.

التعليمات

What is corporate risk management, and why does it matter in 2025?

Corporate risk management means finding and fixing risks to protect businesses. In 2025, it’s important because of fast tech changes and global issues. Managing risks well helps businesses stay strong and compete in a changing world.

How does AI help businesses with risk management?

AI studies big data to spot risks early. It predicts problems, catches fraud, and improves cybersecurity. By handling simple tasks, AI lets you focus on big decisions. This makes work faster and reduces mistakes in managing risks.

What problems might businesses face with new risk tools?

Businesses may struggle with change, AI fairness, and data safety. Workers might feel unsure about using new tools. Clear talks, good training, and mixing tech with human help can solve these problems.

How does the Ruby Key by VERTU improve risk management?

The Ruby Key has strong security like encryption and safe messaging. It spots risks early and helps follow rules. Its mix of style and smart features makes it great for protecting businesses.

Why is employee training important for risk management?

Trained workers handle risks better and feel more confident. Training teaches them to use tools like AI to find problems. This makes your team stronger and ready for future challenges.