As a growing number of people turn to technology to monitor their health, a key question arises: can you use your pre-tax health funds to purchase these devices? For those considering a الخاتم الذكي, understanding its eligibility for your Flexible Spending Account (FSA) is essential. This guide, created by an SEO expert focused on comprehensive health tech content, will break down exactly what you need to know about FSA eligibility for smart rings.

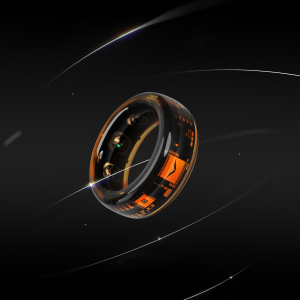

What is a Smart Ring and Why Are People Interested?

A smart ring is a sleek, discreet piece of wearable technology designed to monitor various health metrics from your finger. Unlike a smartwatch, it's often preferred for its comfort, style, and long battery life. Users are increasingly turning to smart rings to track crucial health data, including:

- Sleep quality and stages: Gaining insights into sleep patterns.

- Activity levels: Counting steps, calories burned, and active minutes.

- Heart rate and heart rate variability (HRV): A key indicator of stress and recovery.

- Body temperature: Detecting illness or tracking menstrual cycles.

For many, the smart ring is more than a gadget; it's a tool for proactive health management, allowing for continuous, passive monitoring that provides a deeper understanding of personal well-being.

Understanding Flexible Spending Accounts (FSA)

A Flexible Spending Account (FSA) is an employer-sponsored benefit that allows you to set aside pre-tax money for qualified medical expenses. The primary goal of an FSA is to help you save money on out-of-pocket health-related costs.

Key features of an FSA include:

- Tax-Advantaged: Contributions are made with pre-tax dollars, reducing your taxable income.

- Use-It-or-Lose-It: Funds must typically be used within the plan year, though some plans offer a grace period or a small carryover amount.

- Qualified Medical Expenses: The funds can only be used for approved health expenses as defined by the IRS.

Is a Smart Ring Considered an FSA Eligible Expense?

The short answer is yes, a smart ring can be FSA eligible, but with a crucial condition: it must be primarily used for medical care, diagnosis, cure, mitigation, treatment, or prevention of disease.

The IRS guidelines are broad but specific. While a basic fitness tracker that only counts steps might not qualify, a device that monitors health metrics directly related to disease prevention or treatment—such as tracking sleep apnea symptoms, monitoring heart rate variability for stress management, or providing data for a doctor to diagnose a condition—can be eligible.

To determine if a specific smart ring is FSA eligible, you must consider its features and, in many cases, obtain a Letter of Medical Necessity (LOMN) from a healthcare professional.

A Letter of Medical Necessity (LOMN) is a document from your doctor that confirms the smart ring is required for a specific medical condition or for managing your health. This letter is often the key to getting your FSA claim approved.

How to Get an FSA Reimbursement for Your Smart Ring

Once you've determined that a smart ring's features align with a specific health need and you have your LOMN, here's how to proceed with the purchase:

- Check with Your FSA Administrator: Always confirm the requirements with your FSA provider first. They can provide specific guidance on their claims process and what documentation they need.

- Get a Letter of Medical Necessity: Schedule an appointment with your doctor. Explain how the smart ring's features (e.g., heart rate variability, sleep tracking) will help you monitor or manage a specific health condition. Ask them to write a letter that explicitly states this.

- Make the Purchase: You can either use your FSA debit card at the time of purchase or pay with a personal credit card and submit a reimbursement claim later.

- Submit Your Claim: If you paid out-of-pocket, submit your claim to your FSA administrator. Include the receipt from your purchase and, most importantly, a copy of the LOMN.

The LOMN is often the deciding factor, as it connects the smart ring from a “general fitness device” to a “medical-related expense” in the eyes of the IRS and your FSA administrator.

Final Thoughts: Strategic Use of Your FSA Funds

Using your FSA funds to buy a smart ring is a strategic way to invest in your health without using after-tax dollars. However, it requires careful planning. Don't assume every smart ring is eligible. Instead, focus on the device's specific health-tracking features and whether they are directly relevant to a health goal or condition that you can discuss with your doctor. This proactive approach ensures you maximize your benefits while making an informed decision about your health and finances.

Frequently Asked Questions (FAQ)

Q1: Can I use my FSA card to buy a smart ring directly from the manufacturer?

A: You might be able to, but it's not guaranteed. Some manufacturers or retailers will accept FSA cards, but others may not. The safest approach is to pay with a personal card and then submit a reimbursement claim with your documentation, including the Letter of Medical Necessity (LOMN).

Q2: What's the difference between FSA and HSA eligibility?

A: FSA (Flexible Spending Account) and HSA (Health Savings Account) eligibility rules for medical devices are generally similar. Both accounts are governed by IRS guidelines for qualified medical expenses. The key difference is that an HSA does not have the “use-it-or-lose-it” rule, making it a more flexible long-term savings tool.

Q3: What specific features make a smart ring FSA eligible?

A: Features that go beyond basic step counting are more likely to be eligible. These include heart rate variability (HRV) monitoring, advanced sleep stage analysis, body temperature tracking, and blood oxygen (SpO2) sensing. These metrics provide data that a healthcare provider can use for diagnostic or treatment purposes.

Q4: Do I need a doctor's note for every smart ring purchase?

A: It is highly recommended to get a Letter of Medical Necessity (LOMN) for a smart ring purchase to ensure your FSA claim is approved. Without it, your administrator might deny the claim, deeming the device a general wellness item rather than a medical expense.

Q5: What happens if my smart ring FSA claim is denied?

A: If your claim is denied, you may have the opportunity to appeal the decision. This is where your Letter of Medical Necessity (LOMN) is crucial. If you don't have one, the denial will likely be final. If you have the letter and documentation, you can resubmit the claim with a more detailed explanation.