AI finance analysis transforms how you manage money. By automating data processing, it eliminates tedious tasks and saves valuable time. For example, a global tech company reduced its forecasting process from weeks to just days using AI. Today, 55% of finance teams rely on AI for data analysis, and businesses using AI tools report annual revenue increases of over 10%. These advancements empower you to make smarter financial choices effortlessly, with fewer errors and more confidence in your decisions.

Key Takeaways

-

AI finance tools handle boring tasks, saving time and avoiding mistakes.

-

AI gives personal advice to help you make better money choices.

-

AI predictions improve planning, so you can prepare for changes easily.

-

Using AI in daily money tasks makes things faster and simpler.

-

Pick the right AI tools by knowing your needs and checking if they work with what you already use.

What is AI Finance Analysis?

AI finance analysis refers to the use of artificial intelligence technologies to enhance financial decision-making. It leverages advanced algorithms and machine learning to process vast amounts of data, identify patterns, and provide actionable insights. By automating complex tasks, it empowers you to make smarter financial choices with greater efficiency and accuracy.

Defining AI in Financial Decision-Making

AI in financial decision-making involves applying intelligent systems to analyze data, predict outcomes, and optimize strategies. These systems excel at tasks like real-time analysis, forecasting, and customization. For example, AI tools can assess your financial goals and create tailored investment strategies based on your preferences.

|

Definition/Application |

Description |

|---|---|

|

Real-time analysis |

AI-powered tools enable finance professionals to analyze complex financial flows in real time, surface hidden risks, and optimize planning with predictive intelligence. |

|

Accuracy in forecasting |

AI eliminates many manual processes, reducing errors and increasing accuracy in financial forecasting and reporting. |

|

Customized strategies |

AI tailors financial plans by analyzing individual client data, goals, and preferences, creating customized investment strategies. |

|

Portfolio assessment |

AI algorithms analyze historical performance, market conditions, and economic indicators, offering a clear portfolio assessment with ease. |

These capabilities make AI finance analysis a game-changer for individuals and businesses alike.

Core Functions of AI in Finance

AI performs several critical functions in the financial sector. These include fraud detection, customer service, regulatory compliance, and cash flow management. Each function addresses specific challenges, helping you navigate financial complexities with ease.

-

Fraud Detection: AI continuously monitors transactions to identify unusual patterns, helping to prevent fraud before it occurs.

-

Customer Service: AI tools like chatbots and virtual assistants enhance customer service by providing instant responses to inquiries.

-

Regulatory Compliance: AI automates monitoring and reporting processes, helping financial institutions stay compliant with changing regulations.

-

Cash Flow Management: AI improves cash flow predictions through advanced analytics and real-time data processing.

-

Payroll Management: AI can streamline payroll processes, ensuring accuracy and efficiency.

-

Financial Reporting: AI assists in generating accurate financial reports by analyzing large datasets quickly.

These functions demonstrate how AI finance analysis simplifies complex processes, saving you time and effort.

How AI Processes and Analyzes Financial Data

AI processes financial data using advanced technologies like machine learning, natural language processing, and algorithmic trading. These tools enable AI to analyze vast datasets in real time, extract insights, and provide forecasts almost instantaneously.

|

Evidence Type |

Description |

|---|---|

|

Machine Learning |

AI can analyze vast datasets in real time, extracting insights and providing forecasts almost instantaneously. |

|

Natural Language Processing |

Enables the interpretation of unstructured data, allowing for consideration of external market influences. |

|

Algorithmic Trading |

AI-driven systems optimize trading decisions by processing market data at high speeds, improving performance and reducing errors. |

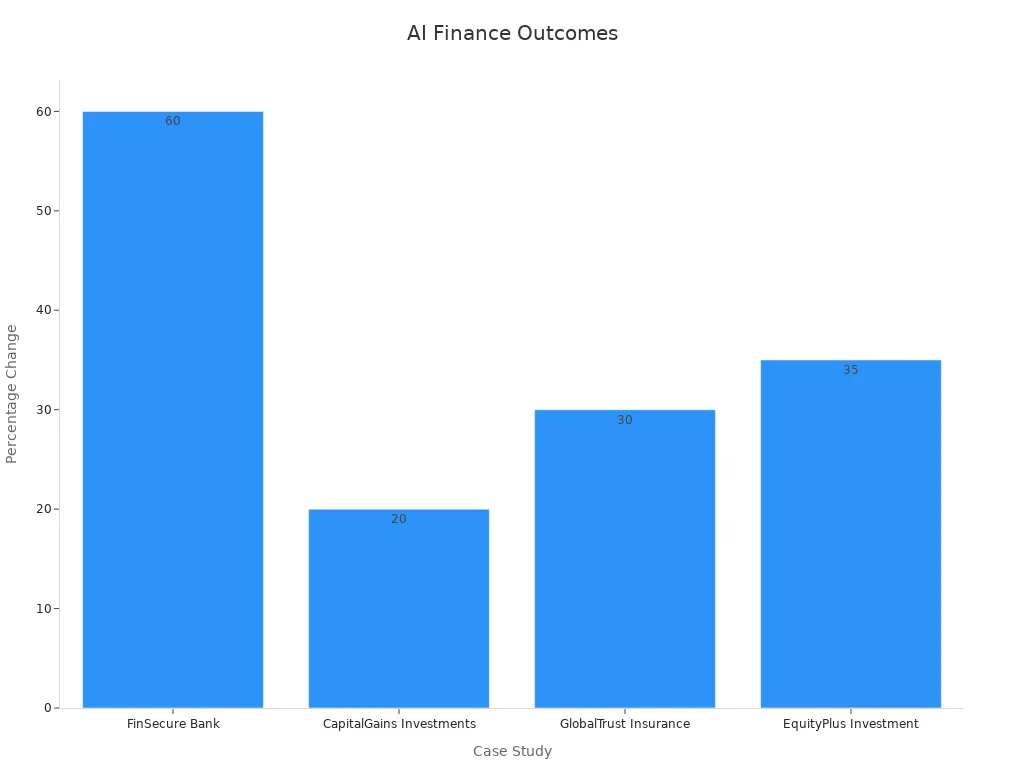

For instance, a case study from FinSecure Bank highlights how AI-driven fraud detection reduced fraudulent activities by 60%. Similarly, CapitalGains Investments used AI to analyze market trends, resulting in a 20% increase in annual returns.

These examples illustrate how AI finance analysis transforms raw data into actionable insights, enabling you to make informed decisions with confidence.

Key Benefits of AI in Financial Decision-Making

Automating Repetitive Financial Tasks

AI finance analysis excels at automating time-consuming financial tasks, allowing you to focus on more strategic decisions. Tasks like data entry, invoice processing, and transaction categorization no longer require manual effort. AI tools handle these processes with speed and precision, reducing operational bottlenecks.

For example, automation can significantly cut costs and improve efficiency. Consider the following quantified benefits:

|

Benefit Type |

Quantified Impact |

|---|---|

|

Cost Reduction |

|

|

Claims Processing Cost |

Up to 40% drop in per-claim processing cost |

|

Operational Efficiency Gains |

3–5% gains in operational efficiency |

|

Monthly Close Cycle Acceleration |

25–40% acceleration in monthly close cycles |

|

Cloud Spending Reduction |

20–40% reduction in cloud spending |

These improvements demonstrate how AI transforms repetitive tasks into streamlined processes, saving you time and money.

Tip: Automating routine tasks with AI not only reduces errors but also frees up resources for higher-value activities.

Delivering Personalized Financial Insights

AI finance analysis provides tailored insights that help you make smarter financial decisions. By analyzing your spending patterns, investment goals, and risk tolerance, AI tools offer recommendations that align with your unique needs.

Here are some real-world examples of how AI delivers personalized insights:

|

Example Description |

Application |

|---|---|

|

A robo-advisor platform simulates portfolio performance under various inflation scenarios. |

Helps users decide on investment strategies. |

|

AI identifies customers likely interested in a new credit card based on spending patterns. |

Enables targeted marketing and personalized offers. |

|

An AI assistant alerts wealth managers about portfolio overexposure and suggests adjustments. |

Supports proactive portfolio management. |

Additionally, tools like Trim, Albert, and Wally enhance your financial management experience:

-

Trim: Analyzes spending patterns to reduce unnecessary expenses.

-

Albert: Combines AI with human expertise for budgeting and investment advice.

-

Wally: Automatically categorizes expenses and offers chatbot services for budgeting.

These capabilities ensure that you receive actionable insights tailored to your financial situation.

Enhancing Forecasting with Predictive Analytics

Predictive analytics powered by AI takes financial forecasting to the next level. By analyzing historical data and market trends, AI tools provide accurate predictions that help you plan for the future with confidence.

Statistical evidence highlights the effectiveness of AI in forecasting:

|

Source |

Evidence |

Improvement |

|---|---|---|

|

International Institute of Forecasters |

Companies using predictive analytics |

10-20% improvement in forecast accuracy |

|

Phoenix Strategy Group |

Organizations using feedback loops |

30-40% boost in forecast accuracy |

|

IBM Study |

Companies using AI for forecasting |

20% decrease in overall forecast error |

These advancements allow you to anticipate market changes, optimize budgets, and reduce financial risks. For instance, companies using predictive analytics report up to a 40% increase in forecast accuracy when feedback loops are implemented.

Note: Leveraging AI for forecasting ensures you stay ahead of financial challenges and seize opportunities with precision.

Reducing human error in financial processes

Human error often leads to costly mistakes in financial processes. Misplaced decimal points, incorrect currency symbols, or overlooked details can disrupt operations and result in financial losses. AI finance analysis minimizes these risks by automating tasks that are prone to human error. It ensures greater accuracy and consistency, allowing you to focus on strategic decisions rather than correcting mistakes.

AI-powered tools excel at processing financial documents with near-perfect precision. They adapt to new data through machine learning, improving their ability to detect and correct errors over time. For example, these tools can identify contextual mistakes, such as mismatched currency symbols or formatting inconsistencies, that might go unnoticed during manual reviews. They also handle diverse document formats, recognizing various fonts, handwriting styles, and unstructured data. This adaptability ensures reliable results across a wide range of financial tasks.

|

Feature |

Benefit |

|---|---|

|

Higher Accuracy |

Achieves near-perfect accuracy in document processing, reducing costly rework. |

|

Machine Learning Adaptability |

Continuously improves with exposure to new data, enhancing error detection capabilities. |

|

Contextual Error Detection |

Identifies and corrects contextual errors, such as incorrect currency symbols or misplaced decimal points. |

|

Handling Diverse Document Formats |

Recognizes various fonts and handwriting styles, improving text extraction from different documents. |

|

Adaptation to Document Structures |

Learns from financial documents to enhance recognition of tables, signatures, and unstructured data. |

These features demonstrate how AI reduces errors while improving efficiency. For instance, when processing invoices or financial reports, AI tools can quickly identify discrepancies and flag them for review. This proactive approach prevents errors from escalating into larger issues.

Tip: Relying on AI for error-prone tasks not only saves time but also builds trust in your financial processes. Accurate data ensures better decision-making and reduces the risk of financial penalties.

By integrating AI into your financial workflows, you can eliminate repetitive manual checks and achieve higher accuracy. This transformation allows you to allocate resources more effectively and focus on achieving your financial goals.

Practical Applications of AI in Finance

AI-powered Budgeting and Expense Tracking Tools

AI-powered budgeting tools simplify personal finance management by automating expense tracking and providing real-time insights. These tools analyze your spending patterns, alert you to upcoming bills, and even flag unusual transactions. For instance, they can predict future expenses based on historical data, helping you adjust your budget proactively.

-

Real-time tracking ensures you stay updated on your financial health.

-

Personalized savings advice helps you cut unnecessary costs and save more.

-

Automation reduces manual effort, freeing up your time for other priorities.

A study by Accenture highlights that AI could boost profitability rates by 38 percentage points, contributing to an economic boost of $14 trillion by 2035. Similarly, Deloitte's research shows that AI-driven forecasting can reduce errors by up to 50%. These advancements make AI-powered tools indispensable for effective financial planning.

Tip: Use AI tools like Mint or YNAB to gain better control over your finances and achieve your savings goals faster.

Investment Platforms with AI-driven Recommendations

AI-driven investment platforms revolutionize how you approach investing. These platforms analyze market trends, assess risks, and provide tailored recommendations based on your financial goals. By leveraging machine learning, they optimize portfolio performance and minimize risks.

For example, robo-advisors like Betterment and Wealthfront use AI to create diversified portfolios that align with your risk tolerance. They also simulate market scenarios, helping you make informed decisions. With AI, you can access professional-grade investment strategies without needing extensive financial expertise.

Note: AI-driven platforms empower you to invest confidently, even if you're new to the world of finance.

Fraud Detection and Prevention Systems

AI enhances fraud detection by analyzing vast datasets in real time. It identifies subtle patterns and flags suspicious activities before they escalate. Financial institutions report fraud loss reductions of up to 90% through AI-powered systems. These tools also reduce false positives by 60%, improving customer experience.

AI algorithms establish a baseline for normal transaction patterns using pattern recognition. Anomaly detection then flags deviations, enabling immediate action. For instance, voice AI technologies have achieved fraud reduction rates exceeding 80% in voice channels. This proactive approach minimizes losses and strengthens trust in financial systems.

Tip: Choose financial institutions that leverage AI for fraud prevention to ensure your transactions remain secure.

Credit scoring and loan approval automation

AI has revolutionized credit scoring and loan approval processes, making them faster, fairer, and more accurate. Traditional methods often relied on limited data and subjective evaluations, which could lead to biases or errors. AI changes this by analyzing vast datasets, including non-traditional factors like utility payments or online behavior, to assess creditworthiness. This approach ensures a more comprehensive and objective evaluation.

For example, AI-powered platforms can instantly evaluate your credit profile and provide loan decisions within minutes. These systems use machine learning to identify patterns in your financial history, reducing the likelihood of errors. They also adapt to new data, improving their accuracy over time. This means you can access loans more quickly and with greater transparency.

AI also benefits lenders by minimizing risks. Predictive analytics help identify potential defaults before they occur, enabling proactive measures. Additionally, automated systems reduce operational costs by streamlining the approval process. This efficiency benefits both you and the financial institutions, creating a win-win scenario.

Tip: Look for lenders that use AI-driven credit scoring to ensure a faster and more equitable loan approval process.

Financial reporting and risk assessment tools

AI-powered tools simplify financial reporting and enhance risk assessment. These tools analyze large datasets in real time, providing accurate and actionable insights. For example, they can generate compliance reports, assess market risks, and detect anomalies in financial transactions.

Here’s how leading institutions leverage AI for these purposes:

|

Institution |

Benefit Description |

|---|---|

|

UBS |

Automates compliance report generation, reducing time and resources for submissions. |

|

Deutsche Bank |

Uses AI for real-time risk assessment adjustments based on economic indicators. |

|

HSBC |

Enhances anti-money laundering efforts through transaction analysis. |

|

JP Morgan Chase |

Continuously analyzes data to assess credit and market risks, improving decision-making. |

AI tools like Narrative Science’s Quill further enhance reporting by automating the creation of financial documents. These tools ensure compliance and accuracy, saving you time and effort. By using AI, you can focus on strategic decisions rather than manual data processing.

Note: Adopting AI-driven tools for financial reporting not only improves accuracy but also reduces the risk of regulatory penalties.

How to Get Started with AI Finance Tools

Researching and Choosing the Right AI Tools

Selecting the right AI tools for your financial needs requires careful research. Start by identifying your goals. Are you looking to automate budgeting, improve investment decisions, or enhance fraud detection? Once you define your objectives, evaluate tools based on their features and compatibility with your existing systems.

Here’s a step-by-step approach to guide your research:

-

Identify and segment your target needs. For example, focus on tools that specialize in budgeting or investment analysis.

-

Develop a clear profile of your requirements. This helps you match tools to your specific financial goals.

When exploring options, consider these trusted platforms:

-

DeepResearch

-

Perplexity

-

ChatGPT-4

-

Upmetrics

Additionally, industry reports suggest evaluating tools based on the following criteria:

|

Criteria |

Description |

|---|---|

|

Support for core finance workflows |

Tools should enhance specific finance tasks like planning and reporting. |

|

Documented adoption by real teams |

Look for tools with proven success in real-world finance applications. |

|

Seamless integration with existing tech |

Ensure compatibility with tools like Excel or Power BI for smooth implementation. |

|

Helpful AI functionality |

Features like natural language processing improve decision-making speed and accuracy. |

|

Enterprise-grade security and governance |

Strong security measures protect sensitive financial data. |

By following this process, you can confidently choose tools that align with your financial objectives.

Integrating AI Tools into Your Financial Routine

Incorporating AI tools into your daily financial activities can transform how you manage money. Start small by automating one or two tasks, such as expense tracking or invoice processing. Gradually expand their use as you become more comfortable.

Here are some real-world examples of successful integration:

-

Global Finance Group reduced compliance adaptation time by 80% using AI-driven systems.

-

FinScore Global improved credit issuance by 40% with AI-powered credit risk assessments.

-

Quantum Capital enhanced portfolio performance by 35% through AI investment analysis.

-

Fintech Innovations sped up expense reporting by 75%, improving customer satisfaction.

These examples show how AI tools can streamline processes and deliver measurable benefits. To integrate them effectively, ensure they align with your existing workflows and provide training for all users.

Tips for Maximizing the Benefits of AI Finance Analysis

To get the most out of AI finance analysis, focus on these strategies:

-

Automate repetitive tasks: Let AI handle routine activities like data entry, freeing up time for strategic decisions.

-

Leverage real-time data: Use AI tools that integrate live data to refine forecasts and improve accuracy.

-

Simplify processes: Choose tools that make financial insights easy to understand and act upon.

-

Scale with your needs: Opt for systems that grow with your financial requirements, ensuring long-term value.

By adopting these practices, you can unlock the full potential of AI tools and achieve greater efficiency in managing your finances.

AI finance analysis transforms how you approach money management. It automates complex processes, delivers personalized insights, and ensures greater accuracy in decision-making. Studies show that AI improves decision-making effectiveness (β = 0.367) and enhances risk management (β = 0.281), reducing financial losses through predictive analytics. Additionally, AI-driven strategies positively impact financial performance, leading to measurable economic benefits.

Adopting AI tools saves you time, reduces stress, and empowers you to make smarter financial choices. As the financial landscape evolves, integrating AI becomes essential for staying competitive and achieving long-term success. Start exploring these tools today to unlock their full potential.

FAQ

What is the best way to start using AI finance tools?

Begin by identifying your financial goals. Research tools that match your needs, such as budgeting or investment platforms. Start small with one or two features, then expand as you gain confidence. Look for tools with user-friendly interfaces and strong security features.

Are AI finance tools safe to use?

Yes, most AI tools prioritize security. They use encryption to protect sensitive data and comply with industry regulations. Choose tools from reputable providers and review their privacy policies to ensure your information stays secure.

Can AI help me save money?

Absolutely! AI tools analyze spending patterns and suggest ways to cut unnecessary expenses. They also optimize investment strategies and forecast future costs, helping you make smarter financial decisions that align with your savings goals.

Do I need technical skills to use AI finance tools?

No, most AI tools are designed for everyday users. They feature intuitive interfaces and provide step-by-step guidance. You don’t need coding knowledge or technical expertise to benefit from their features.

How accurate are AI-driven financial forecasts?

AI forecasts are highly accurate because they analyze large datasets and identify patterns humans might miss. Predictive analytics improve over time, ensuring reliable insights. However, external factors like market volatility can still impact predictions.