On September 5th (Monday), the Organization of the Petroleum Exporting Countries (OPEC) and its allies (OPEC+) will hold a meeting to discuss oil production policies. In light of the fact that the OPEC leader, Saudi Arabia, raised the issue of production cuts last month, the meeting will not rule out discussing reducing production capacity to support oil prices.

Stimulated by the news of a possible production cut, Brent crude oil once broke through $95 per barrel on the 2nd, but then concerns about the slowdown in global economic growth limited the increase, and finally, Brent crude oil only rose slightly by 1% to $93.28 per barrel, and New York crude oil futures rose moderately by 0.74% to $87.25. The weekly lines of the two major benchmark oil prices still closed down, with a drop of about 6.1% and 4.6% respectively.

There are reports that the current oil market supply remains tight, and OPEC+ is expected to maintain its production quotas unchanged at this meeting. Due to the uncertain outlook for the oil market, there is no rule out of reducing production to boost oil prices.

Recently, due to the joint interest rate hikes by various countries to combat inflation, the risk of a global recession has increased significantly, causing a huge impact on oil demand. As a result, Brent crude oil has fallen sharply from a high of around $120 this year to around $93.

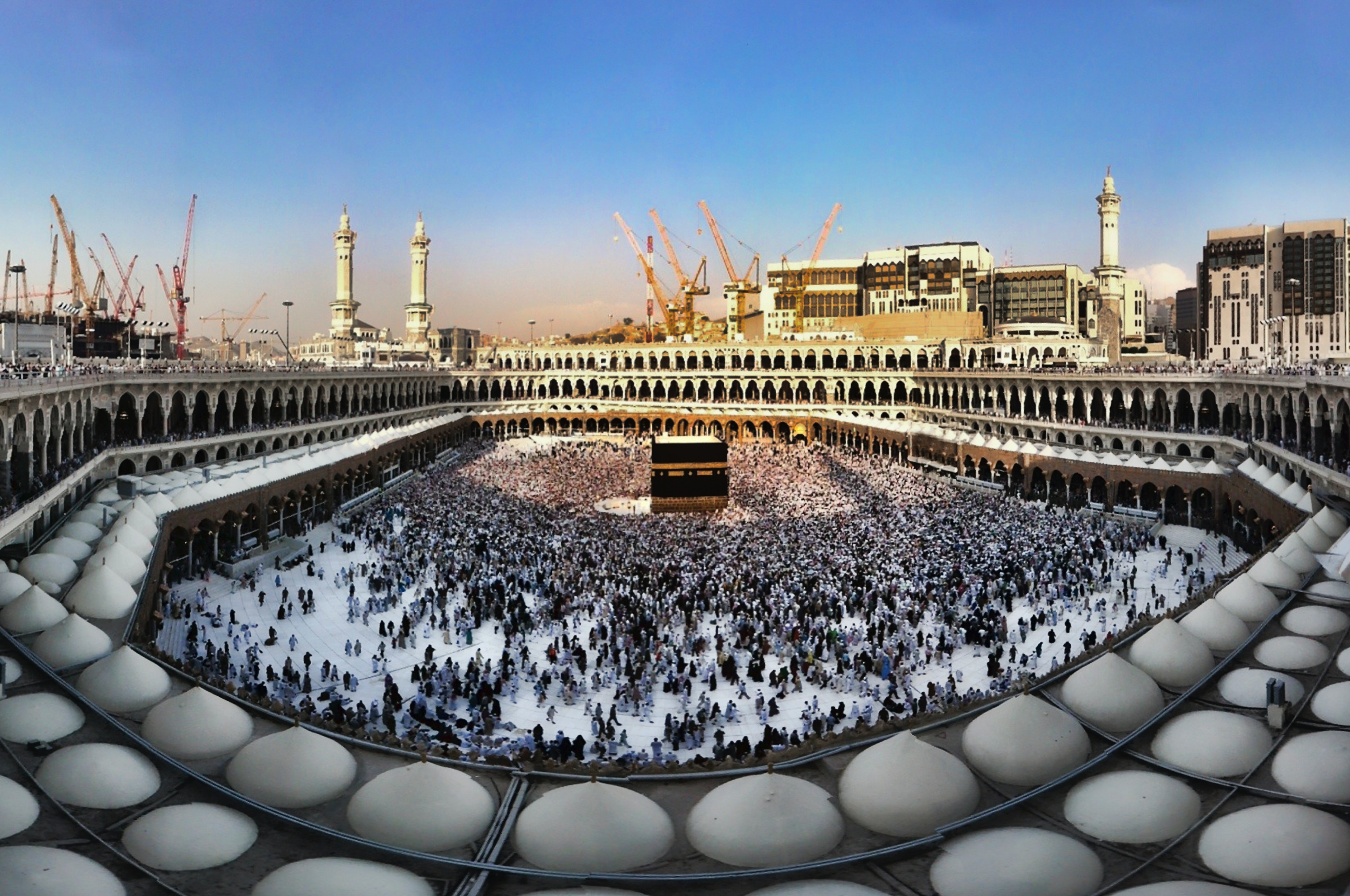

In 2020, the world oil prices fell sharply, which severely affected Saudi Arabia. However, the high oil prices this year have driven Saudi Arabia to become the fastest growing economy among the G20 countries. Saudi Arabia’s budget surplus increased to 77.9 billion riyals (about $21 billion) in the second quarter of this year.

In the second quarter of this year, Saudi Arabia’s daily crude oil export revenue reached 1 billion US dollars, a year-on-year increase of 94%. The total export value of oil in the second quarter exceeded 91 billion US dollars, accounting for 80% of the total export value of goods in that quarter, also setting a historical high.

In March of this year, the oil revenue of Saudi Arabia broke through 30 billion US dollars for the first time. In April, the export value slightly declined, but in May and June, it was above the 30 billion US dollars mark. Before the outbreak of the Russia-Ukraine conflict, the highest monthly oil revenue of Saudi Arabia was only about 23 billion US dollars.

Recently, due to the rising risk of a global economic downturn and the news that Iranian crude oil is about to return to the market, the world oil prices have dropped from 120 US dollars per barrel a few weeks ago to about 90 US dollars per barrel recently.

Uncertain Outlook for the Oil Market

Therefore, the Saudi Energy Minister stated that due to the international oil futures contract prices failing to accurately reflect the fundamentals of supply and demand, in order to avoid significant fluctuations in the oil market, Saudi Arabia will suggest that OPEC reduce production.

Less than 48 hours after this statement was released, several OPEC member countries have issued statements in support. As for the specific reduction amount, it is expected to be announced after the OPEC meeting on Monday.

Some analysts predict that the Organization of the Petroleum Exporting Countries (OPEC) and its allies will maintain stable production at the meeting on Monday. Traders and analysts say that the global market is expected to gradually recover, and sanctions against Russia will reduce crude oil supply.

“I expect OPEC to maintain production quotas unchanged, with tight market supply,” said ANZ bank analyst Daniel Hynes. “However, if crude oil sales cannot be stopped, then OPEC may be forced to take a more aggressive stance.”

Some analysts expect OPEC+ to decide to maintain the production level of October unchanged, while others expect a reduction in production. Representatives of OPEC+ have indicated in private that the group is still weighing its options due to the uncertain outlook faced by member countries. In recent years, the outcomes of OPEC meetings have often surprised observers.

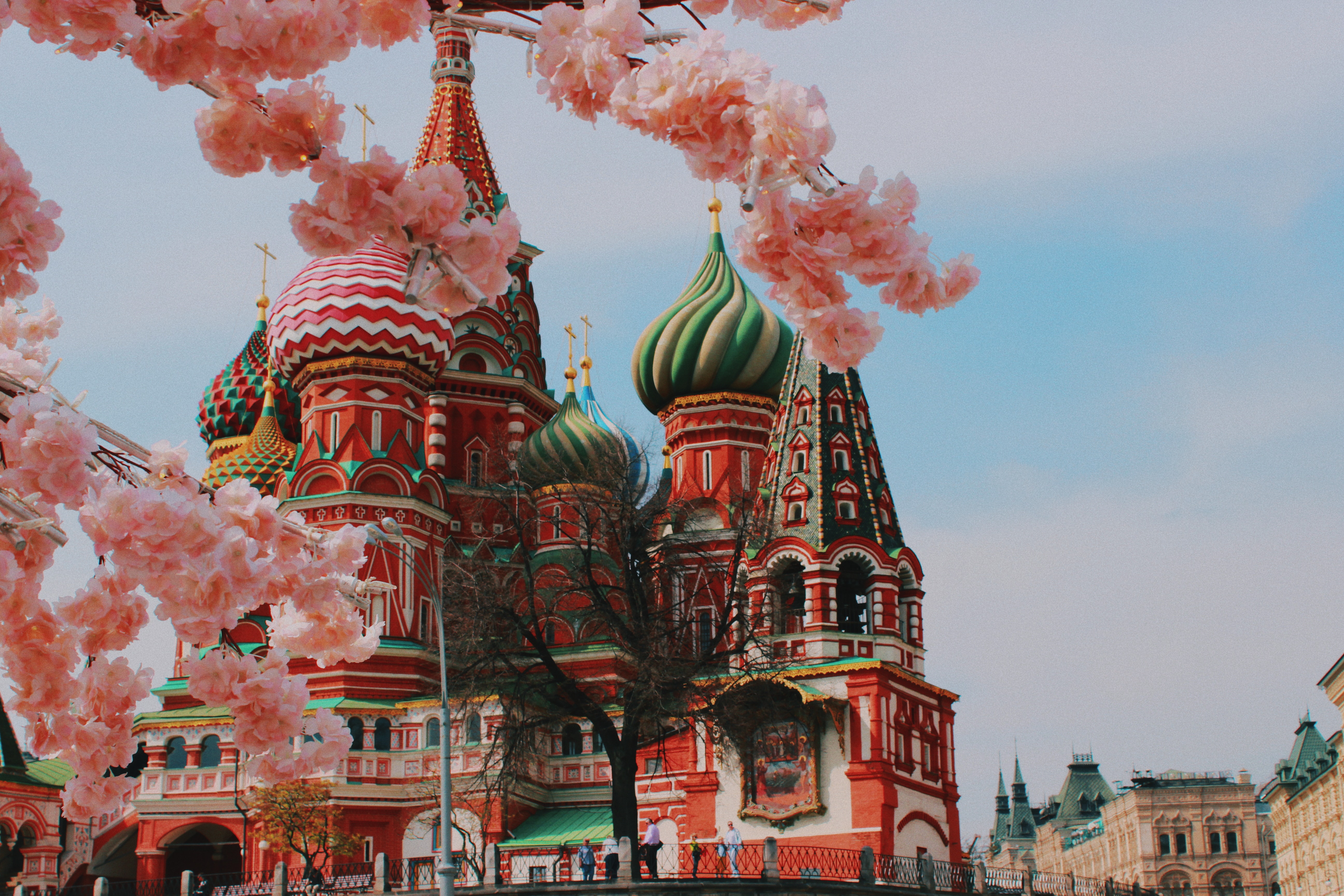

On September 2, the G7 issued an announcement stating that they will impose a price cap on Russian oil. This sanction will be implemented in conjunction with a ban on crude oil imports, with a ban on crude oil taking effect on December 5th of this year and a ban on refined oil products taking effect on February 5th of next year. This move has received the support of the European Commission, but future implementation will still require the approval of EU member states.

The specific price cap and related implementation details of the G7 have not yet been announced (in theory, separate price caps need to be set for crude oil and refined oil products), and Russia has responded that it will stop supplying oil to countries that adopt a price cap.

The G7 price cap is a patch to the previous EU sanctions on the Russian oil sector, with the original intention of limiting Russia’s oil revenue while minimizing the impact on crude oil prices.

Overall, the implementation of the G7 price cap will lead to increased difficulty in exporting Russian crude oil after December 5th, with an expected increase in the export decline, posing an upward risk to oil prices. Although this is not the original intention of the EU policy, the ultimate outcome may be contrary to the original intentions of both the EU and the United States.

According to the EU sanctions schedule, the ban on Russian oil imports will come into effect on December 5th, and Russia’s export volume to Europe is still as high as 2 million barrels/day. It is estimated that about 1.5 to 1.8 million barrels/day of imports need to be phased out, and how to fill this hard gap is the core issue.

Some experts believe that there are the following solutions for the EU at present:

1. Promote the conclusion of the Iranian nuclear agreement to release Iran’s remaining crude oil production capacity and floating storage inventory;

Real-time Upper Limit Prices for G7

2. Global Trade Rebalancing: This refers to an increase in Russia’s exports to India and China, which displaces a portion of Middle Eastern crude oil to Europe.

3. Increased US Crude Oil Imports: Currently, the United States has increased its exports to Europe to nearly 2 million barrels per day. The prevailing view is that it would be difficult for US crude oil exports to increase by more than an additional 1 million barrels per day on the current basis. In addition, the US government’s release of strategic reserves is set to end in October, which will reduce the amount of resources available for export. It is currently unknown whether the US will continue to release reserves.

- Further consume the commercial storage inventories of the EU and other countries, but this is not a long-term solution. It will also push up oil prices. Moreover, from the perspective of high-frequency inventory indicators, European crude oil inventories are not high.

The implementation difficulty of the above solutions is ranked from difficult to easy. Of course, there is also a situation where the EU softens and backs down on sanctions against Russia, but there are currently no signs of this. Before the sanctions, European refineries and traders may rush to import crude oil to replenish their stocks, but how to solve the import gap brought by the Russian oil ban after the sanctions still needs to be seen as we go along.

According to CCTV news, Russian Deputy Prime Minister Novak stated on September 1st that Russia will stop supplying oil and oil products to companies or countries that set price caps on its oil, as Russia will not operate under non-market conditions.

Russian President Putin had previously stated that the G7’s proposals to limit the import of Russian oil and set price caps on Russian oil can only lead to a surge in oil prices, similar to the rise in natural gas prices. Russian Deputy Prime Minister Novak had also stated in July that if the G7 imposes price controls on Russian oil products, Russia will not supply oil at a loss to foreign countries.

If OPEC+ begins to cut production and Russia stops supplying oil due to price caps, it is conceivable that oil prices will continue to soar, making it difficult for high inflation worldwide to be alleviated.